Jun. 19, 2014 8:36 AM ET

Summary

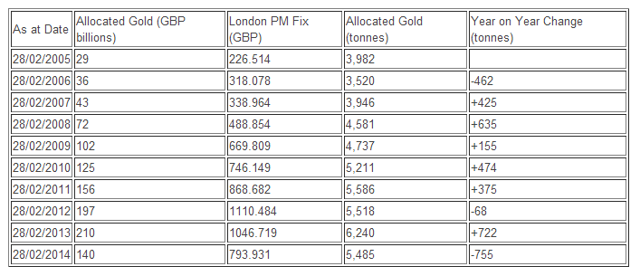

- Bank of England's Quarterly Report shows that the bank held 5485 tonnes of gold for 72 central bank customers.

- The gold holdings of the bank have dropped over 750 tonnes year-over-year with no reported central bank selling.

- This suggests that we may be seeing large amounts of gold repatriation, which is exactly what happened when Bretton Woods broke down.

In its latest quarterly report, the Bank of England (BOE) released some very interesting information, which should interest investors that own physical gold and gold ETFs (SPDR Gold Shares (GLD)), regarding its gold custodial holdings. In this report, it stated that as of February 28th 2014, it held 5485 metric tonnes of gold (valued at 140 billion British pounds at that date) on behalf of 72 central banks. This gold was specifically held in allocated form - that is it was held claim-free for the bank's central bank customers and in a dedicated, not pooled form (i.e. specific bar numbers were owned by clients).

This can be seen in the diagram below.

Source: Bank of England Quarterly Report

We can't find historical data regarding how many central banks held gold at the Bank of England over time, but we do have some data regarding the historical change in the allocated holdings of gold.

Source: Gold Chat

This data was compiled and published by Bron Suchecki of the Perth Mint in Australia, who does a wonderful job of giving a practical look at a very opaque gold market.

The important thing to see here is the massive 755 tonne drop in allocated gold held by the Bank of England from February 2013 to February 2014. We know that central banks actually accumulated gold over 2013 and sold very little during the year, so this large drop in allocated gold reserves wasn't from central bank selling.

The other groups of entities that hold gold at the Bank of England are bullion banks who are members of the LBMA, and of that group HSBC is a member. The importance of that is HSBC is also the custodian of SPDR Gold Shares (GLD), and according to the prospectus, that in addition to the HSBC vault, GLD can keep gold at the Bank of England's vaults.

Over this same period, GLD lost about 451 tonnes of gold, so if we assume that every single tonne came from the Bank of England vaults, it still leaves around 304 tonnes of gold that left the BoE's vaults over the year - an extremely large amount considering that central banks were net buyers of gold.

Conclusion for Investors

Now, this decline in gold may be related to bullion bank selling as they liquidate allocated gold positions, but we believe we may be seeing something else going on here.

What may be going on is that central banks may be quietly repatriating gold from other central banks. That would explain why allocated gold would decline and yet there is little or no central bank selling - it is central banks removing their gold from Bank of England custodianship.

If that is the case, then the implications of this may be very large for gold investors. The accumulation of gold by central banks (as we've seen over the last few years), shows that they are seeking asset diversification, while the repatriation of gold shows that there is a lack of trust. This lack of trust is exactly what ended the previous monetary system of Bretton Woods as the French owned allocated gold that they were accumulating in the form of dollar reserves (which were convertible into gold but were in the custodianship of the US). That wasn't the problem because the system could work fine with the French accumulating even more allocated gold dollar reserves, it wasn't until Charles De Gaulle and the French lost trust in these allocated reserves and asked for their repatriation to France that the system broke.

If we're seeing a breakdown in trust between central banks regarding gold reserves (which are heavily concentrated in London and New York), then the consequences for the financial system and the gold price could be tremendous - especially since the actual physical gold is only a small fraction of total gold claims due to gold leasing, rehypothecation, and fractional reserve banking. If that small physical gold reserve base is depleted through repatriation, then the gold price should rise orders of magnitude higher, as the only way the base can support the claims upon it is with a much higher gold price.

This is simply another one of those reasons that gold ownership makes so much fundamental sense and thus we still think investors would be wise to maintain a strong exposure to gold with positions in physical gold and gold ETFs (SPDR Gold Shares GLD, PHYS, CEF). The gold miners have had a strong run recently and we would take profits in some of them, but investors should also have exposure to the leverage that they provide and may want to consider evaluating gold miners such as Goldcorp (GG), Agnico Eagle (AEM), Newmont (NEM), or even some of the explorers and silver miners such as First Majestic Silver (AG) (we're not suggesting these companies specifically - only suggesting them for further investor research).

We do not know for sure what happened to the allocated gold at the Bank of England, but if it is central bank gold repatriation (which we wouldn't hear about until well after the occurrence) then that may be moving us to the next stage in the financial crisis. With many other strong fundamentals going for it, investors should seriously consider initiating or increasing their position in gold.

via seeking alpha