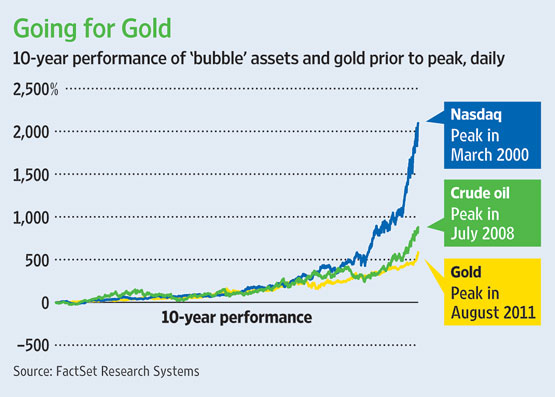

For all the talk of a gold bubble, this chart paints a different picture. As someone who lived through the tech bubble of 1998-2000 as a tightrope shortseller, until I see Maria Bartiromo breathlessly (orgasmically, in all honesty - she was an internet analyst shill) scream the latest Wall Street price targets for gold from the NYSE floor, then there is no comparison. Gold could easily correct back to $1550 in a week or less, but it's not a bubble. Priceline, Redback, Stamps.com, Microstrategy, Digital Island, F5 Networks, Covad, JDSU and dozens more were unfathomable bubbles that cratered from hundreds of dollars per share to less than $5 in each case, and deservedly so. Gold might be over-valued, but it is does not deserve the exaggerated label.