Is QE3 Just Around the Corner?

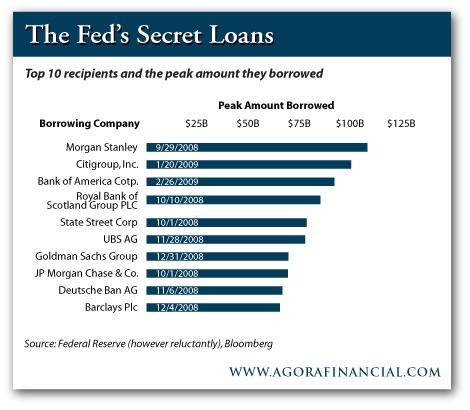

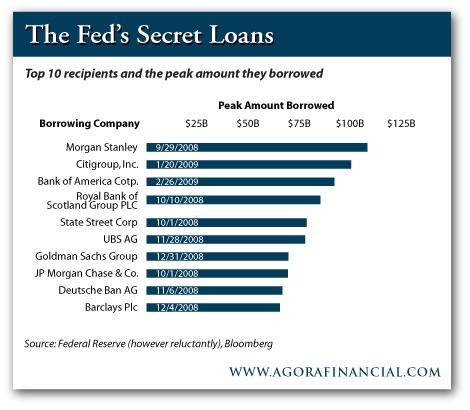

By Addison Wiggin08/22/11 Baltimore, Maryland – Secret loans from the Fed to Wall Street totaled $1.2 trillion at the height of the 2008 panic.

That’s the conclusion of Bloomberg after analyzing 29,346 pages of documents released by the Fed only because Bloomberg went all the way to the US Supreme Court to obtain them.

The top 10 recipients alone account for 56% of the total. The $669 billion these 10 borrowed is, um, rather larger than the “official bailout figure” of $160 billion represented by the TARP program.

“These are all whopping numbers,” according to former Justice Department official Robert Litan, who served on a commission that looked into the savings-and-loan scandal of the 1990s.

“These are all whopping numbers,” according to former Justice Department official Robert Litan, who served on a commission that looked into the savings-and-loan scandal of the 1990s.

“You’re talking about the aristocracy of American finance going down the tubes without the federal money.” To say nothing of the European banks that make up nearly half of the top 30 borrowers.

Under new Fed rules, the banks are to keep a minimum amount of operating funds on hand every day to prevent this from happening again. But the rule doesn’t come into effect until 2015.

In other words, the banks will sober up after one last drink.

That’s the conclusion of Bloomberg after analyzing 29,346 pages of documents released by the Fed only because Bloomberg went all the way to the US Supreme Court to obtain them.

The top 10 recipients alone account for 56% of the total. The $669 billion these 10 borrowed is, um, rather larger than the “official bailout figure” of $160 billion represented by the TARP program.

“You’re talking about the aristocracy of American finance going down the tubes without the federal money.” To say nothing of the European banks that make up nearly half of the top 30 borrowers.

Under new Fed rules, the banks are to keep a minimum amount of operating funds on hand every day to prevent this from happening again. But the rule doesn’t come into effect until 2015.

In other words, the banks will sober up after one last drink.

Read more>>