– Dollar has fallen over 90 percent since Fed was put into place. Fed running out of ammo with negative interest policy.

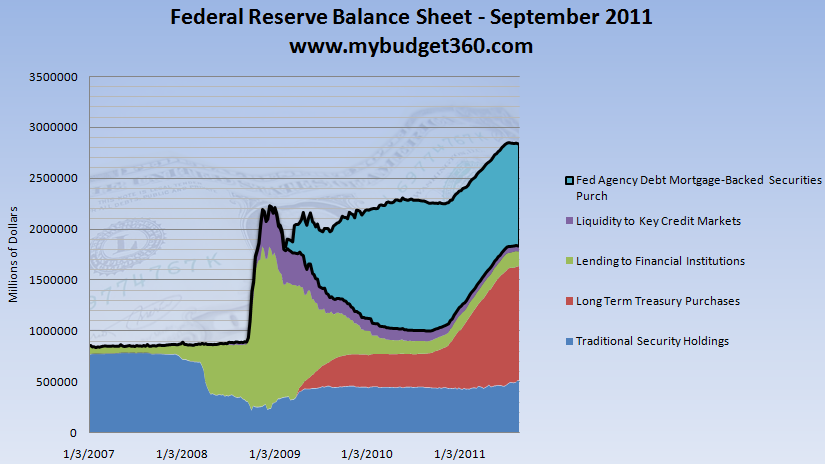

What does the Federal Reserve have in its balance sheet?

The Fed for most of its history has been rather mundane in the types of instruments it would hold as collateral. This was typically in the form of U.S. Treasuries. However, since 2008 the Fed has become rather exotic in regards to its holdings and has grown its balance sheet to a size well over $2.8 trillion:

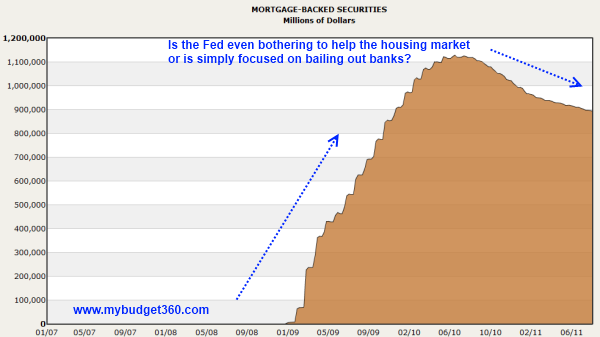

The Fed only recently has delved into the mortgage buying game and did so with the gusto of a kid in a candy shop. The Fed through Quantitative Easing has purchased over $1 trillion in mortgage backed securities from the too big to fail banks. The Fed has also inherited luxury hotels, fast food restaurants, and other failed projects that require banks to be bailed out. Of course this has come at the expense of a declining dollar. The pain being felt in the economy is simply a symptom of a central bank built on darkness and keeping the public completely ignorant to its doings. This was the purpose of the Fed from day one. Reading about the founding of the Fed is like reading about a Skull and Bones initiation:

“(The Creature From Jekyll Island) Picture a party of the nation’s greatest bankers stealing out of New York on a private railroad car under cover of darkness, stealthily riding hundred of miles South, embarking on a mysterious launch, sneaking onto an island deserted by all but a few servants, living there a full week under such rigid secrecy that the names of not one of them was once mentioned, lest the servants learn the identity and disclose to the world this strangest, most secret expedition in the history of American finance. I am not romancing; I am giving to the world, for the first time, the real story of how the famous Aldrich currency report, the foundation of our new currency system, was written…”It was never intended for the public to even have a sense of who was behind the scenes pulling the strings to create the Federal Reserve. Just like in the Wizard of Oz, the power of the wizard comes from the smoke and mirrors. And the insistence that the housing market is fine is merely a giant charade of the Fed buying practically every mortgage backed security it could get its hands on:

There is little reason to pick Jekyll Island instead of say New York to hold this meeting but the bankers needed a place obscure enough to stay off the radar:

Read more>>