-- Posted Thursday, 29 September 2011 | | Source: GoldSeek.comom

By: Rob Kirby

Back on July 21, 2011 – Senator Bernie Sanders [VT] published a paper titled, The Fed Audit, where he made the claim that a GAO [Government Accountability Office] report showed the real cost of the Federal Reserve bailout was 16 Trillion.

A snippet from Bernie Sanders’ The Fed Audit:The first top-to-bottom audit of the Federal Reserve uncovered eye-popping new details about how the U.S. provided a whopping $16 trillion in secret loans to bail out American and foreign banks and businesses during the worst economic crisis since the Great Depression. An amendment by Sen. Bernie Sanders to the Wall Street reform law passed one year ago this week directed the Government Accountability Office to conduct the study. “As a result of this audit, we now know that the Federal Reserve provided more than $16 trillion in total financial assistance to some of the largest financial institutions and corporations in the United States and throughout the world,” said Sanders. “This is a clear case of socialism for the rich and rugged, you’re-on-your-own individualism for everyone else.”

Among the investigation’s key findings is that the Fed unilaterally provided trillions of dollars in financial assistance to foreign banks and corporations from South Korea to Scotland, according to the GAO report. “No agency of the United States government should be allowed to bailout a foreign bank or corporation without the direct approval of Congress and the president,” Sanders said.

The entire GAO report can be read here: http://sanders.senate.gov/imo/media/doc/GAO%20Fed%20Investigation.pdf

Here’s a few snippets directly from the GAO report:

“The Reserve Banks’ and LLCs’ financial statements, which include the emergency programs’ accounts and activities, and their related financial reporting internal controls, are audited annually by an independent auditing firm. These independent financial statement audits, as well as other audits and reviews conducted by the Federal Reserve Board, its Inspector General, and the Reserve Banks’ internal audit function, did not report any significant accounting or financial reporting internal control issues concerning the emergency programs.”

[pg. 23] “The Federal Reserve Board is a federal agency that is responsible for maintaining the stability of financial markets; supervising financial and bank holding companies, state-chartered banks that are members of the Federal Reserve System, and the U.S. operations of foreign banking organizations; and supervising the operations of the Reserve Banks.”

And at page 112:

“Emergency Programs That Have Closed Have Not Incurred Losses and the Federal Reserve Board Expects No Losses on Those With Outstanding Balances.”

So how could something that the GAO reportedly claimed cost 16 Trillion at the same time be showing no losses anywhere?

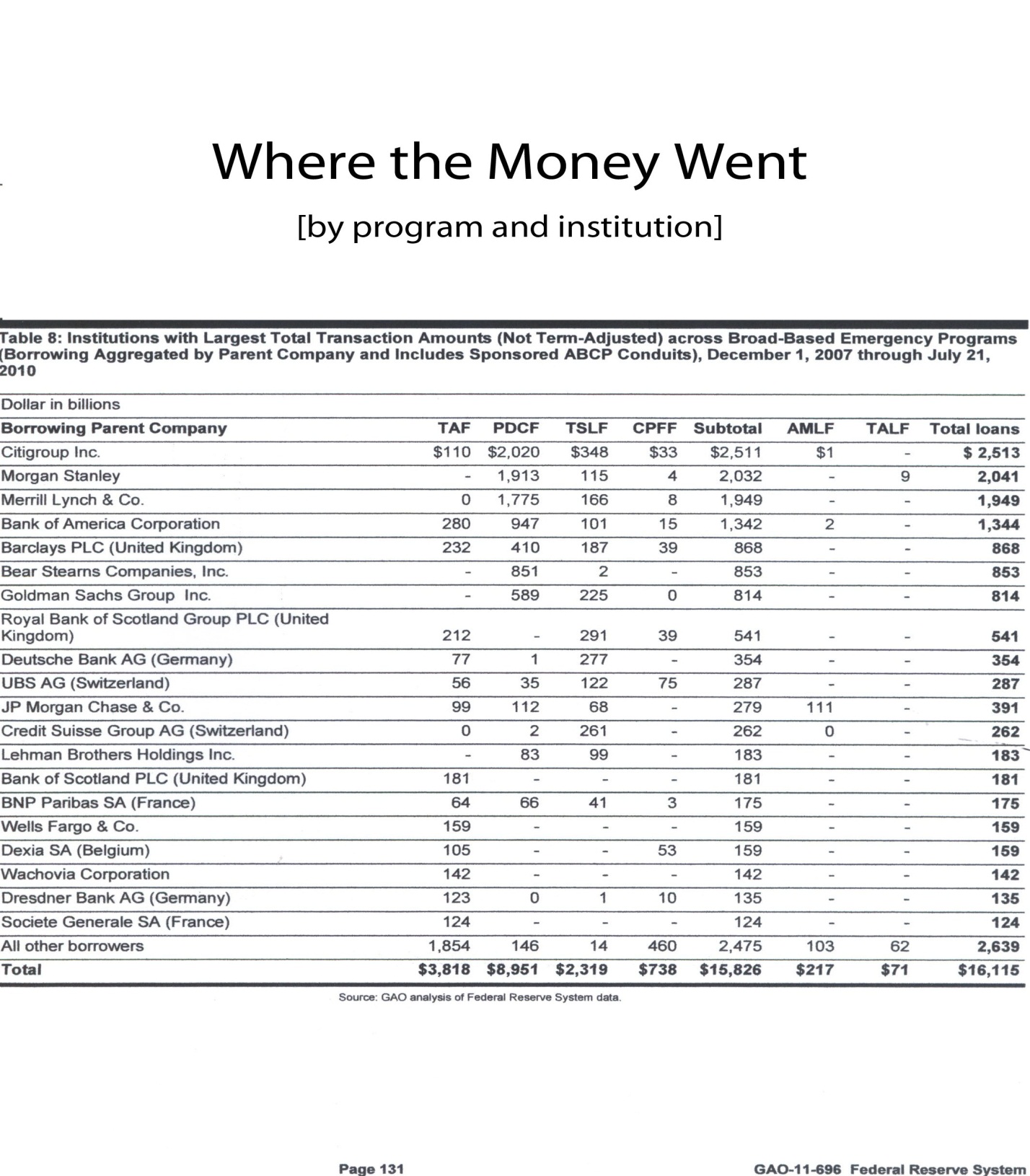

At page 166 we finally begin to get a picture – albeit fuzzy - of how much money [credit] was actually extended during the bailout – with an aggregated breakdown of how much by each institution under broad based programs: