Tuesday, 06 September 2011 09:37

In recent weeks, we've all watched as the sovereign debt issues facing the Eurozone and the United States seem to be spiralling out of control. While the issue is not page one news most days, the situation is still very dynamic and, in combination with what appears to be Part II of the Great Recession, the world's fiscal situation could get rather dicey to put it mildly. In this posting, I'll take a look at a rather arcane (at least to most of us) measure that may signal what lies ahead for all of us.

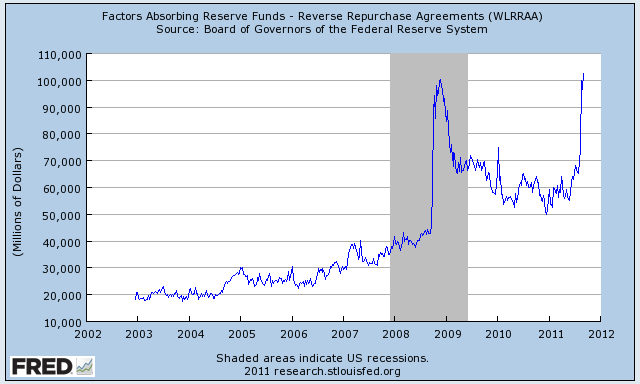

In perusing the web, I happened on this fascinating graph from the St. Louis Federal Reserve Bank as sourced on their FRED pages (Federal Reserve Economic Data):

The RRA in the title of the graph WLRRAA stands for Reverse Repurchase Agreements. I'll let the Fed explain exactly what reverse repurchase agreements are in their own words:

"Reverse repurchase agreements are transactions in which securities are sold to a set of counterparties under an agreement to buy them back from the same party on a specified date at the same price plus interest. Reverse repurchase agreements may be conducted with foreign official and international accounts as a service to the holders of these accounts. All other reverse repurchase agreements, including transactions with primary dealers and a set of eligible money market funds, are open market operations intended to manage the supply of reserve balances; reverse repurchase agreements absorb reserve balances from the banking system for the length of the agreement. As with repurchase agreements, the naming convention used here reflects the transaction from the counterparties' perspective; the Federal Reserve receives cash in a reverse repurchase agreement and provides collateral to the counterparties."

Now that your eyes have completely glazed over, I'll explain what RRA's are in terms that mere mortal earthlings that don't work for central banks can understand.

Reverse repurchase agreements are nothing more than the purchase of a security by a party with the agreement that the purchasing party will be able to sell them on a specific date in the future at a higher price. For the party selling the security and agreeing to repurchase it in the future, the action is known as a "repo". For the party who buys the security and agrees to sell it in the future, the action is known as a reverse repurchase agreement. According to Investopedia, these transactions are classified as money-market instruments.

In the specific case of the Federal Reserve, the central bank uses reverse repurchase agreements to temporarily add or subtract reserve balances in the open market (the amount of money in the system) and to temporarily offset swings in bank reserve levels. In 2009, the Federal Reserve used reverse repurchase agreements to drain some of the $1 trillion that they pumped into the economy during the Great Recession. By selling securities to the 18 primary dealers in the Fed's universe, they can decrease the amount of money available in the banking system. The removal of "money" can result in both an economic slowdown and inflationary pressures, one of the great concerns of removing "paper" that has been created out of thin air from the system.

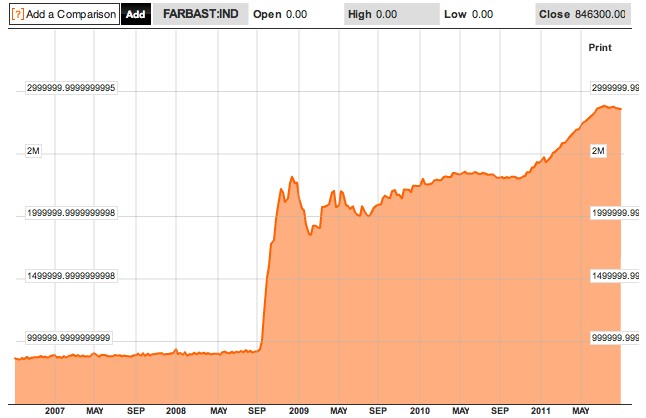

Just in case you were wondering, here's a graph showing just how much the Fed's assets (FARBAST) have grown since the inception of the Great Recession in 2008:

Just prior to September 2008, the Fed had just over $908 billion in assets. This has grown to $2.857 trillion today. That's one giant pile of Bernanke toilet paper!

The Federal Reserve uses repurchase agreements to make collateralized loans to primary dealers with the loans often having a term of only one day (i.e. overnight) but the term can be extended to as long as 65 days. The use of collateral protects the Fed should the borrowing institution default; as an additional layer of protection, the Fed applies a "haircut" to the collateral by valuing it at slightly less than its market value. In return for their largesse, when the repo matures, the Fed returns the collateral to the dealer in exchange for the return of the loaned amount plus accrued interest.

Sorry for the distraction. Let's go back to the first graph. This graph shows the reverse purchase agreements for Foreign Official and International Accounts (RRAFOIAL). Foreign Official Accounts include assets held by the Federal Reserve for foreign governments, central banks and a small number of government investment funds and other international organizations including the IMF and the BIS. In other words, this measure shows the amount of funds that the world's central banks and other official bodies have deposited at the Federal Reserve. Data shows that the reserve funds from "Official Foreign Accounts" have doubled since the start of the year from $53 billion in January 2011 to $102 billion at the end of August 2011 with a marked increase from $65 billion since mid-July when the Eurozone debt crisis reached near catastrophic proportions. This massive increase, seen only once before this decade just as the world's credit markets froze during the advent of the Great Recession, means that central banks around the world are concerned about the security of their deposits so, rather than placing them with what are seen to be risky European banks, they are putting money on deposit with the seemingly stable United States Federal Reserve.

Looking back to 2008, there was a similar rapid growth in the size of the reverse purchase agreements at the Fed. In mid-September 2008, there was $45.7 billion on deposit; this grew very rapidly to $100.4 billion by the middle of November 2008. We all know how that particular story ended, don't we? As well, note that the funds on deposit have remained at an elevated level between $50 billion and $65 billion when compared to the much lower pre-2008 level.

Oh what a tangled web of paper we weave when we fire up the world's printing presses!

I fully realize that $102 billion doesn't seem like much in this world of multi-trillion dollar debts and deficits but it does show us that central banks around the world are feeling rather stressed about the security of their assets just as they were in mid-2008. Perhaps this graph is telling us that we should all be as concerned about the security of our own assets in light of the sovereign debt issues facing the world today.

Over the coming weeks and months I'll keep you posted on the growth rate of the RRAFOIAL funds on deposit with the Federal Reserve. It could well be a harbinger of what lies ahead....and that's most frightening.

Click HERE to read more of Glen Asher's columns.