Posted on November 8, 2011

In its latest report on global systemically important banks, the FSB makes it clear that the world’s largest banks have become too big to fail without crashing the global economy.

The leaders of the G20 recently requested the FSB to develop a policy framework to evaluate the risks associated with “systemically important financial institutions” (SIFIs). In its report to the G20, the FSB states that :

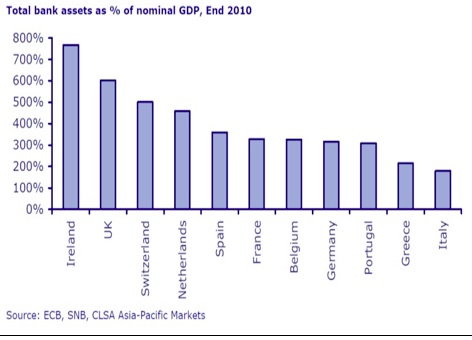

SIFIs are financial institutions whose distress or disorderly failure, because of their size, complexity and systemic interconnectedness, would cause significant disruption to the wider financial system and economic activity. To avoid this outcome, authorities have all too frequently had no choice but to forestall the failure of such institutions through public solvency support. As underscored by this crisis, this has deleterious consequences for private incentives and for public finances.Although the FSB has established a set of policies for dealing with “too big to fail” institutions, none of the measures have been instituted. The largest banks have been allowed to grow so large that their size has overwhelmed the ability of nation’s to bail them out without destroying national balance sheets. Who is left to rescue banks that have become bigger than countries!?

The 29 most dangerous banking institutions (SIFIs) identified by the FSB are listed below. The FSB blandly admits that the sudden failure of even one of these huge banks could result in “contagion risk” that would topple the entire interlocked financial system.

Not surprisingly, U.S. banks are prominent on the list, including Bank of America, Citigroup, Goldman Sachs, JP Morgan Chase, Morgan Stanley and Wells Fargo.

Bank of America

Bank of China

Bank of New York Mellon

Banque Populaire CdE

Barclays

BNP Paribas

Citigroup

Commerzbank

Credit Suisse

Deutsche Bank

Dexia

Goldman Sachs

Group Crédit Agricole

HSBC

ING Bank

JP Morgan Chase

Lloyds Banking Group

Mitsubishi UFJ FG

Mizuho FG

Morgan Stanley

Nordea

Royal Bank of Scotland

Santander

Société Générale

State Street

Sumitomo Mitsui FG

UBS

Unicredit Group

Wells Fargo

source: ProblemBankList