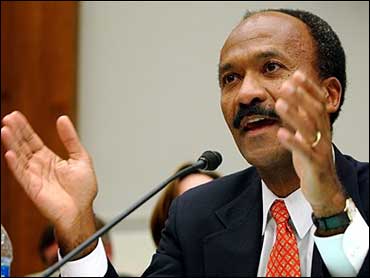

More, related: WHO COULD EVER FORGET FRANKLIN RAINES! As an executive at Fannie Mae, Franklin Raines illegally coerced his employees to falsify accounting facts so he’d get a maximum bonus. The government-backed firm used Enron-like fraud, in part at Raines’s orders, to create the largest bail-out in US history. Raines had the whistleblower fired. [source: Franklin Raines' criminal enterprise from Hennessy'sView]

Posted on November 10, 2011

Posted on November 10, 2011

According to a report released by the Inspector General of the FHFA, a total of $47.8 million was paid to the top ten executives of Fannie Mae and Freddie Mac since they were placed into receivership. The top six wunderkinds working at Fannie and Freddie have received compensation of $35 million since they failed, and another ten executives were rewarded with $12.8 million in bonuses.

At the same time Fannie and Freddie are bleeding the taxpayers dry. The busted agencies have received a total of $183 billion in bailout out funds since they failed and the end to future bailouts is no where in sight.

Fannie Mae, after reporting a loss for the third quarter, asked the U.S. Treasury for an an additional $7.8 billion. Fannie Mae’s heavy investment in risky subprime and high loan to value mortgages helped to fuel the housing bubble and is now producing billions of dollars in losses.

Earlier this month Freddie Mac reported a loss of $4.4 billion for the third quarter and asked the U.S. Treasury for an additional $6 billion. Incredibly, Freddie Mac reported that they lost $4.8 billion on derivatives trading during the quarter. The derivatives, which were supposed to protect Freddie Mac from adverse changes in interest rates, instead blew up and the $4.8 billion loss is being passed on to (you guessed it) – the taxpayers. Ironically, the other side of the derivative contracts held by Freddie were undoubtedly held by the too big to fail banks that dominate derivatives trading. Since derivatives are a zero sum game, Freddie’s losses resulted in billion dollar gains for the casino banks that wrote the derivative contracts.

Aware of the public outrage over excessive compensation to Fannie and Freddie executives, the House Financial Services Committee has moved to apply government pay grades to senior executives at both Fannie and Freddie. It would not be surprising if the taxpayers consider this belated action by lawmakers to be too little, too late.

source: ProblemBankList