Posted on November 23, 2011

The FDIC’s Quarterly Banking Profile for the third quarter of 2011 shows banking industry profits increasing by 48% from the third quarter of 2010. Aggregate net income of the banking industry for the third quarter of 2011 totaled $35.3 billion compared to $23.8 billion in the third quarter of 2010.

Although traditional news organization headlines proclaimed “Strong Profit Growth For U.S. Banks”, a look beneath the surface shows a banking industry still mired in zero organic growth and facing major headwinds from distressed real estate markets, high unemployment, zero income growth, low credit demand, questionable asset valuations, credit exposure to collapsing European banks and the prospect of a looming global recession.

Bank Profits A Mirage

Let’s take a closer look at the $35.3 billion in profits posted by the banking industry in the third quarter.

According to the FDIC’s own admission, $16.5 billion of the third quarter’s profit increase came from a reduction in loan loss provisions rather than organic growth.

As was the case in each of the last eight quarters, lower provisions for loan losses were responsible for most of the year-over-year improvement in earnings. Third-quarter loss provisions totaled $18.6 billion, almost 50 percent less than the $35.1 billion that insured institutions set aside for losses in the third quarter of 2010.

Over half of the banking profits in the third quarter were generated by lower loan loss reserves based on the belief that losses on loan portfolios will decline. Future losses from the onset of a new recession, continued declines in real estate values or a multitude of other adverse events could quickly reverse this source of banking “profit” and require banks to increase loan loss reserves.

FDIC acting Chairman Gruenberg admitted the low quality of the banking industry’s third quarter profit by stating “That can’t go on indefinitely. At some point, in order to generate income and revenues, lending is going to have to expand.”

Too Big To Fail Banks Boost Income With Bizarre Accounting Rules

Financial institutions with over $10 billion in assets account for almost 80% of all banking industry assets. As of September 30, 2011, there were a total of 7,436 FDIC insured financial institutions. Almost 80% of all banking assets are held by only 106 financial institutions that have greater than $10 billion in assets. A review of the third quarter results for some of the country’s largest financial institutions reveal that billions in reported profits were manufactured through a reduction in loan loss reserves and/or bizarre accounting rules related to the decline in the value of outstanding bank debt securities.

Citigroup, the third largest bank in the U.S., reported net income for the 2011 third quarter of $3.77 billion which was 74% above the prior year quarter. Virtually all of Citigroup’s profits for the quarter came from junk income. Citigroup’s loan loss provision dropped by $1.42 billion for the quarter. In addition, Citigroup also recorded a gain of $1.9 billion from a “credit valuation adjustment” (CVA) related to the decline in the value of its debt securities.

The CVA “gain” was generated when the value of Citigroup debt securities declined due to concerns by investors over the Bank’s financial health. Citigroup was allowed to boost its reported income since, theoretically, the Bank could have bought back the distressed debt securities in the open market at a big discount from the issue price, resulting in a gain.

Citigroup did not break any rules by booking the huge CVA gain and was in full compliance with Financial Accounting Standards Board rules. The accounting rules, however, do little to encourage confidence in the banking system. Under this bizarre accounting treatment, the judgment of investors that Citigroup could go under and default on its debt resulted in a large accounting gain. The ultimate lunacy of booking CVA profits will result in the most troubled and likely to fail banks reporting huge profit gains.

Without the benefit of reduced loan loss provisions and a sharp decline in the value of Citigroup’s debt securities, Citigroup would have shown a paltry profit for the quarter of only $45 million rather than $3.77 billion.

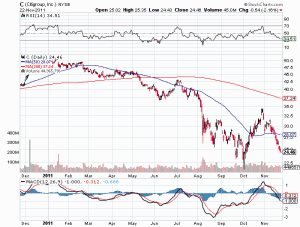

A quick look at Citigroup’s stock price show that investors were not fooled by the huge phony profit gain.

CITIGROUP - COURTESY STOCKCHARTS.COM

Citigroup was not the only bank with a large percentage of third quarter income generated by credit valuation adjustments. Four of the country’s largest banks reported $13.4 billion in CVA adjustments for the third quarter 2011 which accounted for 81% of total profits as shown below.... finish reading @ProblemBankList

An ethical person - like a politician, banker or lawyer - may know right from wrong, but unlike many of them, a moral person lives it. An Americanist first already knows that. Bankers and their government agents will always act in their own best interests. Any residual benefit flowing down to the citizens by happenstance will just be litter.

Thursday, November 24, 2011

Increase In Third Quarter Banking Profits Largely Due To Phony Accounting Gimmicks

Posted by

Charleston Voice