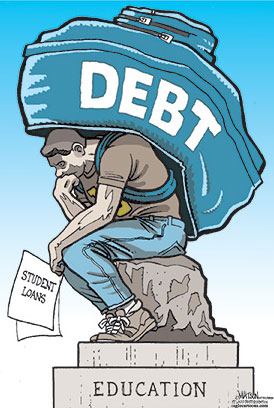

When students borrow money for college, and often saddle themselves with enormous debts, they wind up taking out loans with one of five major lenders in the U.S. A trillion-dollar business, it has been a source of profit for the big five.

The biggest player in the student-loan industry is the SLM Corporation, aka Sallie Mae. Originally a government-sponsored enterprise created in 1972, Sallie Mae went fully private in 2004. Just four years later, it had to be bailed out by the federal government when its version of “subprime” loans to borrowers attending for-profit colleges or trade schools left SLM saddled with unpaid debts.

But Sallie Mae wound up solvent, and even earned profits totaling more than $320 million after the rescue. It was even strong enough to pay $1.2 billion for the right collect payment on $28 billion of Citigroup’s federally-backed student loans after the bank decided to get out of the business.

Second to the SLM Corporation is Wells Fargo. It was the fourth largest lender, but after it bought up Wachovia (No. 3) at the end of 2008, the bank took over the No. 2 spot, with more than $10 billion in student loans. The good news is that Wells Fargo is now offering fixed-rate loans for students. The bad news is that the rates can go up to 14.25%.

About $4.2 billion worth of student loans held by Citigroup’s Student Loan Corporation was snatched up at the end of 2010 by Discover Financial Services, the company behind Discover Card and now third largest lender.

Rounding out the list are Nebraska-based NelNet and Wall Street titan JPMorgan Chase.

-Noel Brinkerhoff, David Wallechinsky

Meet 5 Big Lenders Profiting From the $1 Trillion Student Debt Bubble (Hint: You Know Some of Them Already) (by Sarah Jaffe, AlterNet)

Student Loan Debt Reaches $1 Trillion (by Noel Brinkerhoff, AllGov)