December 26, 2011

Throughout history, the gold-to-silver price (GLD, SGOL, SLV, PSLV) ratio has tended to revert to some long run average. Precisely what this long run average should be has been a matter of debate for centuries.

Some suggest that the natural gold-to-silver ratio is around 10-15, based on the relative physical scarcity of gold relative to silver. This ratio has been seen during historical monetary regimes that supported bi-metalism. Today the gold-to-silver ratio is far higher, but because silver is used in many industrial processes, many suggest silver supply is becoming tight.

Therefore, one might conclude that the gold-to-silver ratio could actually shrink. In fact, some pundits have suggested silver could trade at about $200/oz, putting the target ratio closer to 8.

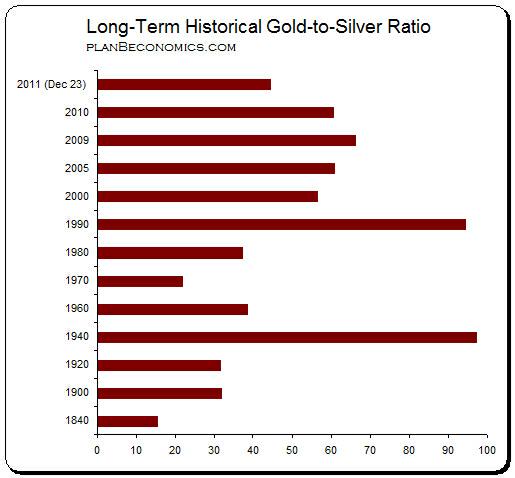

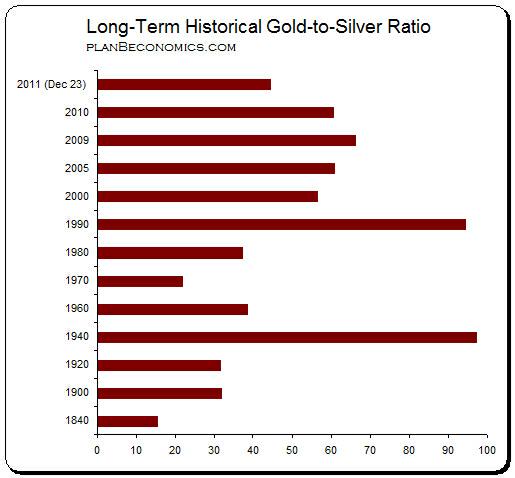

Although silver scarcity might be increasing relative to gold, since 1840, it appears that gold has seen its relative value grow at a faster rate. As you can see in the chart below, in 1840 the gold-to-silver ratio was 15.5. As the U.S. monetary machine became increasingly disconnected from silver, the gold-to-silver ratio has risen and remained at a permanently higher level.

Some suggest that this permanently higher level was caused by the death of silver as a monetary metal. In fact, it seems like the abandonment of convertibility into any metal has supported gold relative to silver. Although fiat monetary regimes currently rule the western world, one could argue that central bank gold reserves have provided support for gold relative to silver, justifying the larger ratio. This is because, in comparison, central banks silver reserves are next to nothing.

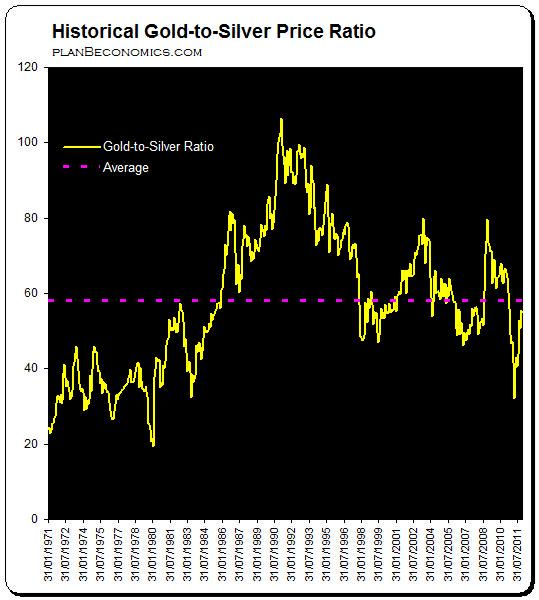

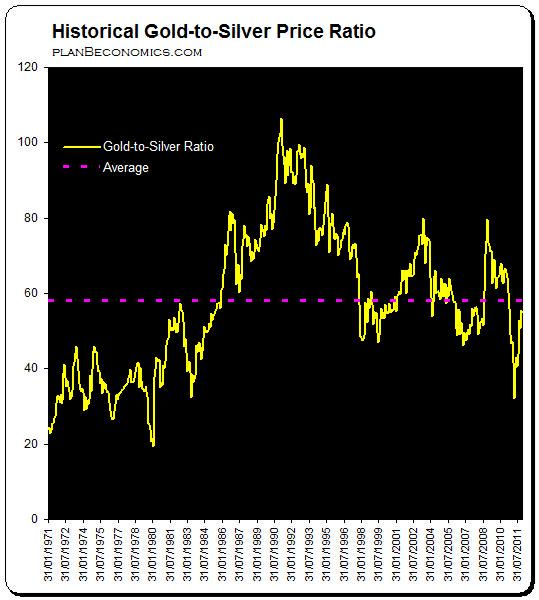

The chart below shows the gold-to-silver ratio since Nixon abandoned the gold standard in 1971. The average ratio during this time was 57.85. Currently, the ratio is at 55.01. Assuming the average ratio over the past 40 years is appropriate, today's gold and silver prices are at relative fair value.

Personally, I think there is a long-term case for silver. In order to be bullish on silver relative to gold, I would argue that one has to a) expect the silver supply-demand relationship to deteriorate (relative to gold) due to reserves depletion and demand growth, and b) expect central banks to increase silver reserves. But if you don't believe this to be true, the feasibility of $200/oz silver forecasts becomes quite doubtful.

source

Throughout history, the gold-to-silver price (GLD, SGOL, SLV, PSLV) ratio has tended to revert to some long run average. Precisely what this long run average should be has been a matter of debate for centuries.

Some suggest that the natural gold-to-silver ratio is around 10-15, based on the relative physical scarcity of gold relative to silver. This ratio has been seen during historical monetary regimes that supported bi-metalism. Today the gold-to-silver ratio is far higher, but because silver is used in many industrial processes, many suggest silver supply is becoming tight.

Therefore, one might conclude that the gold-to-silver ratio could actually shrink. In fact, some pundits have suggested silver could trade at about $200/oz, putting the target ratio closer to 8.

Although silver scarcity might be increasing relative to gold, since 1840, it appears that gold has seen its relative value grow at a faster rate. As you can see in the chart below, in 1840 the gold-to-silver ratio was 15.5. As the U.S. monetary machine became increasingly disconnected from silver, the gold-to-silver ratio has risen and remained at a permanently higher level.

Some suggest that this permanently higher level was caused by the death of silver as a monetary metal. In fact, it seems like the abandonment of convertibility into any metal has supported gold relative to silver. Although fiat monetary regimes currently rule the western world, one could argue that central bank gold reserves have provided support for gold relative to silver, justifying the larger ratio. This is because, in comparison, central banks silver reserves are next to nothing.

The chart below shows the gold-to-silver ratio since Nixon abandoned the gold standard in 1971. The average ratio during this time was 57.85. Currently, the ratio is at 55.01. Assuming the average ratio over the past 40 years is appropriate, today's gold and silver prices are at relative fair value.

Personally, I think there is a long-term case for silver. In order to be bullish on silver relative to gold, I would argue that one has to a) expect the silver supply-demand relationship to deteriorate (relative to gold) due to reserves depletion and demand growth, and b) expect central banks to increase silver reserves. But if you don't believe this to be true, the feasibility of $200/oz silver forecasts becomes quite doubtful.

source