Overview

What if there was a hidden tax that most gold and silver investors were simply unaware of? A tax where the government would take a big chunk of your starting net worth if gold went to $2,000 an ounce, leaving you poorer than you started with? A tax that rises with inflation, so that $100,000 an ounce gold could cripple your net worth?This tax already exists, as we will demonstrate in step by step detail using three easy to follow examples. All but a few investors are unaware of this tax and its devastating implications. Simply put, when we assume that gold acts as “real money” and perfectly maintains its purchasing power during rapid inflation, then the higher that the rate of inflation rises, the higher the percentage of the average gold investor’s starting net worth that ends up belonging to the government.

Knowledge is power. Conversely, a time of severe monetary crisis could be the most dangerous time in our lifetimes to be uninformed. Investors who are unaware of this profoundly unfair tax, or who choose to ignore it, necessarily become helpless victims of the government. When investors become aware of perhaps the number one danger to long term precious metals investment, and adapt their strategies to deal with this danger – then they can unlock the true investment power of gold during times of currency crisis. And turn potential $10,000 or $100,000 an ounce gold prices into the once-in-several-generation wealth creation opportunities that they should be.

$2,000 An Ounce Gold

In the first step of our illustration, we will consider a situation and how it affects the life savings of two investors. The situation is that 50% of the value of the dollar gets destroyed by inflation. This is not a radical assumption, as with modern symbolic or fiat currencies the value of money is always destroyed by inflation. The only question is one of speed, and if we look at the United States, 80% of the value of the dollar was destroyed by inflation between 1972 and 2007 as measured by official government statistics. For this illustration we will assume there is a smaller loss in value of the dollar, but that it happens much faster – because the US is in much worse shape right now than it was in 1972 in some key ways.Kate is well educated, keeps up with the newspapers, and is concerned that the global financial crisis may get worse. So she liquidates her riskier investments, and to play it “safe”, moves her money into a $100,000 money market account.

For our illustration we will assume Kate's money is safe – but the value of her money is not protected. Inflation destroys 50% of the value of the dollar. Kate still has her full $100,000, but it will now only buy what $50,000 used to. Kate has lost 50% of the value of her investments to inflation (for simplicity, we’re leaving out assumptions on interim money market interest payments).

Jack also reads the mainstream media, but reads more widely as well, and believes that high inflation is the logical outcome of the financial crisis. Jack therefore takes his $100,000 and buys 100 ounces of gold at $1,000 an ounce (using round numbers for ease of illustration).

We will assume that gold performs exactly like many investors hope it will. That is, it acts like “real” money and maintains its purchasing power in inflation-adjusted terms. Now, if the dollar is only worth half of what it used to be, and gold does maintain its purchasing power, there is only one way for gold to do so, and that is for gold to sell for twice the number of dollars per ounce than it did before.

Therefore, gold goes from $1,000 an ounce to $2,000 an ounce. Those dollars are only worth fifty cents (in today's terms), so we multiply $2,000 times 50%, and we end up with $1,000. Jack's 100 ounces of gold at $2,000 each will buy exactly same amount of real consumption, of real goods and services, as gold used to buy for him at $1,000 an ounce. Some would say that this is an example of a perfectly successful inflation hedge, where gold has performed exactly like it is supposed to.

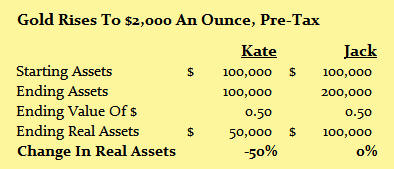

The powerful advantages of having your money in an inflation hedge when entering a period of substantial inflation, can be seen in the chart below, which compares what happened with Jack and Kate.

Adding Taxes

Through placing her money in what is conventionally considered one of the safest possible investments, during a time of high inflation, Kate has lost 50% of her net worth. This is terrible, of course, but at least she should be able to get a nice tax deduction out of this $50,000 loss. Except that when it comes time to fill in her tax return, she starts with $100,000 in her money market fund, and ends with $100,000 in principal in her money market fund. As far as the government is concerned -- there is no loss to be deducted. Kate still has every dollar she started with.Jack decides to lock in his gains by selling his gold investment, redeploy most of his newfound wealth into some new investments, and maybe take a little out to reward himself for having made such a brilliant investment. When it comes time for Jack to fill in his tax return, it shows that he bought his gold for $100,000 and he sold it for $200,000, thereby generating a $100,000 profit. Effectively, the government looks at Jack's having dodged the its destruction of the value of the nation's money, and says “Great move Jack, you made a lot of money! Now give us our share.”

Even in bullion form, gold is currently taxed as a “collectible” in the US, with a 28% capital gains tax rate, or almost twice the long-term capital gains tax rate on investments that the financial industry and government prefer. We’ll call it 30% to allow for some state capital gains taxes, and to keep the numbers round. However, this rate is not sufficient to cover government spending, as the federal government is currently running enormous deficits, as are the states and municipalities (particularly when we take into account not only declining tax collections but the pension fund crisis). So it is reasonable to expect potentially much higher taxes in the not-too-distant future, both in the US and other nations. For illustration purposes then, we will assume a 50% future combined capital gains tax rate on gold – which is not unrealistically high from a historical perspective.

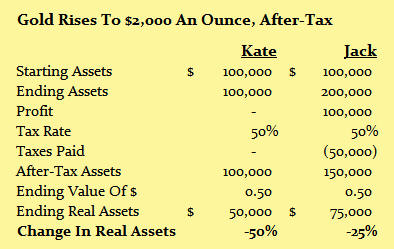

So for Jack, as shown in the chart below, paying a 50% tax rate on $100,000 in profits means $50,000 in required tax payments, and subtracting those taxes leaves Jack with $150,000.

Our final step is to adjust for a dollar being worth 50 cents, so we multiply $150,000 by 50%, and we find that Jack's net worth after-inflation and after-tax has fallen to $75,000. When it comes to what matters, the purchasing power of what our money will buy for us, then Jack didn’t double his money, instead he lost a quarter of what he started with. Jack just met what are known as “inflation taxes”. And they ran him over.