By Peter Papaherakles

On Nov. 27 Bloomberg News released an explosive report revealing that the privately owned and controlled Federal Reserve had lent—at nearly no interest—$7.77 trillion to U.S. banks during 2008 and 2009. By taking advantage of these bargain basement rates, the biggest banks in the world were able to profit by an estimated $13 billion.

The report went on to say that although the banks had received a $700 billion TARP bailout from U.S. taxpayers in the fall of 2008, they did not want to reveal the real depth of their insolvency.

The Fed secretly worked with these top banks and on Dec. 5, 2008 lent another $1.2 trillion to help them get on their feet again. “The banks continued to borrow,” the report said. “Add up guarantees and lending limits, and the Fed had committed $7.77 trillion as of March 2009 to rescuing the financial system—more than half the value of everything produced in the U.S. that year.”

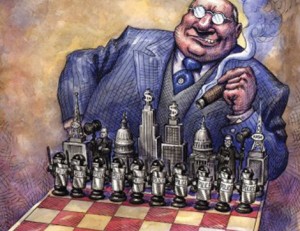

However, the Bloomberg report is full of half-truths. What are these mysterious “guarantees and lending limits?” In essence, these top banks split all this money amongst themselves. Citigroup got $1.76 trillion, Morgan Stanley $1.36 trillion, Merrill Lynch $1.28 trillion and on down the line. That’s because these banks that received this money, as some would claim, are the Fed. According to Eustace Mullins, the bankers that own the Fed include JP Morgan Chase, Goldman Sachs, Citigroup, the Rothschilds, the Warburgs, the Lazard Brothers, Kuhn Loeb and Israel Moses Seif.

So, the banks lent themselves money that actually belongs to the American people.

Another big lie is that these banks were ever in need of a bailout. In 2008 they all reaped billions in profits. JP Morgan made $15.4 billion, Goldman Sachs $11.6 billion and Bank of America $15 billion. In contrast, GM sustained a $38 billion loss and still stayed afloat.

Finally, the Bloomberg report failed tomention that it wasn’t $7.77 trillion that was secretly lent out by the Fed, but a staggering $17 trillion. Most of the money went to overseas banks. The European Central Bank alone received an eye-popping $8 trillion, with the Bank of England accepting nearly another trillion.

Through fractional reserve banking, these banks can lend many times more money than they have and collect interest on it. In the U.S. they can legally lend 10 times as much, and, in Europe, it’s 33 times. Often, however, they lend much more than that. Goldman Sachs has been assailed for lending 333 times the amount of money it had in reserve. The banks had the ability to turn $17 trillion into at least $400 trillion. That’s “crazy money” when one considers that the sum of what the whole world produces amounts to about $60 trillion per year.

In this process, a significant secret has been revealed, namely that money isn’t what we think it is. The financial crisis we are seeing in Europe and in the U.S. is smoke and mirrors. If the Fed can create trillions of dollars in interest-free money for all its banker friends, surely they can do the same for the American people they allegedly represent. There is no depression. The Fed is simply driving the United States into the ground while its friends profit untold trillions from our misery.

——

Peter Papaherakles, a U.S. citizen for more than 35 years, was born in Greece. He is AFP’s outreach director. If you would like to see AFP speakers at your rally, contact Pete at 202-544-5977.

——

Peter Papaherakles, a U.S. citizen for more than 35 years, was born in Greece. He is AFP’s outreach director. If you would like to see AFP speakers at your rally, contact Pete at 202-544-5977.

Source @AFP