Robert Hallberg Eric Sprott, the founder of Sprott assets management has repeatedly said that gold was the investment of the last decade but silver will be the investment of this decade, and by looking at some of the fundamentals he might just be right.

There is currently an equal amount of investment money going into silver as there is for gold, yet the gold/silver ratio is close to 50:1, which means that investors are buying 50 ounces of silver for every ounce of gold. Not only that, but there is nowhere close to as much silver available for investment as there is for gold.

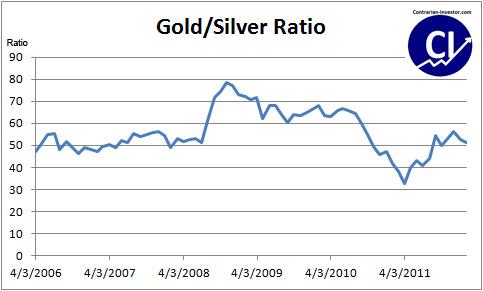

The chart above shows the gold/silver ratio for the last couple of years. This ratio is currently at 50:1 but the historical average over the past couple of hundred years have been around 16:1 which also represents the gold to silver concentration available in the ground. With a 16:1 ratio, silver would be priced over $100 in today's market, yet there are good reasons to believe that gold is going much higher. With such a strong demand for physical silver it is seems likely that we will once again see a 16:1 ratio, perhaps towards the end of this bull market.

Why is silver undervalued?

There have been a lot of discussions about silver manipulation by the people that are short silver on the Comex and there seems be some truth to this. The events orchestrated in the silver market last April were highly suspicious. It started with a record amount of selling on a Sunday night that sent the price plummeting six dollars overnight. This all happened on a day when the Chinese markets were closed. Then that same week the Comex raised margin requirements four times. This put a tremendous amount of stress on anyone long silver and forced most people out of the paper market.

We may still see some of these raids in the silver market but they cannot to continue forever. There simply isn't enough physical silver available to continue this sort of manipulation. Right now there is about a billion ounces of silver traded in a day on the Comex, yet the market only produces 900 million ounces in a year. Given these discrepancies there will be a real shortage of silver sooner or later. Perhaps a manufacture will be unable to locate inventory or maybe the Comex will fail to come up with the metal if enough people take physical delivery. When this happens, the physical supply and demand of silver will determine the price and not the buying and selling on the Comex.

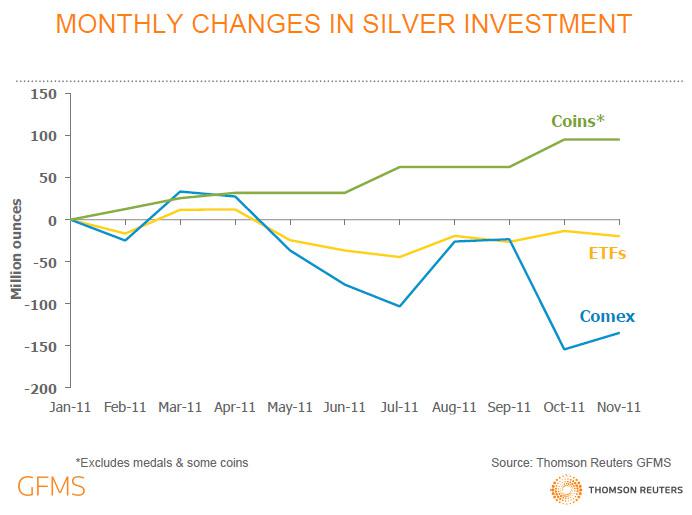

There is already a trend of investors moving away from paper derivatives into physical metal, and this trend was accelerated after the collapse of MF Global. If this trend continues at its present rate, it may not be much longer before the physical market determines the price. At that time, the activity on the Comex will become irrelevant. The chart shows the demand for physical silver and other silver derivatives.

Furthermore, a lot of the weak hands and speculators were washed out of the market during the crash last year and only the strong hands remain in the market. Many of these investors own physical silver and are unlikely to sell. Buyers of American silver eagles in particular have been known to hold on to their metal for very a very long time, sometimes for years or even decades.

As silver is consolidating and creating a base for the next breakout I suggest investors buy physical silver and to a lesser extent financial instruments such as, Sprott Physical Silver Trust (PSLV), Central Fund of Canada (CEF) and senior mining companies (streaming company) such as Silver Wheaton (SLW).

Source @SeekingAlpha