Chart Du Jour

By Tim Iacono

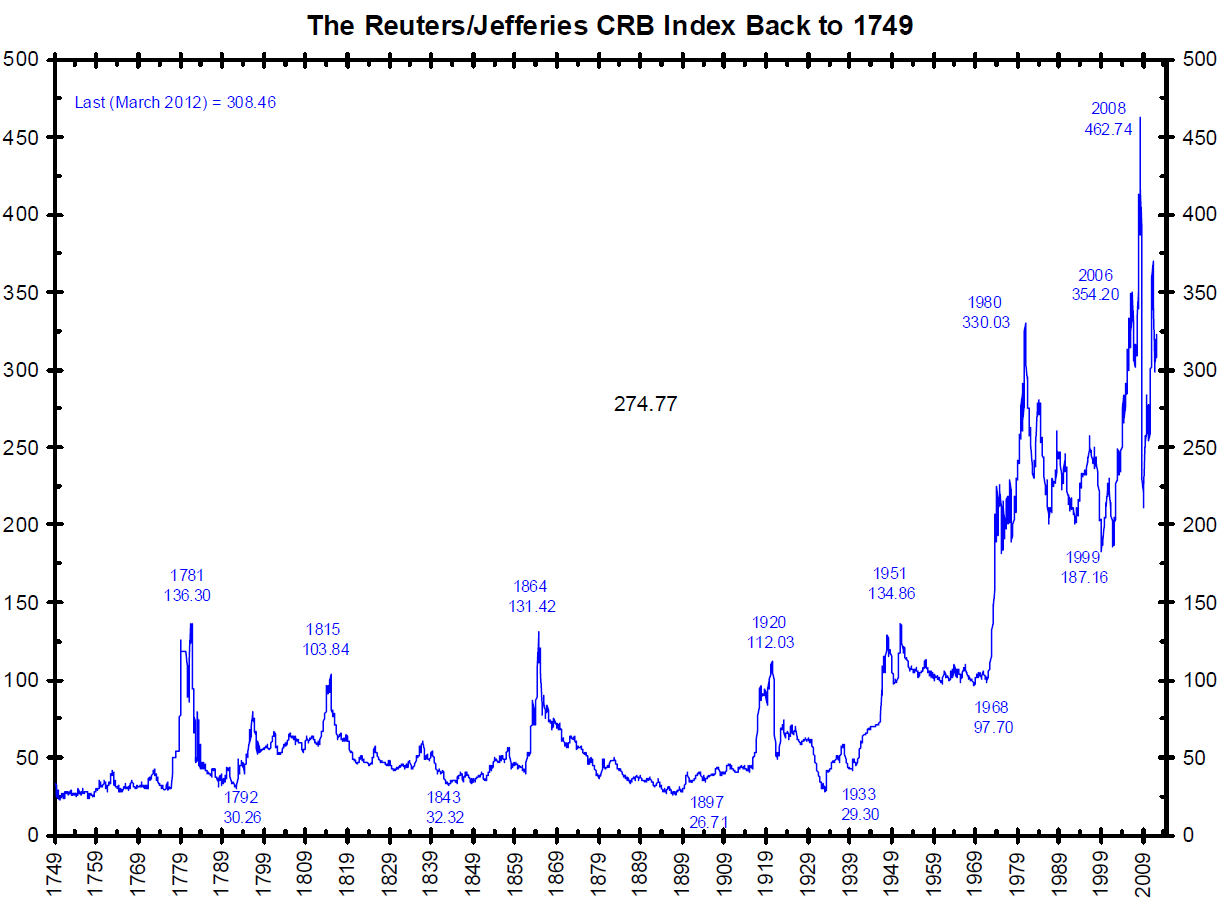

It ‘s not clear how graphics like the one below (spotted at The Big Picture)

are created since there probably wasn’t a Bloomberg-like organization

to collect data for the price of sugar back in the 1700s, but, if the

data is anywhere near accurate, it tells a fascinating story – not about

commodities, but about the U.S. dollar.

Of course, history will be the judge of the current era of pure fiat

money. My guess is that, at some point in the not-too-distant future,

the curve above will steepen rather sharply, the monetary system as we

know it will get its RESET button pushed, and we’ll revert to something other than pure fiat money.

About The Author - Tim Iacono, a retired software engineer living in Bozeman, Montana, is the founder of Iacono Research. (EconMatters author archive here.)