– JP Morgan Chase CEO earns $23 million in 2011 while 2.7 million foreclosures are filed in the US. GDP at record levels but employment figures down by 5.3 million from their peak.

The US economic and political system is doing an excellent job sealing off opportunities for millions that aspire to be part of the middle class. Many are starting to realize that the system is rigged in favor of large financial institutions and those with political connections.

The idea of raw success based on talent can be thrown out the window with the corporate welfare generosity leveled at the too big to fail financial institutions. Many Americans are being told that forced austerity is a necessary part of rebalancing yet the CEO of JP Morgan Chase just received $23 million in 2011 while tens of thousands of foreclosures riddled Chase’s balance sheet. Earned success? If we examine real GDP the facts show the US economy is as large as it has ever been but we are running it with over 5,300,000+ fewer workers. The system is designed to extract economic rents from the public and drive them into a few select sectors. The working and middle class are feeling this change deeply as noted by the over 5 million fewer workers that we have.

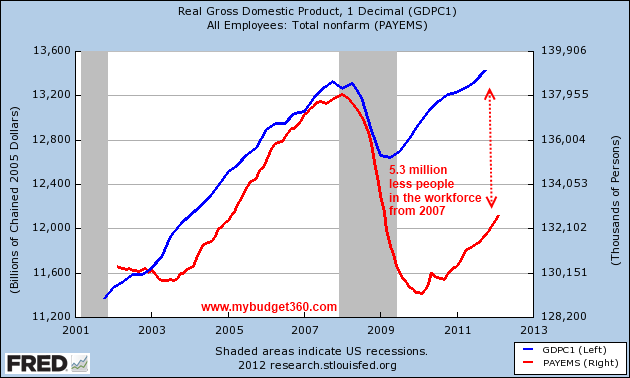

An interesting chart is examining real GDP and total US employment:

The above chart is interesting because it tells us two important things:

1. The US economy overall as measured by GDP is at a high point

2. Employment is still 5.3+ million below the peak in 2007

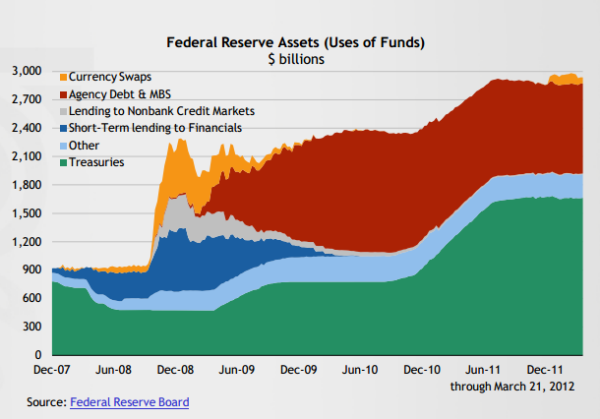

Many of the lost jobs that hit in this recession have come at the expense of the working and middle class. Many new workers were brought on with leaner wages and practically no future job security. This is happening while large financial institutions have built-in golden parachutes that come at the public’s expense. This isn’t merely speculation, this is fact and we need only look at the Federal Reserve balance sheet to verify this:

What is going on here? The Fed is serving as dumping ground for all the toxic assets from the too big to fail banks. The balance sheet has not retreated. Many of these assets have no real market so they sit in purgatory on the Fed’s balance sheet. Things are obviously going well when $23 million annual earnings are being made in the financial sector all the while junk debt and collateral sit in the Fed. Is it any wonder that inflation is now picking up steam as we are printing our way out of this mess and of course much of this is carried by the public?

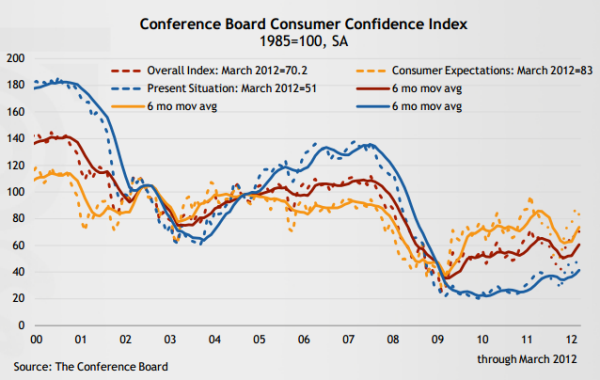

Consumer confidence tells us another story

If we look at consumer confidence, the public is not buying into the peak GDP data:

Consumer confidence is still very weak. It certainly doesn’t look like a chart that would accompany a peak GDP situation. This is largely due to the way the middle class is being crushed at the expense of a financial and political plutocracy. Americans are largely being pushed to believe that times are lean and that somehow, these giant failed banks need leadership that comes at a cost of millions of dollars. Keep in mind it is these same institutions that wrecked havoc in the economy in the first place. That narrative never even made it on the airwaves and so life gingerly goes on. In fact people get captivated by hitting the lottery since it would now appear luck is the only way up. In the mean time, economic output is at high levels yet we have a tremendously leaner workforce.

It was once hard to imagine a US with no middle class but that is no longer the case. All we need to do is look around and see how the financial industry destroyed pillars of this dream. The housing market was transformed into a speculative casino that was merely a pawn in the Wall Street game of mortgage backed securities and derivatives. Education turned into a rip off mill where students were lured in by snake oil salesman like tactic and saddled with unsupportable levels of debt. The markets wobble when the Fed mentions it is likely to pull back from its non-stop buying up of worthless debt. This process is completely unsustainable especially when US debt markets are above $53 trillion. Let us all keep believing the mainstream press and willfully ignore reality. Source