– twin balance sheets near peak levels and many European nations back in recession. Methods of understating US unemployment rates

Posted by mybudget360

The Fed and ECB (European Central Bank) have taken notes from the exact playbook in dealing with the global financial crisis.

People tend to believe that these are somehow fully set government

agencies but in reality, they are designed to protect their number one

constituency group. The Fed and ECB have the primary mission of

protecting select financial institutions.

At their core they are where the bankers bank.

I was examining the

balance sheets of both the Fed and ECB and from 2008 onward their

reactions to the financial crisis have been nearly mirror images. But

ask most Americans and Europeans if their trillion dollars of asset

maneuvers have worked out. To the contrary, many of the European

nations are back in recessions while in the US the unemployment rate

only falls because people are dropping out of the workforce or being

shadowed out in colleges with massive student debt.

The central banks have succeeded in allowing the financial system to

essentially transfer the waste onto the backs of the public.

Fed and ECB balance sheet look like financial twins

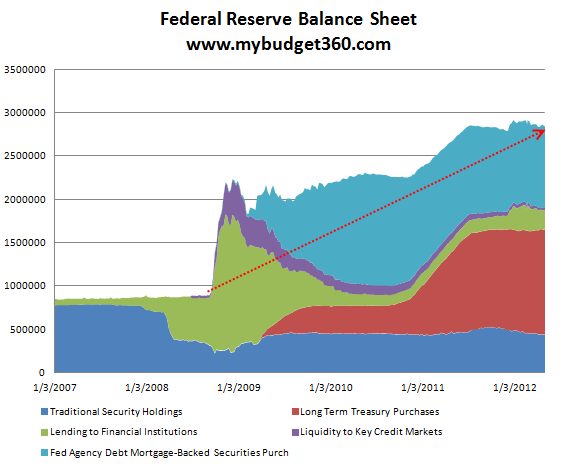

If we look at the balance sheets of the Fed and ECB we realize that

they are still holding onto peak levels of questionable assets. First,

look at the Fed balance sheet:

Not much has changed and the number of “assets” held by the Fed are

still near peak levels. Keep in mind that we already know some of these

items included failed luxury hotels, strip malls, and gambles that bankers took in the real estate bubble.

You need to ask how does this help working and middle class Americans?

Nearly five years later we know the answer is that it does not help the

public but rather subsidizes the risky bets of the banks in toxic real estate deals.

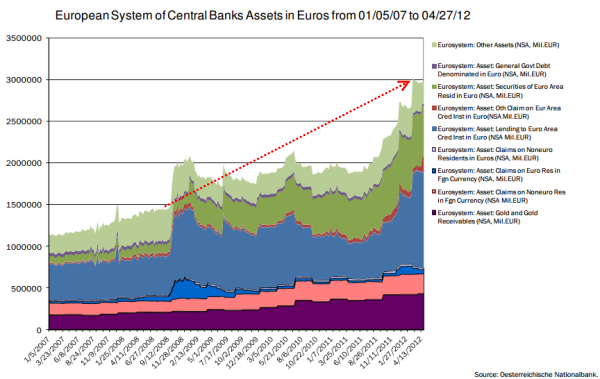

This only happened in the US with the Fed right? Actually, the ECB essentially followed down the same path:

What is different in the ECB is that they continue to expand their

debt holdings. How many loans can be given to economies with 20+ percent unemployment rates?

This is an issue of solvency and not liquidity. The Fed and ECB

essentially are playing out the same pattern which is useful for the

connected too big to fail institutions but just look at the employment

situation and wages for those in the US and Europe and a different story

emerges. There is a cost to all of this.

US dollar crushed over last few decades

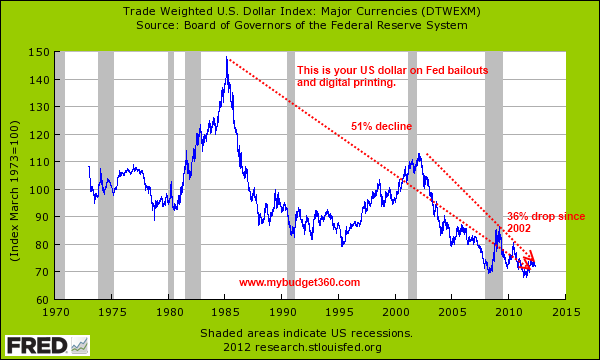

The US dollar has been crushed over the last few decades:

The US dollar has lost 51 percent of its purchasing power since 1985

and 36 percent since 2002. Is it any wonder why we are seeing creeping inflation in the cost of daily goods?

The falling dollar also is reflected in the higher prices for energy.

As usual there is always a cost to actions taken and debt does matter.

The “deficits do not matter” mentality is completely wrong and the

shadow bill is being paid by the working and middle classes of the two largest economic blocks in the world... Finish reading @Source