– CEO pay at regional banks surge on average to $10.5 million thanks to bailouts while austerity is forced onto the middle class.

Posted by mybudget360

The biggest economy in the world just reached a new peak with their

unemployment rate. We are not talking about the United States but the

massive block in the Eurozone.

The unemployment rate in the 17 country block reached a new all-time

high at 10.9 percent as austerity measures are being used to combat massive levels of debt.

There is no single rule of thumb as to how much debt is too much. A

few respected economists from the 1800s once stated that too much debt

is reached when the market suddenly acknowledges that too much debt has

been reached. In Europe it appears that this apex of debt has been

reached and certainly in a handful of economies too much debt has been

reached. The trouble of course is that Europe is a massive trading

partner to the US but also the world. It is naïve to think that issues

in the European zone will not trickle over to our already fragile

economy. The working and middle class

are likely to have another tough challenge put ahead of them as

countries overseas begin redefining what life is like with too much

debt.

The economic impacts of contagion

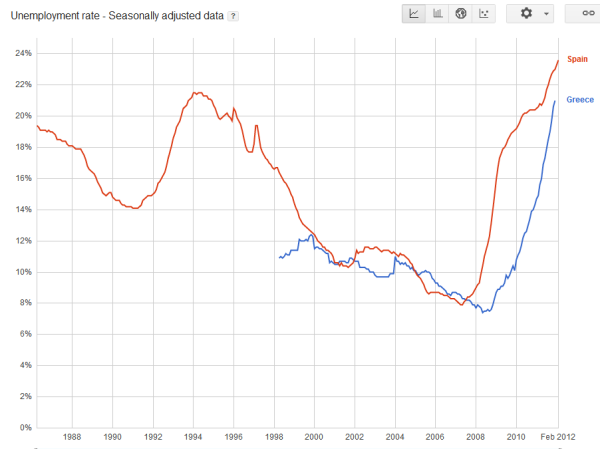

Two economies that are deep into severe recessions, practically

depressions are Greece and Spain. Their unemployment rates are reaching

levels that are likely to produce political instability:

These are unsupportable levels for any industrialized nation. The middle classes

across the world are dealing with central banks that have produced too

much debt to cater to large financial interests. Europe has taken

severe austerity measures and so far, it has not had a beneficial impact

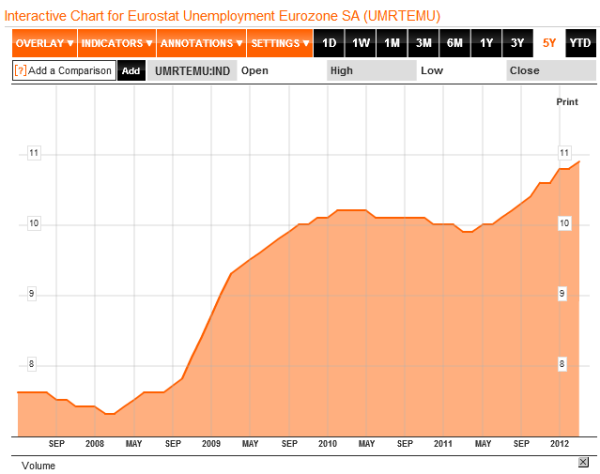

to the EU. The unemployment rate in the Eurozone is now at an all-time

high:

This trajectory is not healthy. It is interesting that while much of

the attention is guided towards Europe we here in the US keep on

printing digital money like it was going out of fashion. We have a

perfect case example of too much debt being misallocated to support the bailout of banks

and here we go printing more and more digital currency and to what

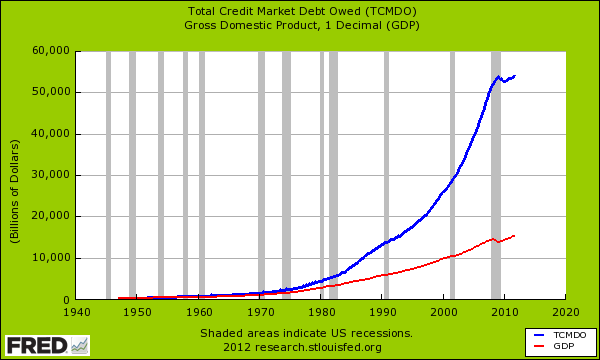

effect? Think this isn’t the case? Just take a look at total credit

market debt in the US:

I find this debt epidemic fascinating from a case study in behavioral

economics. Here in the US, many confuse access to debt with money.

This is a modern day mentality that is commonplace but very misguided.

Debt does not equal money. Yet it is understandable how the public can

confuse the two. Money is a medium of exchange for real goods. So if

someone can get a mortgage for a $500,000 home

and a $50,000 auto loan for a car and a $100,000 for an education, they

actually “received” real items from the real economy. Yet they now owe

$650,000. Depending on the ability to service this debt, this can be

problematic and that is exactly what has occurred. When you look at the

total credit market debt it is many times bigger than our current GDP.

In other words, we are spending for goods today with money that will be

paid off over many decades. It all can work when people believe they

will get paid back. It breaks when this perception starts cracking.

The risk of debt spreading over is growing

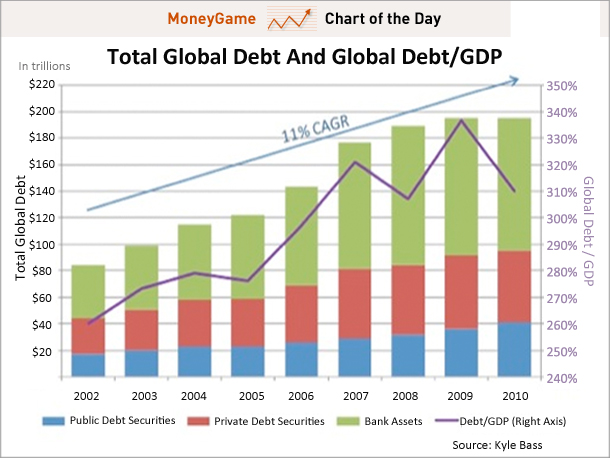

Total global debt has now reached a stunning $190 trillion:

Source: Business Insider

Keep in mind that many of the bailouts taking place through central bankers

is simply through producing more loans or similar products that keep

assets inflated. Total global debt increased by $80 trillion since

2002. While the global economy contracted, actual debt just kept on

increasing. We have seen that the impact of this strategy has done very

little good for the average worker in Europe and the United States.

Yet if we look at the financial sector, we find some are doing

exceptionally well:

“(Fierce Finance) CEO pay at the big six banks–JPMorgan Chase, Bank of America, Citigroup, Wells Fargo, Goldman Sachs and Morgan Stanley–fell to $85.4 million for 2011, from $147.8 million for 2007, according to Bloomberg. Average pay dropped 42 percent to $14.2 million.

Meanwhile, CEO pay at next five largest banks–U.S. Bancorp, PNC, Capital One, SunTrust and BB&T–rose to $52.6 million from $46.4 million for 2007. Average pay increased 13 percent to $10.5 million.”

The issue of course is the debt being infused into the system is benefitting the financial sector

and keeping the same institutions that caused this crisis to stay

afloat. The spreading of debt is going viral and at a certain point,

the axiom that too much debt is when people realize it is too much debt

is starting to ring louder and louder across the world. If the sound of

$190 trillion in total global debt doesn’t wake you up, I’m not sure what will.