Posted by Charleston Voice, 05.25.12

Wave of monetary accumulation will see gold continue upwards march

With the

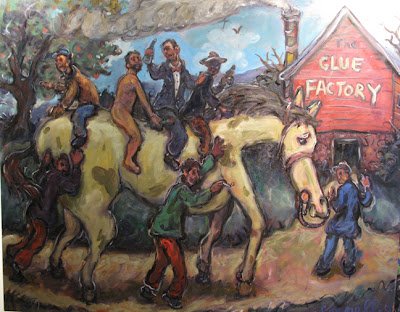

greenback merely "the best-looking horse on its way to the glue

factory", the global economic imbroglio will lead to gold regaining its

mojo and hitting new heights

Posted: Friday , 25 May 2012

Gold's recent performance has certainly been a major disappointment to the many analysts and investors who have been anticipating another stellar year for the yellow metal. But the year is hardly over . . . nor is gold's long-term bull market.

I believe we will see a reversal of gold's fortunes and new all-time highs, if not this year then certainly in 2013. Moreover, the now decade-long advance in the metal's price could last another five-to-ten years given the global economic challenges that lie ahead.

For now, gold's short-term prospects remain uncertain. So far this year, gold has traded at well beneath its all-time high of $1,924 recorded last September. Its subsequent low near $1,520 an ounce registered in late December now, in recent days, again seems to be a vulnerable support level. As we have previously cautioned, a fall back to $1,520 - or even lower - is certainly possible before gold resumes its long-term ascent.

What could trigger gold's next up-leg and march into virgin territory?

The answer is another wave of monetary accommodation, not just by the U.S. Federal Reserve but also by the European Central Bank (the ECB) and other European central banks, the People's Bank of China (the PBOC), the Reserve Bank of India, and a host of others who do not want to see their currencies appreciate against the dollar.

In the U.S. and China, the catalyst bringing on more monetary reflation will be continued signs of weakening economies along with lower commodity prices and consumer price inflation. Meanwhile, the ECB will be responding not only to rapidly contracting economies - but it will be staging the biggest bail-out of all time.

Gold's reversal from last September's record high and its continuing anemic performance reflect an Olympian tug of war between short-term institutional traders and speculators operating in derivative markets trading paper proxies for gold, proxies that have no supply limitation and are, in effect, created by the sellers themselves . . . and physical markets where long-term investors, jewelry consumers, and central banks have continued to accumulate a growing quasi-permanent stock of metal.

It is in the physical realm - the real world of supply and demand for gold bullion - where the long-term average price of gold is set. And here the fundamentals are decidedly bullish. In fact, thanks to continued central bank buying, rising Chinese private-sector demand despite signs of a slowing macro-economy, and limited mine supply availability, the fundamentals are becoming increasing bullish despite the current episode of price weakness.

It is worth noting that global gold-mine production has grown in recent years - but much of this growth has occurred in China and Russia - and every ounce these countries produce is absorbed locally by central bank accumulation and private-sector investment and jewelry demand.

You'd think gold prices would, by now, be flying at much higher altitudes what with Europe sinking deeper into recession, bank runs spreading from Greece to Spain, Portugal, and Italy, Greece increasingly likely to secede from the Eurozone, and the European Union coming apart at the seams.

Instead, the flight from the euro has favored the U.S. dollar - and the appearance of a stronger U.S. dollar has contributed to a short-term bet against gold by institutional traders and speculators. But the greenback is merely the best-looking horse on its way to the glue factory and its recent strength is merely a reflection of the euro's decline. It is not supported by a healthy American economy and sound U.S. monetary and fiscal policies.

Finish reading @Source