-- Inflated college tuition, lower home ownership rates, and compressed wages

Posted by mybudget360

Posted by mybudget360

The American Dream was always tied to economic prosperity. The

ability to work and save for a respectable retirement seemed

cornerstones to this vision of middle class success. The idea that future generations

would have it better seemed to also be part of this vision of economic

prosperity. The last two decades have seen a dramatic shift to this

vision. The struggle to stay in the middle class is getting more

difficult since more are being pushed into the poor or working poor

categories. The recovery has been largely an odd accounting function

courtesy of bailouts to the banks and massive government spending.

Today, we have the largest number of Americans on food stamps. Those seeking to follow their desire to get a better education are saddled with a minefield of student debt

and subpar institutions that simply look to steal their money and give

them a piece of paper that is hardly recognized in any professional

context. The home ownership rate, the symbolism of the American Dream

is drifting further into the shadows.

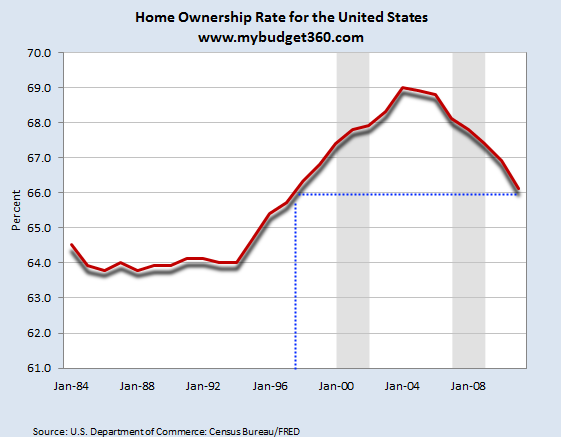

The consequences of the housing bubble

The current home ownership rate across the country is now back to levels last seen in 1996:

What does this mean for the middle class

that once relied on housing as the cornerstone for the American Dream?

At the core, it has shaken the faith of many because housing was

supposed to be a sure bet. Every year, your home value would go up and

you subtly built equity. That assurance has been wiped away in the

current aftermath of the housing bubble. The housing market had been a

steady investment for many decades providing this bedrock of stability.

This all changed of course when investment banks

in conjunction with government backed guarantees co-opted the market

and turned it into just another commodity to speculate and destroy.

Keep in mind many of these investment banks and government cronies

sought to increase home ownership across the nation and have only done

the opposite. Glass-Steagall was repealed back in 1999 and here we are

with a home ownership rate now back to 1997 levels and an economy that

is still in disarray for working and middle class Americans.

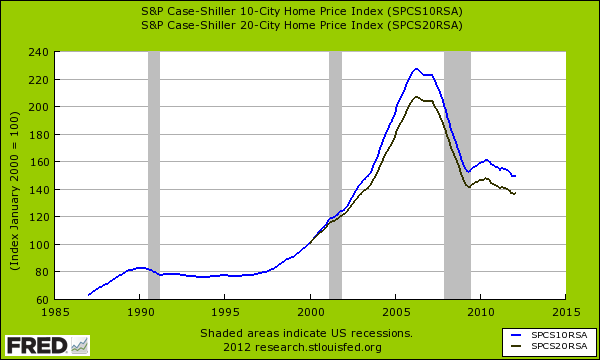

The Case Shiller Index reveals a lost decade in home values:

Yet this destruction in illusory and real wealth in real estate has impacted the net worth

of most Americans. The biggest asset most Americans have is in their

property and it has been one of the worst performing items in the last

decade. Keep in mind that many Americans already had a small net worth

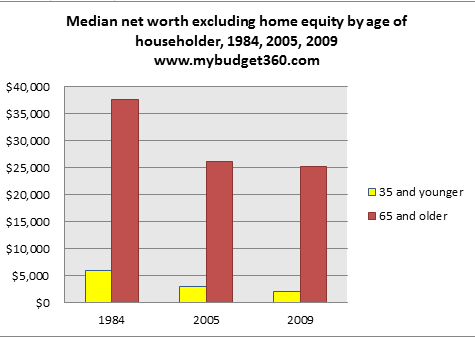

to begin with:

So here you have a two prong attack to a symbolic item of the American Dream:

-1. Younger Americans now have a much more skeptical view of housing. The low wages and big student debt already make them a harder sell for current housing.

-2. Older Americans had most of their wealth in housing and have seen their biggest asset class pop only a few years before many enter into full retirement mode.

The student debt bubble

The blue collar power that built a big middle class

after World War II is no longer an option for many in this country.

Many of the viable careers that are available today require specified

training through education. Yet many are led into for-profits

with the notion that all degrees are created equal and are saddled with

back breaking levels of debt. Put yourself in the shoes of a young

person today. You are 18, you realize that there are little options for

making it into the shrinking middle class without a solid education.

So many take the big plunge into for-profits or subpar schools

and simply come out with a giant level of debt.

State schools and

local community colleges cannot compete with marketing budgets of

for-profits. How many at 18 really have a solid understanding of

macroeconomics and future trends?

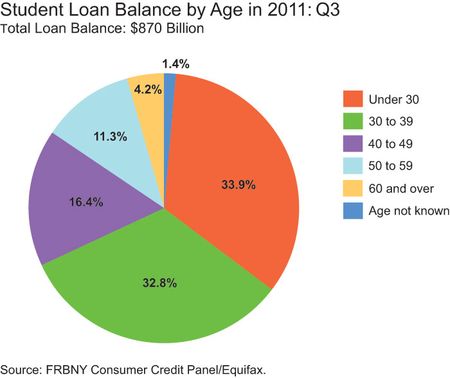

Over 66 percent of all student debt is held by those 39 and younger.

If you remember that first net worth chart, most of these people

already have a terribly low net worth. This is going to be a big issue

moving forward especially given the structure of student loan debt.

Almost every form of debt including mortgages, auto, and credit card

debt can be discharged through the bankruptcy process. This makes sense

in any balanced economy with a responsible financial system. For

example, a bank does a careful analysis of a home and requires a down

payment that is meaningful. For whatever reason, the current owners are

unable to meet their mortgage payment (a very common issue). The bank

will start foreclosure proceedings and take the home back. The owner is

not responsible for the mortgage once the bank takes over the house and

gets a clean start and if the bank was diligent, the home can be sold

for market value. Of course the financial system did not exercise due diligence and that is why we are in the mess we are in.

However with student loans, there is no formal discharge process. So

now you have many young Americans either underemployed or unemployed

yet they need to pay back that student loan debt. Do you think these

people are eager to take on another giant debt load with a mortgages?

The middle class dysphoria is causing this recovery to feel more like a

shadow recession because in reality, it is for most Americans. The

stock market is up over 100 percent from the lows in 2009 but look at

how Americans feel in poll after poll. Why?

Most Americans derive

their wealth from housing and solid employment and those two items are

in the doldrums. The stock market largely benefits those in the top one percent

who derive a sizeable income from dividends or stock gains. We’ve seen

banking executives making millions of dollars in bonuses for what?

Breaking apart the middle class? Taking out trillions of dollars in bailout funds? No wonder why most Americans are questioning what it means to be middle class. Source