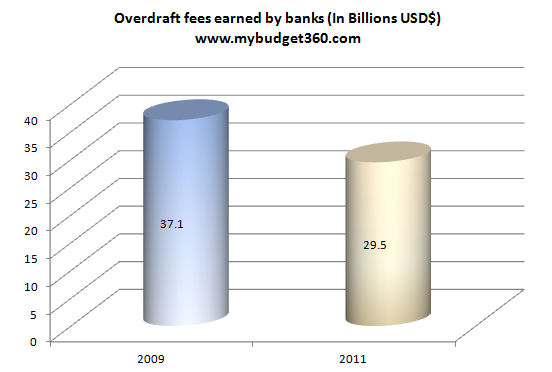

– how banks lure working and middle class Americans into losing hard earned money. $29.5 billion in overdraft fees charged last year

Posted by mybudget360The Federal Reserve and US Treasury have given an open ended response in terms of bailing out the banking system should any additional financial crisis should arise. Even at the moment no real changes have occurred and this is troubling given the headwinds that are approaching. In the US the largest banks, the too big to fail variety, charged Americans over $29.5 billion in overdraft fees last year. This ludicrous figure was released in a recent Pew Research study showing that banks have no desire in consumer protection and would rather operate like a loan shark. If you calculate the annual percentage based on these short-term “loans” you would understand that the overdraft piece of the pie is too lucrative to banks but provides no real service. Banks would argue that they are helping the public access money when they need it. If we did a survey, I think most would opt out of paying $35 for a burger or for a cup of coffee. Yet this is part of the larger banking shell game still going on.

Borrow low and lend extremely high

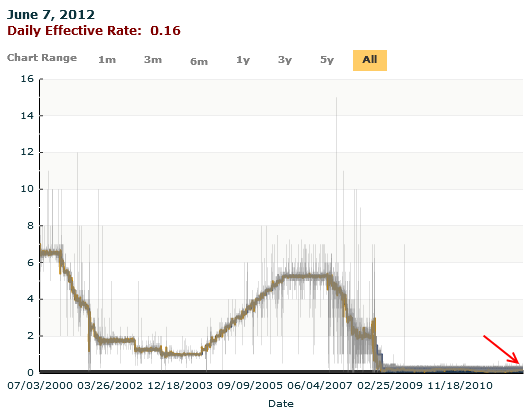

The entire focus of the bailout schemes has been on helping provide banks very low rates on their capital. If you look at the Fed Funds Rate (FFR) it has been at practically zero for a very long time:

“(NY Fed) By trading government securities, the New York Fed affects the federal funds rate, which is the interest rate at which depository institutions lend balances to each other overnight. The Federal Open Market Committee establishes the target rate for trading in the federal funds market.”This rate has been close to zero since 2009. The too big to fail banks have access to cheap capital. The fact that $29.5 billion in overdraft fees were charged last year shows that the public does not have this same access to capital even though this money is backed by the public! In other words we are subsidizing the success of these banks to loan shark the working and middle class into poverty.

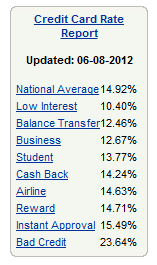

Let us move away from the overdraft fees for a second and examine credit card rates. These same banks also provide credit cards to the public. With lower interest rates, are banks passing on the savings to customers? Let us find out:

The national average for a credit card is 15 percent. How high is that? Bernard Madoff, the ultimate Ponzi scheme king was promising rates of 15 percent to his clients. He is now in prison. These financial institutions are averaging out a rate that the Ponzi king would have been proud of.

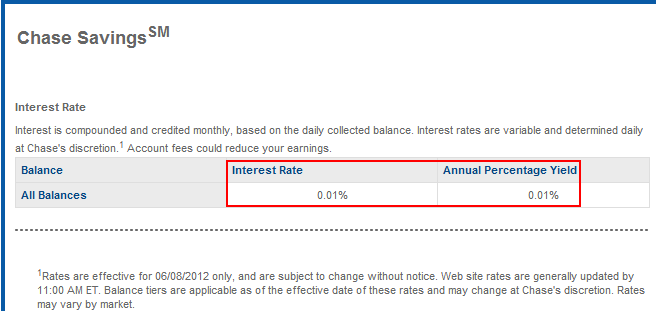

How about interest rates on savings accounts?

Banks are offering customers almost zero percent for keeping their money at their savings institution. And if you happen to not pay attention and go over your balance (very possible given 1 out of 3 Americans have no savings), expect to be hit by a $35 overdraft fee. In other words, if you had $10,000 saved yet went over on your checking account it would take you over 30 years just to save that up on interest for the onetime fee that you will be charged.

It would be one thing if you were borrowing from a local bookie. Yet this is coming from the kings of our financial system who are wards of the state via massive bailouts and subsidies. The shell game continues and this is part of the system supporting 46,000,000+ Americans on food stamps and a growing low wage population. The relationship is symbiotic because as many live paycheck to paycheck, the risk of overdrafts will simply get higher. Your bailout dollars at work. Source mybudget360