– The sandwich generation saw a 59 percent decline to their net worth as they deal with college aged students living at home and elderly parents.

Posted by mybudget360Over 90 percent of Americans have been crushed through this recession if we examine net worth data. They have seen their wealth decline from a net worth perspective but also their incomes have fallen. Not the ideal sort of combination for economic prosperity. The information released is troubling but beyond that, it must serve as a push for a panic button to fight for the middle class. Whether people acknowledge or not, the middle class is being lost day by day.

Being crushed in the middle

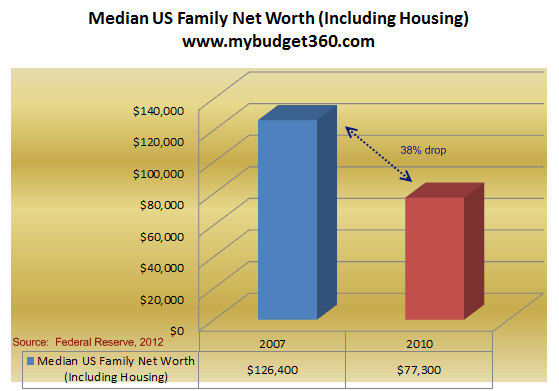

The Federal Reserve report showed that overall households lost 40 percent of their net worth between 2007 and 2010:

That is a crushing blow. Yet data released from the Fed shows those in the middle, those from 35 to 44 saw a stunning 59 percent hit to their net worth:

“(LA Times) Household heads ages 35 to 44 — the group usually saddled with a mortgage and college-bound kids — have watched their median net worth slump 59% from before the recession.

It’s the most painful decline among age groups studied by the Census Bureau. Overall, American net worth took a 35% dive from 2005 to 2010, according to data tables released Monday.”This generation is largely taking care of elderly parents but also paying the high college costs for their children going to college. Many are also dealing with their young adults coming back home from college since they are unable to pay for bills with the work they are landing (if they even land work). So some of these households have grandpa/ma, dad/mom, and son/daughter all living under one roof. This has been a big reason for slower household formation growth.

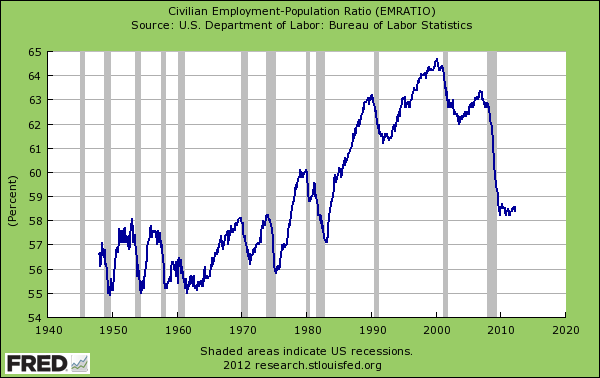

The employment-population ratio is still at very low levels:

What is deeply troubling regarding these reports is that it shows that those that go to college do earn more over a lifetime:

“And the chasm is widening. College graduates made nearly twice as much as those with only a high school diploma in 2000. In 2010, they were making nearly 3 1/2 times as much.”Yet this data is largely skewed by those who went to school prior to 2000 when student loan debt was below $200 billion for the country. Today it is near $1 trillion and the job market and stock market are the weakest they have been in over a generation. If we break out earnings for recent college graduates we find something very different:

So it is important to look at the entire picture before simply saying that anyone that goes to college is better off. Does someone going to a for-profit paper mill and dives into $50,000 of debt for a worthless bachelor’s make more sense than someone going to a local community college for a few hundred dollars per class to learn a marketable vocational skill? The higher education bubble would like you to believe that yes, any college degree is worth the money.

The more degrees the better. The market is telling us something very different.

The young in our country are going to face a challenging decade ahead unless a reinvigoration for middle class protection is brought into place. Otherwise, we should get used to these declining wealth figures for the majority of Americans. It would even look worse if we adjust for inflation and factor in the weakness of the dollar. Source