Posted by Charleston Voice, 06.17.12

A very remarkable read. Added value for its placing empires and their state monies in historical context. It was a reminder to me to keep whatever is used as money for exchange in a relative value reference to commodities and services. Meaning, if gold goes to $50,000 or whatever price, why is that important if both dollar and gold are hoarded?

Realize wrapping our minds around Armstrong's view may be awkward for some of us, but work at it. You could bring about a 'V8-slap-on-the-forehead' moment upon yourself if you don't!

HOW DO Empires Die?

by Martin Armstrong

I began writing what I thought would be a report. Toward the final chapters in Adam Smith’s Wealth of Nations, he wrote about Public Debt asking why anyone considered it to be quality since all government defaulted on their debts and never paid them off. I assumed the list wasn’t that long, since everyone knew about the defaults of Spain,

France, and England. The more I began to investigate since Smith merely made that statement with no reference to such defaults, the more I was left in a state of devastating shock. When it comes to research, those that know me understand that I leave no stone unturned. I allow the research to carry me along a journey of exploration. I never PRESUME anything and try to LEARN myself to round out my knowledge.

It is almost finished. I am publishing for the first time the Table of Contents. There just seems to be such profound conviction that everyone will flee to gold, gold will save the world, and there is always an alternative for capital to flee. The emails from the Goldbugs just refuse to understand that there is also DEFLATION. Here is the latest:

“You assume two things here, sadly both are wrong. You assume firstly that the US dollar will always be more stable than (for example) the yuan, the Brazilian Real, the Euro. A dangerous and flawed assumption, one perhaps made by a dying Roman empire, and the British Empire too. Nope, always something new out there to step in. Your other assumption, even more flawed, and currently being proven wrong as I type the world over, is that capital will flee to another fiat. Nope, much of it will flee to (or try to flee to) solid physical gold. Because that is what the world has always done. ‘Giant’ money is already there, the US’s strategic enemies are already there, and adding gold reserves every month, rather than soaking up the ever-growing flow of US dollar debts.”

It is just astonishing. I am interested in discovery what makes the world tick. I am not like Marx who tried to dictate to the world this is how I say you must function to fit some preconceived idea. If the dollar is the CORE RESERVE CURRENCY and the reserves around the world are really in US government bonds, just how does anyone assume you can flee to the yuan, Brazil or better still to the Euro that will create their desperate vision of hyperinflation? There is not enough assets in those countries combined to absorb the cash in US bonds. Only about 18% of the German DAX freely floats since the rest is tied up in cross-holdings. Only the dollar can absorb that amount of cash. Brazil? Come on! China has its own bubble. Buildings are vacant in ghost cities and the quality of new construction has been extremely poor. Like all emerging markets, it is over-extended.

When municipals went bankrupt in the 1930s like the city of Detroit, capital was able to distinguish a muni from the feds and not all munis defaulted. However, had the feds defaulted, then they take down ALL the munis at once. There is a HUGE difference between a fringe and a core economy. The assumption is other countries reserves will somehow survive a US hyperinflation? Brazil and China combined could NOT absorb all the cash from the US and Europe. Their economies are not that big. To arbitrarily say “giant” money is already in gold – where? How? When? Why is it still fleeing to the dollar sending 10-year rates to record lows?

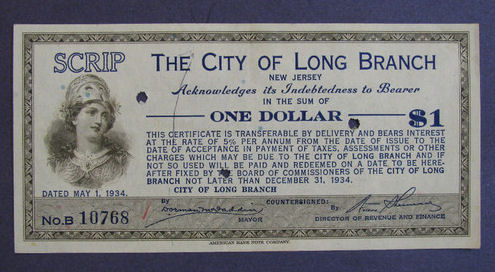

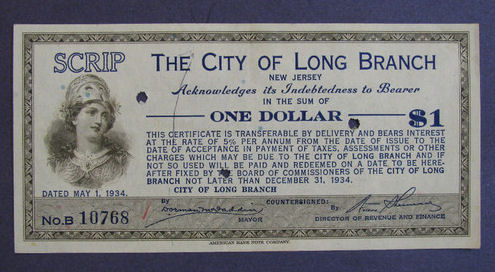

Another best kept secret of the Great Depression I have included in the upcoming book on the Great Depression & the Sovereign Debt Crisis of 1931, is the fact that there were vast amounts of private currency being issued at that time because of hoarding and bank failures. There was NO money to even circulate. Of course the socialists did not want to write about that as well because it reflected the collapse in government’s ability to manage the economy.

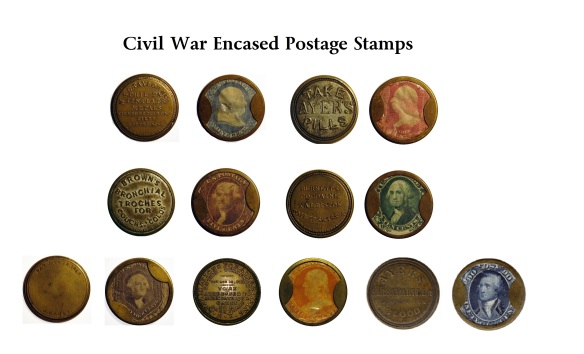

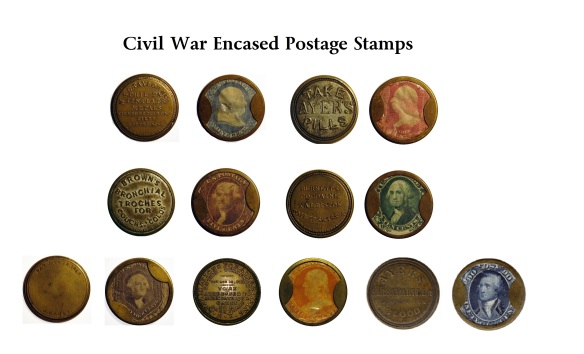

It seems axiomatic that whenever a government fails to provide an adequate supply of currency or coin to maintain commercial trade, the people will step in and provide their own to fill the vacuum. This is something the Goldbugs fail to grasp. Money will become whatever the people accept as the medium of exchange and when government fails to provide that medium, they create their own fiat system. Thus, the use of scrip during the 1930’s was not a new idea in the United States. During other earlier financial crises such as the Panic of 1837, the Civil War years, and the Panics of 1873, 1893 and especially 1907, many different kinds of private emergency fiat currency had been issued.

During the worst periods of the Great Depression, many communities were temporarily deprived of normal monetary supplies and functions because of bank failures, hoarding of money, and inability to collect taxes. People simply had no money to spend. To counteract this situation, various forms emergency currency or scrip were issued. The first of these appeared as early as 1931, though it was not until a year later that it was being issued in any appreciable quantities. By February of 1933, according to a Bureau of Foreign and Domestic Affairs estimate, there were over 400 communities using some form of emergency fiat currency – and this was before the official “bank holiday” and the resulting flood of scrip across the country. Gold was hoarded – not used as money.

Clearly, people will create money if the state fails to provide it. Roman coins exist in quantity today solely due to the very same human trends that appear in every crisis – hoarding. This reduces the VELOCITY of money creating DEFLATION.

I have stated numerous times that the purchasing power of the Roman denarius collapsed to the point it purchased 1/50th of its previous worth. The German Hyperinflation was 170 marks to the dollar at the beginning to 87 trillion. To compare this with the fall of Rome with money dropping to 1/50th of its former value, that is only 170 to 8500. Rome did not do the way of hyperinflation. It was the CORE economy and it collapse at 170 to 8500 level not 170 to 87,000,000,000.

Sorry, but you can die in a desert from extreme heat or freeze to death in Antarctica from extreme cold. To survive, we need a temperate client to live within. DEFLATION or INFLATION can kill an economy. Empires do not die by HYPERINFLATION – that is reserved for the fringe. When an empire dies, it historically has ALWAYS been by DEFLATION. How? Real wealth is driven from the ABOVEGROUND economy into the UNDERGROUND economy where it is hoarded and tucked away. This is why we find hoards of Roman coins. This reduces the VELOCITY of money and commerce is reduced. This is ALWAYS AND WITHOUT EXCEPTION how empires die. This is why there was scrip issued in the United States during the Great Depression. The VELOCITY of money came to a halt. Continue reading @Armstrong Economics

A very remarkable read. Added value for its placing empires and their state monies in historical context. It was a reminder to me to keep whatever is used as money for exchange in a relative value reference to commodities and services. Meaning, if gold goes to $50,000 or whatever price, why is that important if both dollar and gold are hoarded?

Realize wrapping our minds around Armstrong's view may be awkward for some of us, but work at it. You could bring about a 'V8-slap-on-the-forehead' moment upon yourself if you don't!

HOW DO Empires Die?

by Martin Armstrong

I began writing what I thought would be a report. Toward the final chapters in Adam Smith’s Wealth of Nations, he wrote about Public Debt asking why anyone considered it to be quality since all government defaulted on their debts and never paid them off. I assumed the list wasn’t that long, since everyone knew about the defaults of Spain,

France, and England. The more I began to investigate since Smith merely made that statement with no reference to such defaults, the more I was left in a state of devastating shock. When it comes to research, those that know me understand that I leave no stone unturned. I allow the research to carry me along a journey of exploration. I never PRESUME anything and try to LEARN myself to round out my knowledge.

It is almost finished. I am publishing for the first time the Table of Contents. There just seems to be such profound conviction that everyone will flee to gold, gold will save the world, and there is always an alternative for capital to flee. The emails from the Goldbugs just refuse to understand that there is also DEFLATION. Here is the latest:

“You assume two things here, sadly both are wrong. You assume firstly that the US dollar will always be more stable than (for example) the yuan, the Brazilian Real, the Euro. A dangerous and flawed assumption, one perhaps made by a dying Roman empire, and the British Empire too. Nope, always something new out there to step in. Your other assumption, even more flawed, and currently being proven wrong as I type the world over, is that capital will flee to another fiat. Nope, much of it will flee to (or try to flee to) solid physical gold. Because that is what the world has always done. ‘Giant’ money is already there, the US’s strategic enemies are already there, and adding gold reserves every month, rather than soaking up the ever-growing flow of US dollar debts.”

It is just astonishing. I am interested in discovery what makes the world tick. I am not like Marx who tried to dictate to the world this is how I say you must function to fit some preconceived idea. If the dollar is the CORE RESERVE CURRENCY and the reserves around the world are really in US government bonds, just how does anyone assume you can flee to the yuan, Brazil or better still to the Euro that will create their desperate vision of hyperinflation? There is not enough assets in those countries combined to absorb the cash in US bonds. Only about 18% of the German DAX freely floats since the rest is tied up in cross-holdings. Only the dollar can absorb that amount of cash. Brazil? Come on! China has its own bubble. Buildings are vacant in ghost cities and the quality of new construction has been extremely poor. Like all emerging markets, it is over-extended.

When municipals went bankrupt in the 1930s like the city of Detroit, capital was able to distinguish a muni from the feds and not all munis defaulted. However, had the feds defaulted, then they take down ALL the munis at once. There is a HUGE difference between a fringe and a core economy. The assumption is other countries reserves will somehow survive a US hyperinflation? Brazil and China combined could NOT absorb all the cash from the US and Europe. Their economies are not that big. To arbitrarily say “giant” money is already in gold – where? How? When? Why is it still fleeing to the dollar sending 10-year rates to record lows?

Another best kept secret of the Great Depression I have included in the upcoming book on the Great Depression & the Sovereign Debt Crisis of 1931, is the fact that there were vast amounts of private currency being issued at that time because of hoarding and bank failures. There was NO money to even circulate. Of course the socialists did not want to write about that as well because it reflected the collapse in government’s ability to manage the economy.

It seems axiomatic that whenever a government fails to provide an adequate supply of currency or coin to maintain commercial trade, the people will step in and provide their own to fill the vacuum. This is something the Goldbugs fail to grasp. Money will become whatever the people accept as the medium of exchange and when government fails to provide that medium, they create their own fiat system. Thus, the use of scrip during the 1930’s was not a new idea in the United States. During other earlier financial crises such as the Panic of 1837, the Civil War years, and the Panics of 1873, 1893 and especially 1907, many different kinds of private emergency fiat currency had been issued.

During the worst periods of the Great Depression, many communities were temporarily deprived of normal monetary supplies and functions because of bank failures, hoarding of money, and inability to collect taxes. People simply had no money to spend. To counteract this situation, various forms emergency currency or scrip were issued. The first of these appeared as early as 1931, though it was not until a year later that it was being issued in any appreciable quantities. By February of 1933, according to a Bureau of Foreign and Domestic Affairs estimate, there were over 400 communities using some form of emergency fiat currency – and this was before the official “bank holiday” and the resulting flood of scrip across the country. Gold was hoarded – not used as money.

Clearly, people will create money if the state fails to provide it. Roman coins exist in quantity today solely due to the very same human trends that appear in every crisis – hoarding. This reduces the VELOCITY of money creating DEFLATION.

I have stated numerous times that the purchasing power of the Roman denarius collapsed to the point it purchased 1/50th of its previous worth. The German Hyperinflation was 170 marks to the dollar at the beginning to 87 trillion. To compare this with the fall of Rome with money dropping to 1/50th of its former value, that is only 170 to 8500. Rome did not do the way of hyperinflation. It was the CORE economy and it collapse at 170 to 8500 level not 170 to 87,000,000,000.

Sorry, but you can die in a desert from extreme heat or freeze to death in Antarctica from extreme cold. To survive, we need a temperate client to live within. DEFLATION or INFLATION can kill an economy. Empires do not die by HYPERINFLATION – that is reserved for the fringe. When an empire dies, it historically has ALWAYS been by DEFLATION. How? Real wealth is driven from the ABOVEGROUND economy into the UNDERGROUND economy where it is hoarded and tucked away. This is why we find hoards of Roman coins. This reduces the VELOCITY of money and commerce is reduced. This is ALWAYS AND WITHOUT EXCEPTION how empires die. This is why there was scrip issued in the United States during the Great Depression. The VELOCITY of money came to a halt. Continue reading @Armstrong Economics