– The dramatic problems of peak debt in 2012.

Posted by mybudget360 |

| Debt Death Star |

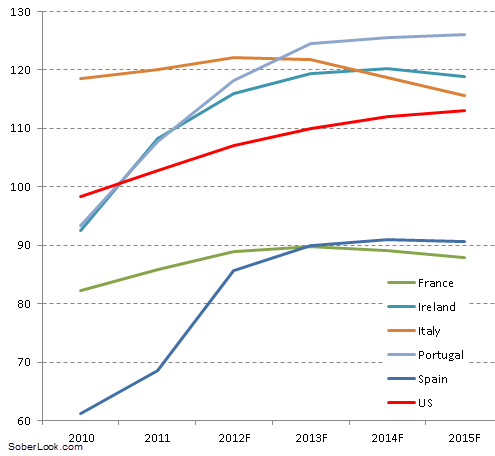

US debt growth outpacing GDP growth

In the simple equation of debt-to-GDP you want GDP to grow much quicker than debt. This is similar to having your income growing quicker than your actual debt. When we look at various countries we realize that the US is facing a much faster growth in debt than our GDP:

Debt to GDP ratio for select countries (source: Barclays Capital)

Now one of the major differences the US currently has is the insatiable appetite for US debt. For the moment, the fear trade is helping the US gain access to globally cheap debt. You also have the world’s most powerful central bank that is willing to step in at any stage of the process. This is good if you are a large bank centered out of the US but is not helpful for the working and middle class. The fact that the Fed can print digital dollars is not necessarily a good thing for the country overall. Slowly, Americans are moving backwards. The nation has lost two decades of wealth growth as demonstrated by figures released from net worth studies. Yet look at the above chart and you will realize that simply increasing debt is not necessarily a recipe for economic success.

The Euro Central Bank has the ability to print but they do not have the common union that the US has. This isn’t to say that one debt is better than the other but when diving into fiat currencies, confidence is a big player and you realize that hunger for Greek and Spanish debt is not unlimited and this is infecting the Euro as a connected system. The issue at hand is that too much debt is floating around in the global system. It is impossible to deal with a debt issue simply by expanding debt. Growth speed is also important. The US has been growing but our debt has been expanding much faster. Much of the recent growth is because of this debt spending but when you run the math you realize that for every dollar in debt brought into the system the corresponding growth is much lower. In other words a dilution and depreciation of the currency occurs.

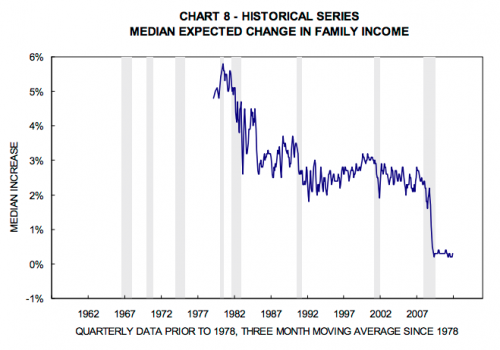

The underlying change has fallen largely on the middle class of the nation as demonstrated by income figures:

This is why net worth figures have fallen by 40 percent for your typical family between 2007 and 2010. For the moment, there is still an appetite for US debt because it is still viewed as the world’s safe haven. Yet we have major political dysfunction and unsustainable costs coming down the pipeline. Will this always be the case? The market is operating currently on the assumption that this will be the case but as we have learned, expect the unexpected especially in a system where central banks can simply print away any financial issues and push the costs to their citizens. Source

Must read, there IS a SOLUTION for us: Why Iceland Should Be in the News, But Is Not - Remarkable!