Federal Reserve Chairman Ben Bernanke warned us repeatedly that he

would repress interest rates indefinitely in order to help the economy

and the housing market.

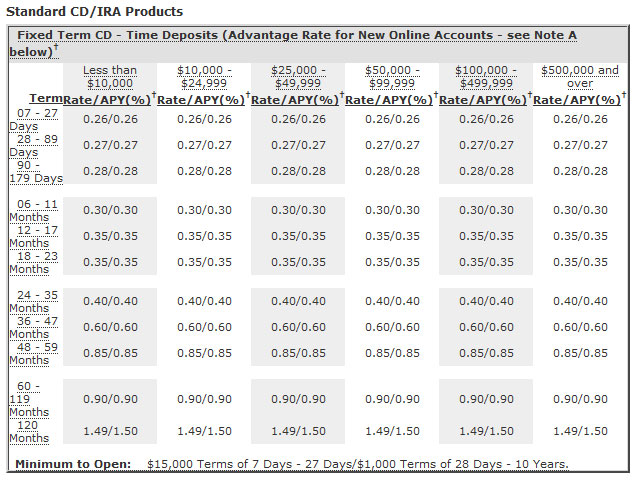

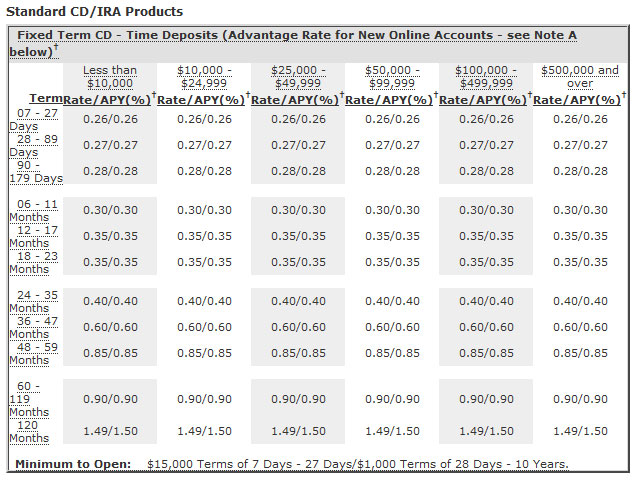

Interest rates on government treasury securities have reached all time lows and bank depositors are receiving close to a zero return on their savings. Meanwhile, both housing and the economy remain flat on their backs despite Mr. Bernanke’s zero interest rate policy (ZIRP).

Savers looking for a rate above 1% on a CD would have to tie up their money for a ridiculously long period of time. A 10 year CD yields only 1.5% – does anyone believe that this return will outpace inflation over the next 10 years? After taxes and inflation, bank savers are reaping a negative rate of return. Shown below are the current rates offered by Bank of America.

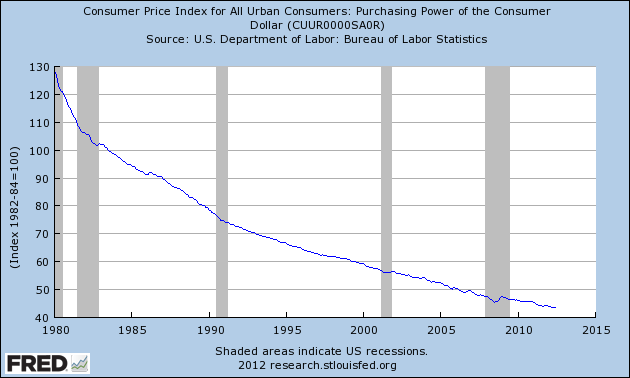

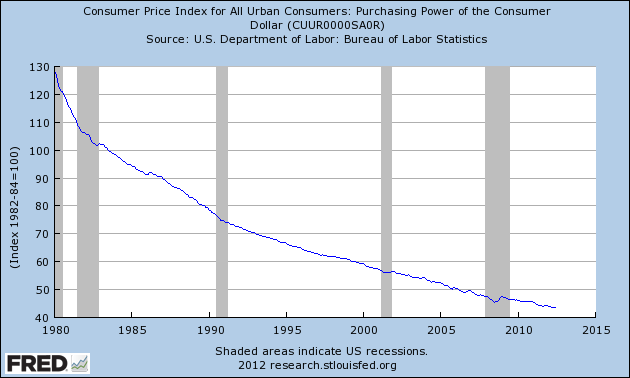

The devastating decline in the purchasing power of U.S. dollar since

1980 is shown below (graph courtesy of Federal Reserve Bank of St.

Louis).

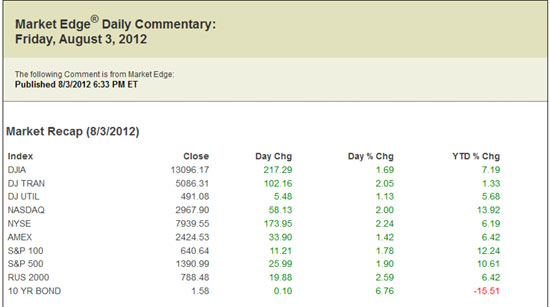

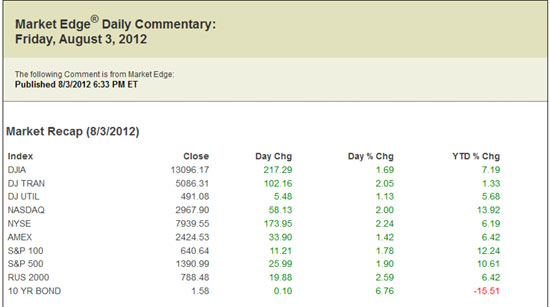

Exactly where should a saver have put his money this year? The stock

and bond markets have been on a tear this year as a result of the super

easy monetary policies of the Federal Reserve. Here are the returns as

of today’s market close. Note that the result for bonds indicate a

decline in yields which translates into higher prices (gains) for

holders of long term U.S. treasury securities.

Exactly where should a saver have put his money this year? The stock

and bond markets have been on a tear this year as a result of the super

easy monetary policies of the Federal Reserve. Here are the returns as

of today’s market close. Note that the result for bonds indicate a

decline in yields which translates into higher prices (gains) for

holders of long term U.S. treasury securities.

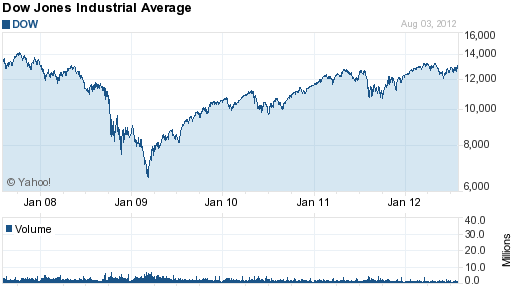

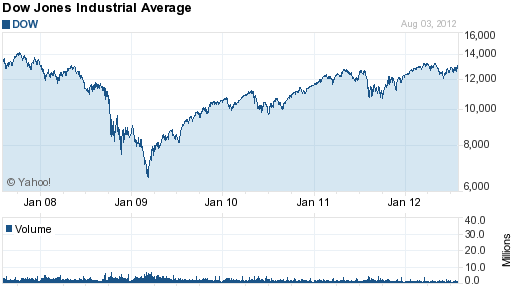

Naturally, there is a good reason people keep all or a part of their

savings in the banks – they do not want to risk a loss of principal and

feel reassured since the FDIC provides deposit insurance. In addition,

the past decade has shown us that stock markets have an unsettling

tendency to suffer major sell offs resulting in huge losses for

investors. The Dow Jones Industrial Average, for example, is no higher

today than it was in 2007 and during the financial crisis of 2008, the

Dow plunged a horrifying 50%.

Going forward, in a twisted world of inflation, massive government

deficits and interest rate manipulation by the Federal Reserve, it may

be extremely challenging for any asset class to provide a positive real

rate of return to either investors or bank depositors.

Source: Banks Were The Worst Place To Keep Your Savings This Year | Problem Bank List

Interest rates on government treasury securities have reached all time lows and bank depositors are receiving close to a zero return on their savings. Meanwhile, both housing and the economy remain flat on their backs despite Mr. Bernanke’s zero interest rate policy (ZIRP).

Savers looking for a rate above 1% on a CD would have to tie up their money for a ridiculously long period of time. A 10 year CD yields only 1.5% – does anyone believe that this return will outpace inflation over the next 10 years? After taxes and inflation, bank savers are reaping a negative rate of return. Shown below are the current rates offered by Bank of America.

Source: Bank of America

Courtesy: Charles Schwab

Dow Jones - courtesy yahoo finance

Source: Banks Were The Worst Place To Keep Your Savings This Year | Problem Bank List