Delinquent student debt now reaching record levels as defaults spike. Paying more and earning less.

Posted by mybudget360

The great deleveraging event continues to unwind while one sector of debt continues to grow by leaps and bounds.

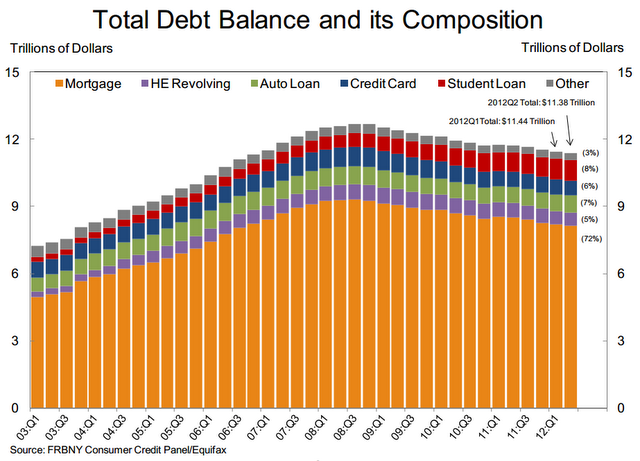

While other forms of debt have fallen by $1.6 trillion since the peak of the debt bubble mania, student loan debt has increased by a stunning $303 billion since the third quarter of 2008. What is more disturbing is the rising delinquencies seen in the student debt market that has now breached the $1 trillion barrier.

While education overall is correlated with higher wages, there isn’t a clear distinction between university quality or even various degrees. Most of the studies examine the aggregate college pool when many went to college when prices were much cheaper. Many students are sucked into the for-profit vortex only to come out with a worthless piece of paper and mounds of debt. There is absolutely a bubble in higher education and how things unfold will carry a deep impact on the economy.

Rising problems with student debt

The cost of attending college has outstripped almost every other spending category. Even the housing bubble cannot contend with the rising costs of college tuition. Yet problems are now soaring with student debt:

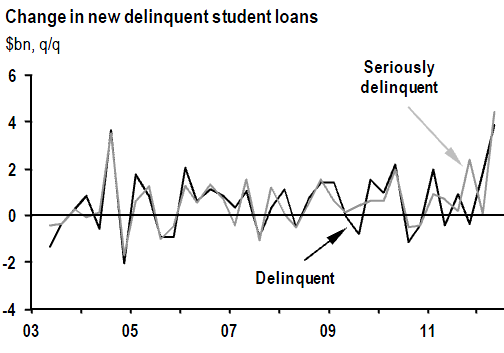

Source: JP Morgan

Keep in mind the above is occurring at the same time of a supposed economic recovery. What this tells us is that many with student debt are no longer able to service their existing debts. This is extremely problematic. Of course the issue stems from the way college attendance rises during economic downturns. This wouldn’t be such an issue if the cost of going to college wasn’t so sky high. So you have the perfect storm:

-1. Economic sluggishness pushing many to go to collegeThe above scenario is the ecosystem that has created a student debt market that now soars above $1 trillion far surpassing the credit card debt market. Student debt now makes up over 8 percent of the total US household debt market:

-2. Federal backing of student debt creates a situation where schools care very little of a student’s financial well being

-3. A prevalence of subpar academic institutions with an appetite and marketing budget to drag in many students

-4. Students graduate with degrees that largely do not meet the demands of the current employment market but also have back breaking debt

In our car obsessed culture student debt has also surpassed this category. Yet the more you spend on college does not mean you will earn more: Read more>>Student debt crisis enters a tipping point – Delinquent student debt now reaching record levels as defaults spike. Paying more and earning less.