By Patrick A. Heller

Commentary on Precious Metals Prepared for CoinWeek.com

September 19, 2012

The general public probably attributes the recent strength in gold and silver prices to a huge surge in demand from a wide swath of the population. That perception is completely false.

Bron Suchecki of Australia’s Perth Mint was recently interviewed by the Financial Survival Network. By his estimation, the huge surge in demand for buying physical gold and silver in late 2008 represented less than 2% of potential buyers. Yet the demand from this small part of the public resulted in huge delays in availability of bullion coins and bars, often one to two months at the peak, and some even longer. Other coins in comparatively ready supply such as US 90% Silver Coins, reached retail premiums of more than 35% above silver value.

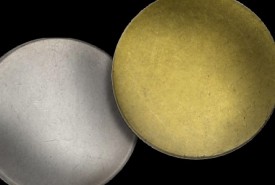

Suchecki further explained that this demand surge identified the main bottleneck in producing fabricated bullion-priced coins—obtaining sufficient blanks to meet demand.

Producing planchets

to meet the rigorous weight and purity specifications is more involved

than might appear on the surface. In order to operate efficiently in an

environment where demand can and does fluctuate to a great degree, many

mints do not prepare their own blanks. As former US Mint Director Moy

explained to me, he didn’t want to manufacture the blanks in-house

because the equipment and personnel would too often either be idle or

working overtime. Most of the time, it is more efficient for the mints

to purchase the blanks as needed.

Producing planchets

to meet the rigorous weight and purity specifications is more involved

than might appear on the surface. In order to operate efficiently in an

environment where demand can and does fluctuate to a great degree, many

mints do not prepare their own blanks. As former US Mint Director Moy

explained to me, he didn’t want to manufacture the blanks in-house

because the equipment and personnel would too often either be idle or

working overtime. Most of the time, it is more efficient for the mints

to purchase the blanks as needed.In 2008, for instance, the US Mint obtained its planchets to strike Silver Eagles from the Perth Mint and two US fabricators. The Perth Mint experienced a huge demand for their silver coins at the same time that the US Mint wanted more blanks provided by their three suppliers. In order to maintain future business from the US Mint, the Perth Mint had to trim output of its own coinage to devote resources to supplying planchets for Silver Eagle production.

The demand in late 2008 from a small segment of the population overwhelmed the ability of the planchets manufacturers and the mints to create product to quickly satisfy customers. Product delivery delays were not cured until after the spot price of silver jumped more than 50% in early 2009.

Suchecki is convinced that any surge of demand for physical gold and silver will again catch the mints unable to quickly fill orders. The recent actions of the European Central Bank and last week’s announcement by the Federal Open Market Committee promise to flood the currency markets with quantitative easing. Gold is already trading at record high levels as measured in the Euro and India Rupee. Coupled with continued efforts by China, Russia, Brazil, and other emerging economic powers to displace the use of the US dollar in international commerce, it is almost inevitable that there will be another surge in demand from physical precious metals.

Today it is still possible to acquire physical gold and silver for immediate or short-delay delivery and at reasonable premiums. I predict that both conditions will change within the next six months. Just imagine what might happen if only 3% of the citizenry wanted to buy physical precious metals!

Patrick A. Heller was honored with the American Numismatic Association 2012 Harry J. Forman Numismatic Dealer of the Year Award. He owns Liberty Coin Service in Lansing, Michigan and writes Liberty’s Outlook, a monthly newsletter on rare coins and precious metals subjects. Past newsletter issues can be viewed at http://www.libertycoinservice.com. Other commentaries are available at Numismaster

(under “News & Articles) . His award-winning radio show “Things

You ‘Know’ That Just Aren’t So, And Important News You Need To Know” can

be heard at 8:45 AM Wednesday and Friday mornings on 1320-AM WILS in

Lansing (which streams live and becomes part of the audio and text

archives posted at http://www.1320wils.com.

Patrick A. Heller was honored with the American Numismatic Association 2012 Harry J. Forman Numismatic Dealer of the Year Award. He owns Liberty Coin Service in Lansing, Michigan and writes Liberty’s Outlook, a monthly newsletter on rare coins and precious metals subjects. Past newsletter issues can be viewed at http://www.libertycoinservice.com. Other commentaries are available at Numismaster

(under “News & Articles) . His award-winning radio show “Things

You ‘Know’ That Just Aren’t So, And Important News You Need To Know” can

be heard at 8:45 AM Wednesday and Friday mornings on 1320-AM WILS in

Lansing (which streams live and becomes part of the audio and text

archives posted at http://www.1320wils.com.Source: What If Only 3% of Adults Wanted To Purchase Physical Gold And Silver?