The tipping point for global debt – total global needs to grow to $213 trillion by 2020 just to sustain current growth

We are also quickly approaching the debt ceiling, again. Does anyone think that $16 trillion will ever be paid off? Total global debt is at a silly number no matter how you slice it. The problem is you get a diminishing level of return and you can see this in places like the Euro-zone that is bailing out banks and countries left and right. Then you have economies like China were they are having internal bubbles in real estate because hot money is flowing too quickly. Is there a tipping point for global debt?

Total global debt addiction

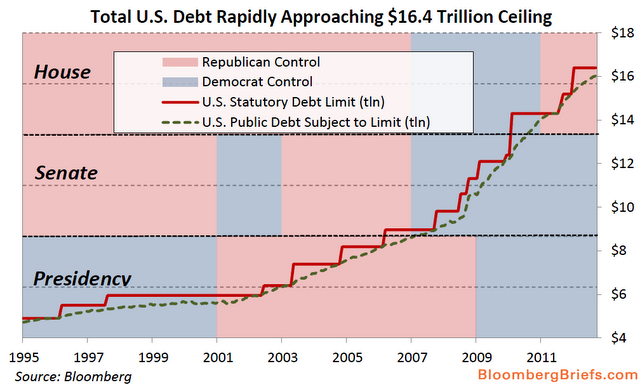

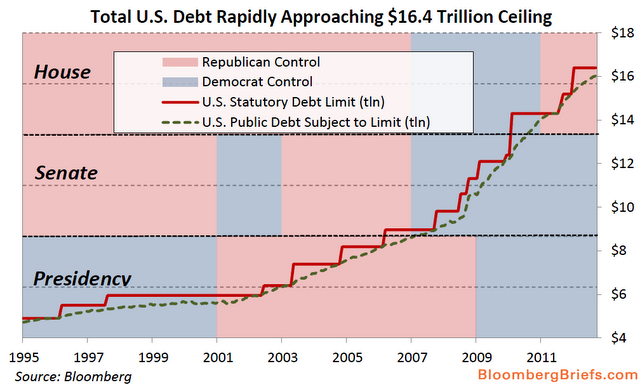

The US is on a fast pass to breaching the debt ceiling yet again. This is bi-partisan type of event:

The issue above is that our total debt is now higher than our actual GDP. That is a problem.

People sometime point to countries like Japan as an example of a nation with massive debt (around 200 percent of GDP) and use this as a best case. How is that? There economy has been stagnant for more than 20 years. They have major demographic issues hitting. Has anyone looked at their stock market?

The Japanese stock market is lower today than it was in 1984. Is this really the example we want to use as a “too much debt” doesn’t matter argument? Plus, they are a nation of savers and we are definitely not (1 out of 3 Americans has zero dollars to their name). The fact of the matter is we are globally on a debt addicted path. It is hard to remove debt from the market once it is already introduced. That is why the Fed with QE3 will need to keep adding program after program because now, the market is conditioned to mortgages rates that really defy any sort of open market program. Yet this action is having other reactions like crushing the standard of living of Americans merely for the sake of bailing out banks.

Total global debt is on an unsustainable path:

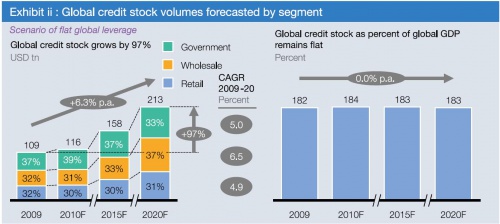

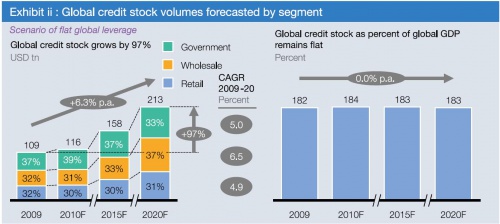

Global debt is going to need to grow a stunning 97 percent in the next few years up to $213 trillion just to keep up with recent growth projections. Now this would not be an issue if GDP actually came hand and hand along with it. But that is not the case. Debt spending does not have the same impact as normal sustained growth. This is why in China you have millions of empty apartments and horrible investments in real estate because hot money is flowing everywhere just for the sake of growing GDP. This bubble will burst just like every other bubble has burst. In Europe you are seeing deflating housing markets from Holland, Ireland, and Spain.

Total global debt is now the drug of choice for growth. Central banks are powerless without this tool and their massive use of it has created a market where everyone is dependent on this one central authority. Just think of the Fed with QE3 announcing they will buy nearly $500 billion of mortgage backed securities over the next year with no congressional authority. The public goes up in arms over billion dollar projects yet this goes unquestioned or even unchallenged for debate? It isn’t like this was an urgent or novel action (after all it was phase three of quantitative easing). It is just simply another action of this debt addiction.

The above chart shows that total global debt is going to grow at a rate of 6.3 percent. There is little evidence to believe that globally we will be able to sustain that kind of growth especially when it comes at the expense of easy money. The markets have forgotten for the moment that too much debt does have a tipping point.

Source: The tipping point for global debt – total global needs to grow to $213 trillion by 2020 just to sustain current growth.

We are also quickly approaching the debt ceiling, again. Does anyone think that $16 trillion will ever be paid off? Total global debt is at a silly number no matter how you slice it. The problem is you get a diminishing level of return and you can see this in places like the Euro-zone that is bailing out banks and countries left and right. Then you have economies like China were they are having internal bubbles in real estate because hot money is flowing too quickly. Is there a tipping point for global debt?

Total global debt addiction

The US is on a fast pass to breaching the debt ceiling yet again. This is bi-partisan type of event:

The issue above is that our total debt is now higher than our actual GDP. That is a problem.

People sometime point to countries like Japan as an example of a nation with massive debt (around 200 percent of GDP) and use this as a best case. How is that? There economy has been stagnant for more than 20 years. They have major demographic issues hitting. Has anyone looked at their stock market?

The Japanese stock market is lower today than it was in 1984. Is this really the example we want to use as a “too much debt” doesn’t matter argument? Plus, they are a nation of savers and we are definitely not (1 out of 3 Americans has zero dollars to their name). The fact of the matter is we are globally on a debt addicted path. It is hard to remove debt from the market once it is already introduced. That is why the Fed with QE3 will need to keep adding program after program because now, the market is conditioned to mortgages rates that really defy any sort of open market program. Yet this action is having other reactions like crushing the standard of living of Americans merely for the sake of bailing out banks.

Total global debt is on an unsustainable path:

Global debt is going to need to grow a stunning 97 percent in the next few years up to $213 trillion just to keep up with recent growth projections. Now this would not be an issue if GDP actually came hand and hand along with it. But that is not the case. Debt spending does not have the same impact as normal sustained growth. This is why in China you have millions of empty apartments and horrible investments in real estate because hot money is flowing everywhere just for the sake of growing GDP. This bubble will burst just like every other bubble has burst. In Europe you are seeing deflating housing markets from Holland, Ireland, and Spain.

Total global debt is now the drug of choice for growth. Central banks are powerless without this tool and their massive use of it has created a market where everyone is dependent on this one central authority. Just think of the Fed with QE3 announcing they will buy nearly $500 billion of mortgage backed securities over the next year with no congressional authority. The public goes up in arms over billion dollar projects yet this goes unquestioned or even unchallenged for debate? It isn’t like this was an urgent or novel action (after all it was phase three of quantitative easing). It is just simply another action of this debt addiction.

The above chart shows that total global debt is going to grow at a rate of 6.3 percent. There is little evidence to believe that globally we will be able to sustain that kind of growth especially when it comes at the expense of easy money. The markets have forgotten for the moment that too much debt does have a tipping point.

Source: The tipping point for global debt – total global needs to grow to $213 trillion by 2020 just to sustain current growth.