– US paid $454 billion in interest payments alone in 2011. Equity in real estate for households cut in half

Posted by mybudget360

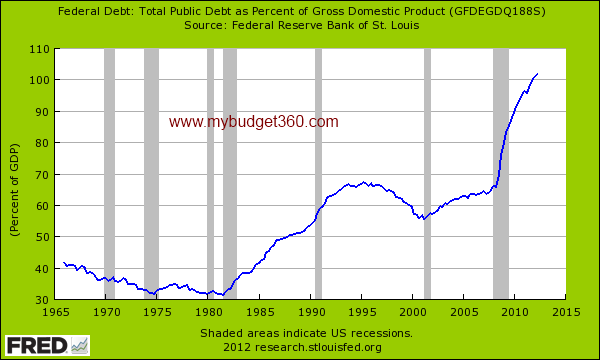

It is hard to say how much debt is too much debt for a country but a generally agreed upon figure is when the debt goes above 100 percent of annual GDP then issues begin to arise. The US fortunately is able to get incredibly low interest rates on world markets by a variety of methods including having the Fed use quantitative easing techniques. Given the size of our debt, low interest rates are sold as an aid to US households but the reality is that a more important reason is to keep payments on interest lower. What are the consequences of too much debt?

Debt versus production

Too much debt is never a good solution to fixing an ailing economy. The allure is easy and it is understandable why countries would embark on this easy path. Yet reverting back to a more normal balance is rarely that easy. Recently our total public debt surpassed annual GDP:

Clearly this is the worst recession since the Great Depression. On the back-end, the bailout mechanisms are still fully in place. When you have solvency issues adding more debt simply pushes out the pain deeper into the future. The Federal Reserve with Quantitative Easing sold it as a way for US households to get easier access to cheap money. But if we look at interest payments we begin to realize what is going on:

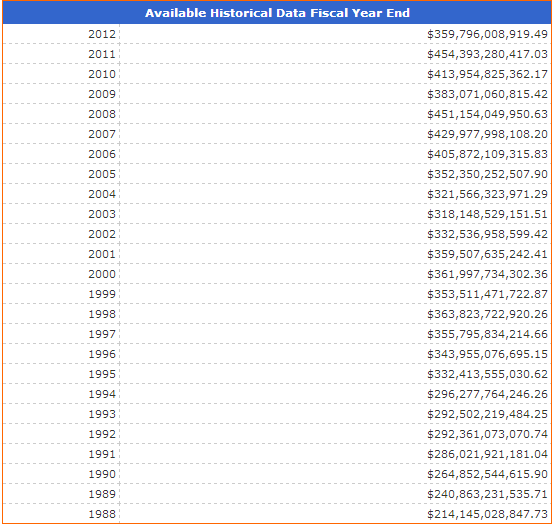

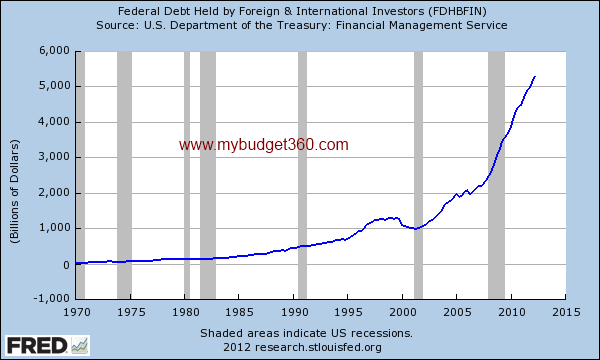

Last year we paid out $454 billion in interest payments. If you run the numbers on this, assuming a similar amount paid out in 2012, we are only paying 2.7 percent on our total debt. This is an incredibly low blended rate. Keep in mind new issuances are at even lower levels thanks to the Federal Reserve. This is really the big addiction. Say rates went up to a modest 5.4 percent we would be paying out $908 billion a year in interest alone! And a large portion of this debt is now held outside of the country:

Over $5 trillion of our debt is held by foreign institutions and investors. Given that our entire global economy is interconnected, a surge in interest payments for us is going to sap out productivity from the world’s number one economy. What do you think this will do to interest rates? Our trading partners especially with China are more than willing to lend out money at lower rates since they need the US consumption machine to keep going so more Chinese can find work. Their concerns are very much the same as our own.

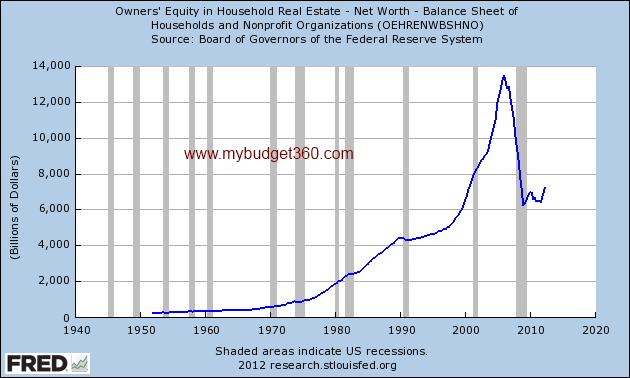

Yet if you look at places like Spain you will find the issues of solving a solvency crisis with more debt. At the core of the problem was the real estate bubble bursting. Let us take a look at the number one asset for Americans, real estate:

At the peak of the mania, US households had nearly $14 trillion in equity in their properties.

Today, that number is still cut in half hovering at roughly $7 trillion. All the bailouts and other measures still have real estate wealth near the trough. This is why for most working and middle class families the recession still feels very much in place. Also, you have a large portion of recent buyers entering with low down payment mortgages so not much equity has been built up. Those low interest rates do help but again the bigger help is largely directed to banks and the government that are now stuck with the low interest rate appetite.

We have a complicated interconnected system in place. There are now more and more hints that the Chinese real estate market is taking a leg down. This is another potential problem looming. Again, too much speculation and too much debt are at the core of these issues.

The problems in Europe are not gone. In fact, Europe has now slipped into another recession and their unemployment rate is at the highest level on record. As a trading bloc, this is the biggest economy in the world. This will have larger ramifications on the global economy.

The US is now going to have Quantitative Easing into infinity similar to what Japan did. But this can only occur as long as the markets are willing to invest in such low rate levels. In Europe the market is already bailing out. If China’s economy slows a bit their appetite will pull back. Japan is dealing with their own internal issues. The core problem is still here. Too much debt and a crisis brought on by solvency.

Source>> Quantitative addiction and the allure of low interest rates