The most educated and indebted generation ever – Average student debt has tripled since 1990 while earnings have gone stagnant for college graduates.

Most have very fond memories of their college going years. Going off to college is one of the few rites of passage that we have in the United States ushering future generations into official adulthood. Yet the cost to attend this passage has gotten astronomically expensive.

College has now turned into a very large business funded by deep levels of student debt. In the past, the state took on a larger role with public universities but with state budgets in shambles these are now becoming much more expensive options. We speak of the student debt problem as a nationwide issue but this crisis is really a burden largely shouldered by our young. Poor Americans aspiring to go to college have to walk cautiously on this passage and avoid paper mill for-profits and going into massive student debt. This rite of passage is now turning into a debt filled nightmare.

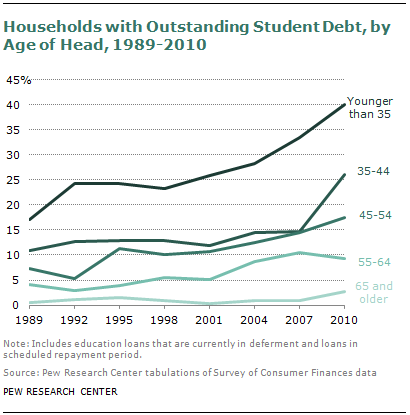

Student debt by age

While we speak of student debt as some sort of “we” problem, it largely falls on the shoulders of the young:

Of baby boomer households, less than 10 percent carry any sort of student debt. Not only do they carry a lower debt load they also went to school at a time when college education was affordable and people were graduating into a healthy job market. Take a look at the chart carefully and you will see that over 40 percent of households under the age of 35 have student debt. There is a big difference between carrying $5,000 in student debt and $50,000.

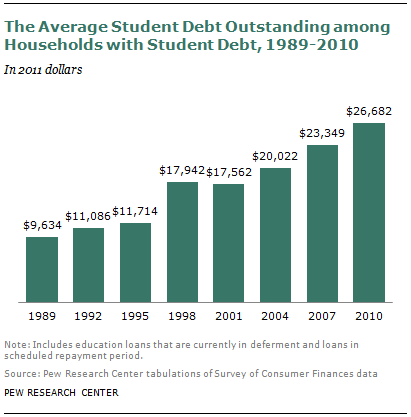

The burden has only gotten larger in recent years as incomes have gone stagnant:

The average student debt has more than tripled since 1989. A good way to measure this is by looking at median household income:

1990 median household income: $30,000

Average student debt: $9,634

Ratio: 3.11

2012 median household income: $50,000

Average student debt: $26,682

Raito: 1.8

The real cost of going to college has gotten much more expensive. If incomes kept pace with college costs the median household income would be above $90,000.

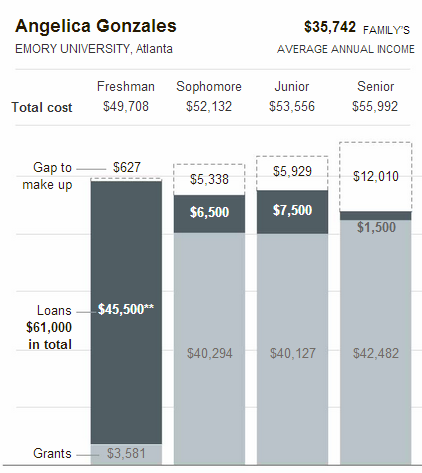

Student debt example

Many lower income students are lured into the for-profit machinery that simply survives courtesy of Federal government student debt. These institutions are mired with poor outcomes and are largely designed as efficient operations to draw in students and extract as much federal loan money from them as soon as possible. Yet this is only one part of the higher education market making up one out of ten students. Even at good institutions students can fall between the cracks. The New York Times did an in depth piece on college and the pitfalls for many lower income Americans. Here is one example given:

While the article explores the pitfalls for poor students, it does not go into the details of how middle class students are crushed on these sliding scale financial aid models. In the above example, the student did not clearly report her financial situation and because of this, ended up needing to take $45,500 in loans for year one of her education. Once things were clarified most of the funding was covered by grants... Continue reading>>