Posted by mybudget360

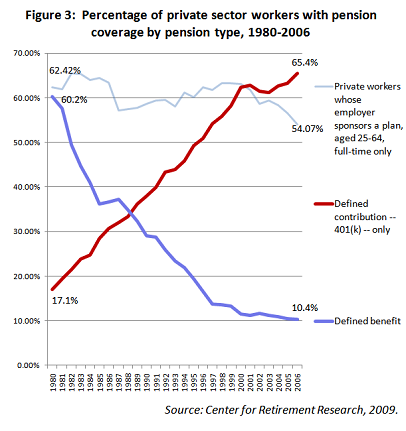

In the early 1980s, roughly 60 percent of private sector workers had a pension. Today, it is down to 10 percent in the latest data and will likely continue to decrease. For young Americans entering the workforce, the self-funded 401k is likely the only path to having a nest egg and any sort of retirement. This is why so many people get angry when they hear about some in California that retire in their early 50s pulling in annual pensions of $100,000. Over 20 to 30 years this can range from $2 to $3 million of payouts. And we wonder why states face a $3+ trillion funding gap with pensions. Are we simply ignoring another looming crisis?

The shift away from pensions

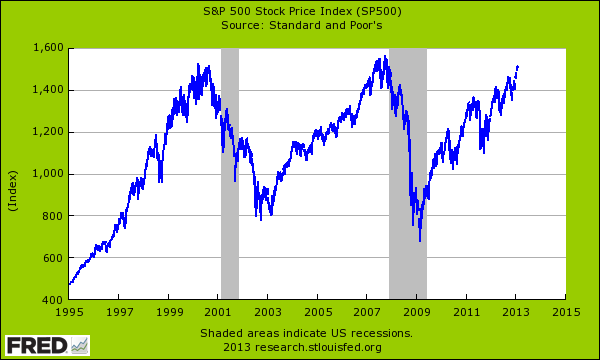

While the stock market inches closer to a previous peak, the shift with pensions has been rather dramatic:

Only about 10 percent of private sector workers have the opportunity for a pension. This of course is likely lower given the trend above. While many might think this is an issue to deal with in the future the crisis is very real:

“(The Atlantic) In addition, states have funded only about 80 percent of their pension liability, leaving a $3.32 trillion funding gap. Ohio and Rhode Island are in the worst shape, having underfunded their pensions by almost 50 percent of their gross state product. Other liabilities, such as retiree health and dental insurance, also are underfunded. City governments similarly are plagued by underfunded pensions, with Los Angeles underfunding its public pension liabilities by $3.53 billion, with an additional $2.43 billion owed for other employment benefits such as healthcare. As of June 2009, New York City public pension programs had liabilities that exceeded their assets by $39.9 billion with an additional $65.5 billion owed for other benefits.

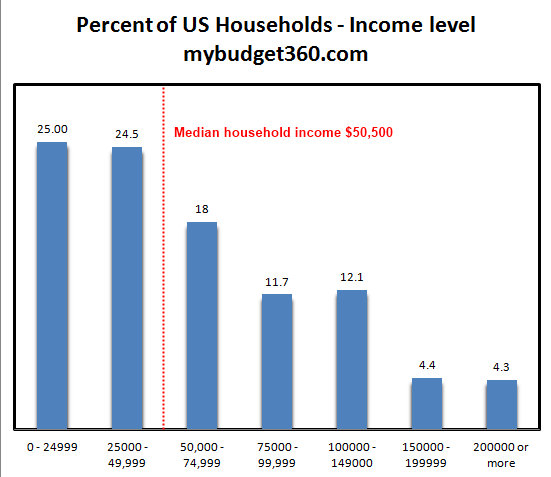

So both the private and public components of the U.S. pension system are under severe strain, as the Great Recession combined with pre-recession patterns of rising inequality and a diminishing social contract have taken their toll. With fewer workers covered by pensions, this leg of the three-legged stool of retirement security is too short — and growing shorter.”This is incredible. Guess who will cover this gap? The taxpayer. And of course, we are talking about massive payouts for many. In California, over 18,000 people collect pensions of over $100,000. Given that the income figures, this is very generous:

This of course will cause many Americans to become furious at the current situation given that most are left to the whims of the stock market to save up any sort of nest egg. Most will depend on Social Security deep into retirement. Yet for many younger Americans, many realize that the estimated benefits will be cut (we already know that only a 75 percent payout will be had after 2033). For someone in their 20s or 30s, that is reality.

You even have some collecting at much earlier ages:

“(MarketWatch) My two friends on the PATH train would have their blood pressures rise when they hear about stories such as this one from the St. Augustine Record about a 43-year old retired firefighter who will receive a $58,000 pension after 25 years of public service . To achieve this for a private sector worker, they’d have to have nearly $1.5 million dollars in their retirement account. And that doesn’t take into consideration the health benefits that many public service employees will also have.”Think about that. Someone at 43 receiving $58,000 a year. Someone working in the private sector would need a nest egg of $1.5 million to make up for this. This is why it is unsustainable. Even at $50,000 payouts given the early age of retirement, these payouts will amount to well over one million dollars. In other words, it is like lottery payouts for many. And this is why the $3 trillion underfunding problem is a big issue.

Keep in mind the pension wasn’t designed to be some sort of lottery winning. The idea that coupled with Social Security, a pension, and your own savings that many retirees would have a modest life after their working years. Yet you have an entire portion of Americans receiving well beyond the median household income into their retirement years for 20, 25, or even 30 full years. Think about that.

$50,000 x 20 years = $1,000,000I’m surprised how little coverage is being given to this. Of course, when the assumption was that we were going to be at DOW 30,000 then all of this would have gotten swept under the rug. But instead, we have this:

$50,000 x 25 years = $1,250,000

$50,000 x 30 years = $1,500,000

The stock market is back to where it was in the late 1990s even after the incredible rally from the lows of 2009. So obviously those in the private sector have had a hard time building up their wealth in their 401ks. Yet pensions have always had extremely generous built in assumptions.

A $3 trillion unfunded liability is big. This is baked into the cake. This is going to hit one way or another. Of course, many of those receiving giant pensions right now would probably disagree. Something tells me that they did not pay $1 or $2 million over their working life however. Consider this another big issue we will contend with while many younger Americans are left fighting to stay afloat and are entering a world where the safety net is no longer visible.

MyBudget360