The Sequestered Gilded Age: Top 20 percent of households control over 90 percent of all stocks and financial wealth: .

Posted by mybudget360Income inequality is now at levels last seen in the United States during the Gilded Age. This was a time of incredible opulence for the few while the many struggled to get by. There is even a story of a Mrs. Stuyvesant Fish throwing a dinner party to honor her dog that arrived wearing a $15,000 diamond necklace. A very stark contrast to how most lived. In 1890 11 million of the 12 million families earned less than $1,200 per year. Of this group the average annual income was $380, well below the poverty line.

While we think we are far removed from a time of such dramatic contrast, we now have a country where the stock market is reaching a peak, yet truly the benefits go to a small number of Americans. The top 1 percent controls 42 percent of all financial wealth (the top 20 percent control roughly 90 percent of all stock ownership and financial wealth). The bottom 80 percent of Americans control less than 10 percent of all stocks owned. People seemed shocked to find out that the average per capita wage in the US is $26,000. Is this kind of wealth inequality beneficial to our country?

Where the income is going

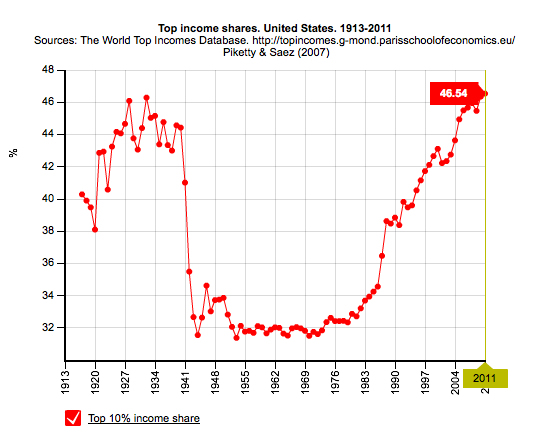

Income inequality is resembling levels last seen in the early 1900s:

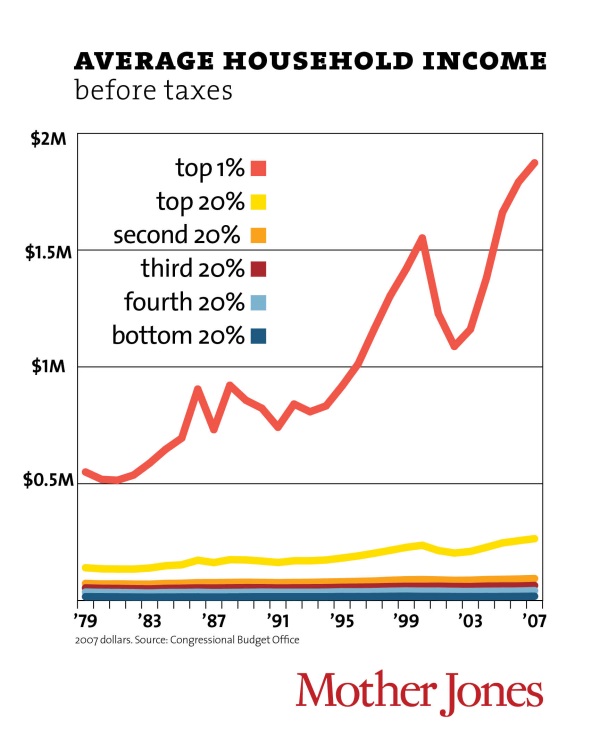

The top 10 percent of income earners took in roughly half of all income earned in the United States. Compare this to 32 percent between 1941 and 1983. Income inequality has grown because most of the income gains over the last few decades have gone to the very top. The middle class in the US has shrunk dramatically during this time. Take a look at wage growth over this period:

Most of the real gains went to the top 10 percent and even here, most went to the top 1 percent. Wealth is really an important measure of financial well being because it is what you have saved. Most in the US live paycheck to paycheck. 47.6 million are receiving food stamps. If we really want to look at wealth distribution in the US, we would find it distributed like this:

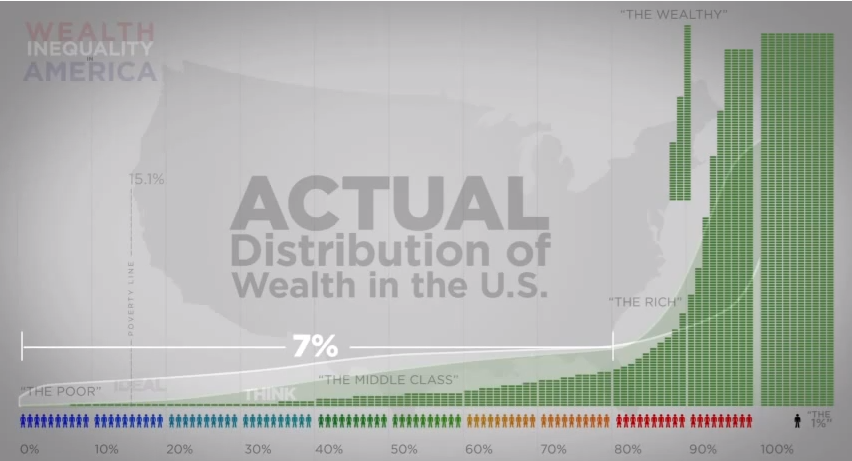

The bottom 80 percent of Americans hold roughly 5 to 8 percent of all financial wealth (non-housing related). So you can understand why the stock market getting close to a peak again isn’t really generating that much fanfare from your typical working American. Many Americans are deep in debt and access to debt has provided a cover for the lost purchasing power over the last few decades.

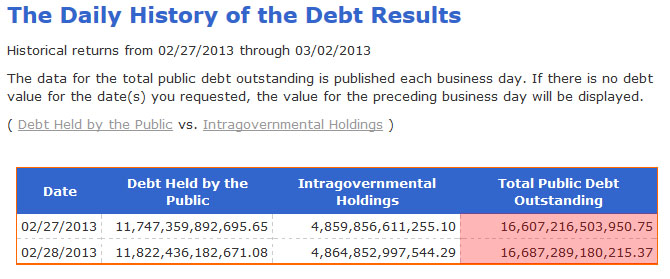

It was interesting that all the talk of the sequester cuts, about $85 billion generated so much news that in one day we boosted our national debt to the tune of $80 billion and nothing was said about this:

Similar to the above when it comes to wealth and income inequality, we seem to ignore the big picture. Reading an often cited study regarding ideal wealth distribution we find that most Americans understand that undoubtedly you will have top earners in the country. Yet they really have no idea how skewed things are:

It is important to examine this chart. When Americans from both parties were asked, many said the ideal wealth to be held by the top 20 percent of households was around 30 percent. They guessed that the number was at 60 percent. However, the top 20 percent hold more than 80 percent of all US wealth. The bottom 20 percent have virtually no wealth at all while Americans said the ideal would be about 10 percent.

One of the big changes that has occurred is the big financialization of our system creating a Wall Street casino that has entered into a perpetual bubble machine. We went from the tech boom to bust, followed by the real estate boom to bust, and now it appears that with the Fed, Wall Street is back to inflating the housing market this time by allowing big banks to use money to purchase properties in bulk. The irony here is that most Americans (those with wealth) actually have it locked up in real estate. And here we have the financial sector diving back in to crowd out the trade. Then we find out last month that income had its sharpest one month drop in 20 years.

One of the many startling figures that comes out from the data is that the bottom 40 percent of Americans carry a mean household net worth of -$10,600. That is right, they are in a negative net worth position. As nation, we’ve rarely had periods of such skewed wealth inequality. While we may not have diamond parties for bets, we do have Wall Street bankers taking on one night restaurant bills that cost more than the average per capita American makes in one year and other signs of opulence. I’m sure everyone is feeling good about all those bailout dollars going to shore up this sector of the economy.