Wednesday, 6/26/2013 19:05

This year's crash in gold prices is not unprecedented. Nor is the likely price action over the next one and 3 months...

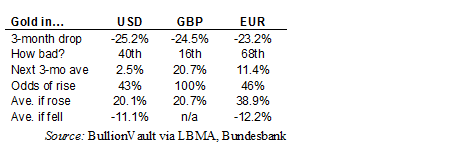

OVER the last three months, gold prices have sunk 25.2% for US Dollar investors. That's some drop, writes Adrian Ash at BullionVault – the 40th worst three-month drop since prices were floated during the death throes of the Gold Standard in 1968.

Heavy selling created this plunge. So it's natural for longer-term holders to be weighing their options as well today. Panic selling is a clear risk. Sitting like a duck in hunting season is also a risk, of course.

But whether gold's underlying fate is to keep falling or not, today doesn't look such a smart day to rush for the exits. Not according to history at least. A short-term surge looks highly likely.

Over the last 45 years, when gold has dropped this much or worse in three months, it has typically rallied hard over the following four weeks. Better than four-fifths of the time in fact, with an average one-month rise of 11.1%. On those occasions when gold fell and extended its loss, however, the average drop for Dollar investors who held on was 5.3%.

You makes your choice, in short. But it's good to know how the historical odds are stacked, if not the future. Over the last 45 years, this dramatic a sell-off has been followed on average by a one-month rise of 8.2% overall.

Further out, however, the underlying dynamics will matter. Or so history says. And especially for non-Dollar investors.

Gold has been through six distinct periods when Dollar gold prices crashed this hard or worse over three months. Five of them saw prices rise sharply over the three months which followed. But the one gold crash which didn't knocked a big hole in the averages, nevermind the portfolios of die-hard precious metal investors.

Late 1973, like mid-1974, proved only a way station in gold's long inflationary bull market. The snapback after crashing 27% and 25% respectively was noteworthy too – a huge 92% and then 39%.

May 1980 and March 1982 also both offered a solid three-month bounce in gold (28% and 15% respectively). But like August 1981 (with its 5% rally) these gold crashes hit during what proved a very long bear market. Two decades long in fact.

So gold owners who sat on their hands during those slumps only got chance to cut their losses when the relief rallies came. And investors who sat tight in winter 1980-81 didn't even get that. Gold prices sank month over month, extending a drop of 25% by another 20% three months either side of end-February 1981.

Moral of the data? Non-Dollar investors take note. Most especially UK savers and gold owners. Because based on the early '80s – the best comparison today – it's US Dollar rallies which tend to dent gold, and keep it dented. Leaving non-Dollar and particularly Sterling-based buyers with much steeper rallies, thanks to their own currency slipping itself against the greenback. (NB: The Euro data in our table is figured from the Deutsche Mark gold price pre-1999.)

Whether to sell into those bounces, quit now or start buying fast is one choice. Reviewing the broader financial landscape, and remembering that history rhymes only, is another. Good luck.

SOURCE