Posted Friday, 14 June 2013

What arbitrage could be occurring in COMEX? As with my analysis of GLD, I make no claims to special knowledge. I do not know who is doing what. I have heard no whispers from big traders in London, and have no inside information from the regulators or banks. I don’t talk to large aquatic mammals. I am only doing some basic detective work. READ MORE>>

Gold conspiracy theorists have a new bogeyman. Inventories of gold bars held in the COMEX warehouses are falling. This fact is offered to support the stale allegations of “fractional gold” and “manipulation”.

They have been predicting a “signal failure” that is coming any day now, like the Great Pumpkin in the Charlie Brown Halloween special. If not that, then surely at least the price of gold is going “to da moon”. Any day now, we have been repeatedly told, every day and every dollar down from the peak around $1900.

They have been predicting a “signal failure” that is coming any day now, like the Great Pumpkin in the Charlie Brown Halloween special. If not that, then surely at least the price of gold is going “to da moon”. Any day now, we have been repeatedly told, every day and every dollar down from the peak around $1900.

The price will rise again, as the centrally planned paper currencies continue their inexorable slide towards the oblivion of bankruptcy. The dollar, like all irredeemable paper currencies before it, will become worthless one day. That does not mean that there cannot be significant volatility in the meantime.

As I discuss in this article, the COMEX inventories are not the best place to look for changes in the scarcity of gold. One should look at the gold basis.

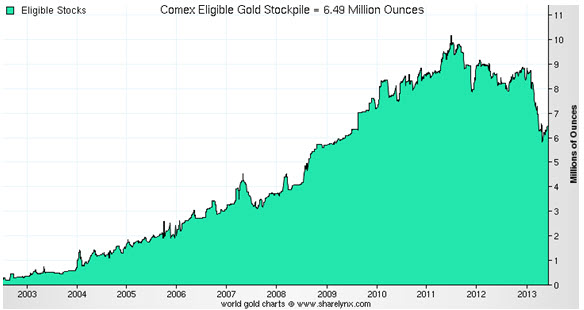

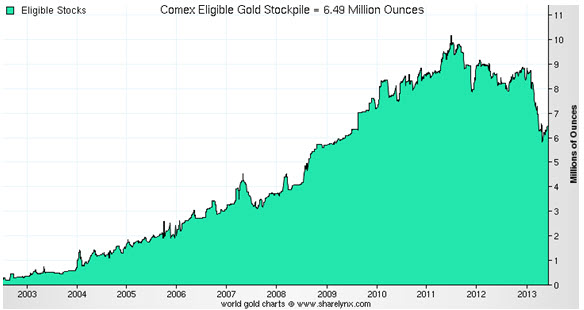

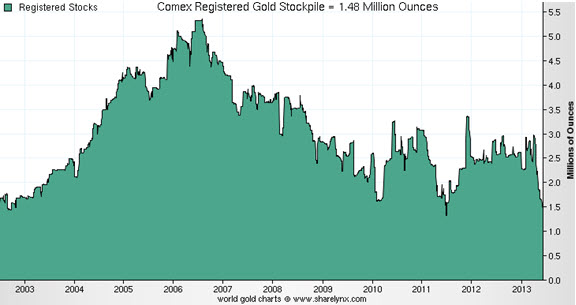

As this chart shows (all graphs are courtesy of Sharelynx), the eligible inventory of gold bars in COMEX-approved warehouses has been falling this year, and is now at a four-year low. An eligible bar is a bar that was manufactured by an approved refiner, has a documented chain of custody, and is in a COMEX licensed depository.

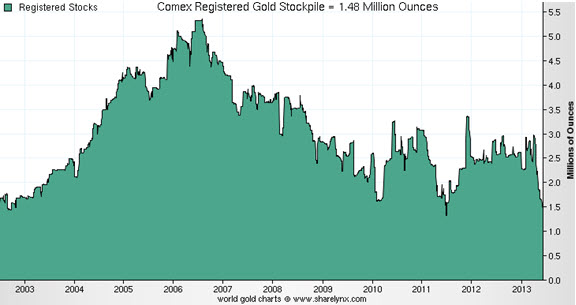

Eligible inventory has been in decline since 2011, and has dropped sharply this year. This is bad enough, but what has really got some tinfoil knickers in a twist is the drawdown of registered inventory. A registered bar is an eligible bar for which a registration has been made. Registered inventory is down to a 2-year low, though if it falls much farther, then it will be at a 10-year low.

Some contend that registered gold means the metal is owned by a dealer, and eligible means a client. I don’t find that explanation satisfactory, any more than to call the bid “wholesale” and the offer “retail”. At best it is oversimplifying, and usually misleading too.

The distinction is not based on who owns a bar of gold, but whether a warehouse receipt number has been assigned. Eligible gold can be owned by anyone, but it cannot be delivered against a futures contract. Once it has been registered, then it can.

The difference between eligible and registered is the filing of paperwork. This may reflect the possible intent of the owner to deliver the gold against a future he has shorted. But that is a tenuous and ambiguous distinction, and I do not consider it to be meaningful in analyzing the gold price.

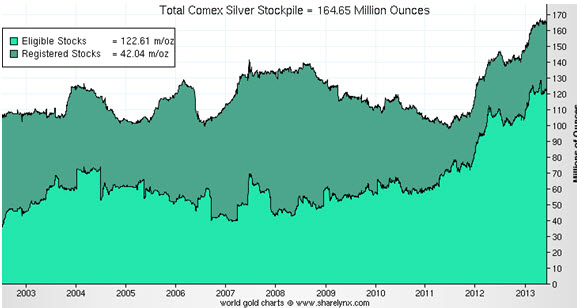

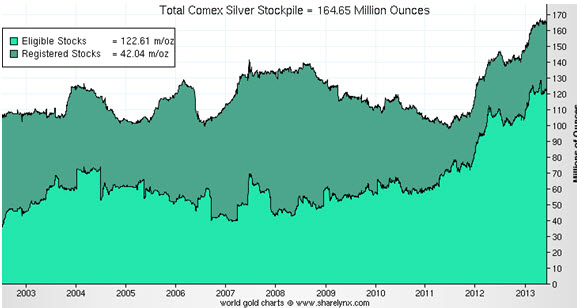

Before we go on and look at what really drives COMEX inventories, here is a graph of both registered and eligible stocks in silver. If the falling gold inventory is a bullish signal to some analysts, then by the same logic they should write that the rising silver inventory is bearish.

This is a false logic. Since January, I have been calling for silver to underperform gold, and likely fall against the dollar as well. It has indeed fallen from 52oz of silver per ounce of gold to 63.9oz (on Friday, June 7), and from around $32 to $21.66 per oz of silver. My call has not been based on COMEX inventories in either metal.

In What is the Meaning of GLD Outflows?, I explained the falling inventory levels at the Exchange Traded Fund through the theory of arbitrage. In short, gold (and every good) flows to where the price is highest. If it is possible to buy something at a lower price in one place, and sell it at a higher price elsewhere, then someone will do it. The same applies to the gold in GLD. It was possible to buy and redeem shares of the ETF at a lower price per ounce than the metal was worth in the market, so someone did it. In GLD, only Authorized Participants can perform this arbitrage. COMEX is open to anyone (though the practical consideration of transaction costs will preclude retail traders).