BUY or DIE!

Author : Bill Holter

Published: October 28th, 2013

Published: October 28th, 2013

Source MilesFranklin

We live in a world of constant change yet those running the show need the "status quo" to remain. China and others are calling for a "de Americanized" world that is no longer reliant on the dollar while it is absolutely imperative to the U.S. that the dollar remains king.

Without the central role of the dollar worldwide, the U.S. would almost immediately drop 2 rungs to 3rd world status. Over the last few weeks (months) the "status quo" has started to quietly shift, first interest rates started to rise almost simultaneously with the precious metals hitting panic bottoms. Now it is the turn of the dollar downward that is posing a threat to the status quo.

It seems as if like a light switch being flipped, the talk of tapering QE has stopped and been replaced by talk of further and renewed QE. Alan Greenspan was paraded last week (under the guise of promoting his new book) in an effort to massage history at a time when the next Fed Chairman(woman) is set to step up, Janet Yellen. I'd like to remind you of a little bit of recent history. QE started from the depths of the financial crisis. Each episode had a timeline and a general "amount" associated with it. The stock market (and bonds) would anticipate another round of QE by rising and also anticipate its ending by rebelling in "softness." We also saw this action in gold where it would rise in anticipation of further ease and trade sideways anticipating the end of QE.

Until this latest round of QE of course. Gold not only responded differently, it responded negatively. It is now obvious after the fact "how" this was done and "where" the metal came from to depress the pricing structure. This is also beginning to change as we had a test of the late June lows then a month or so later and now the action is "different." Premiums have risen to over $100 per ounce in India, we are in another round of negative GOFO rates and inventories (GLD and COMEX) are extremely low in comparison to a year ago.

My point is this, we are 1 year down the road from the latest QE effort and only now is it dawning on everyone that there is no "exit" door. Only now are market participants figuring out that the "lunatics" were right all along. The "liquidity" provided by the various QE's did not and never could "fix" the insolvency that was already in place; "liquidity" could only kick the can down the road that got heavier with each new round of printing.

It is important to understand "where" we are now a year after the fact. Gold inventories have been absolutely plundered. GLD has lost over 600 tons and COMEX another 200+…with December right around the corner.

It is important to understand "where" we are now a year after the fact. Gold inventories have been absolutely plundered. GLD has lost over 600 tons and COMEX another 200+…with December right around the corner.

December COMEX has open interest representing over 22 million ounces.

TOTAL COMEX inventories are roughly 7 million ounces with only 1/10th of that standing as "registered" gold for delivery. A year ago the registered category had over 2.5 million ounces, now it stands at just 707,000 ounces.

Yes I know, 22 million ounces will not ultimately stand but what will happen if even 1 million ounces stand for delivery? Where will the metal come from? October alone (which is not an historically active delivery month) has 436,000 ounces standing *which is more than half of dealer inventory…December is a more active month so to see 1 million ounces or more standing for delivery would not be a shocker. Where will the metal come from? And then comes February the most active month and one that saw over 40 tons delivered this past year…where does that gold come from? I ask "where does the gold come from?" because for a year now gold has been on a one way street exiting the inventories while very little has entered. The delivery question is now becoming critical.

I have said all along that the Chinese et al will "pull the plug" when the first ounce is not delivered. How much more gold can come from GLD? What if we "lunatics" really were correct and GLD didn't really hold 100% of what they said they held? What if it was really 60 or 70%? How much is really left? That

is a hypothetical question, the questions regarding the COMEX are a little different and even by their own numbers…December is a problem, a BIG problem! I would like to remind you that even though our markets are now nearly 100% robotic and computer controlled, but even with computers running the show we will not enter into December and an announcement will not be made that "we ran out of gold." A mad scramble will front run any reality that "the gold is gone" if this is truly the case. I don't see where the real gold is going to come from to deliver out and one must wonder whether or not JP Morgan's "one in 4 million year .000″ deliveries are part of the preamble because the deliveries do not seem credible to me.

|

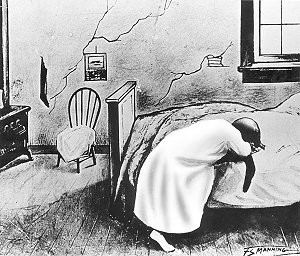

| Don't become a member of the Empty Stocking Club |

Before finishing this piece I would like to add that life can go from one "reality" to another very real "reality" overnight. Zero Hedge put out an article regarding Detroit's woes and the 84% haircut the bondholders look to be facing. In this article they show how Lehman bondholders were holding securities valued at close to .70 cents on a Friday only to see them valued at less than .10 cents Monday morning after they filed for bankruptcy. I liken this in reverse to the potential setup coming in December (or before). If there are more contract holders who ask for their gold than there is gold available then what will happen to price? The "reality" on a Friday afternoon may be very different from the "new" reality on a Monday morning. Both "realities" are (were) just as real as the other one "at the time" but one was manufactured and fleeting while the other is natural and thus more permanent. Looking back after the fact is always easy, it's harder to do when you are "living" it but your own common sense is the key.

Similar Posts:

|

This email is free from viruses and malware because avast! Antivirus protection is active.

|