DeBow’s Review

Serial: The Old guard.

Title: National Notes vs. Labor [pp. 8-12], January, 1864

NATIONAL NOTES VS. LABOR

THE most direct and wanton attack that has been made upon the rights of independent States, and the interests of the sovereign people, by the present party in power at Washington, is, beyond all question, the political scheme of Mr. Chase to consolidate political power through the operation of some 3,000 issuers of irredeemable paper, which he calls " a national currency," but which are, in fact, cheats to rob the working man of the proceeds of his daily labor. The issue of any kind of paper promise to circulate as money, is a fraud upon the producer, because its tendency is to give him less of money's worth than he would get if he was paid in specie. This is so well known, that even the advocates of the old United States Bank scheme, which was opposed by Mr. Chase before love of place tempted him to use the paper system as a means of personal advancement, were not slow in denouncing it. Daniel Webster, the earnest champion of the Bank, exclaimed, "Of all the schemes for making the poor poorer, and the rich richer, for getting the produce of the laborer and giving it to the schemer and the idler, irredeemable paper money is the most insidious, as it is the most effective."

Seven-Thirties Three year Treasury Notes bearing interest at a rate of 7.30% (seven-thirty) were first authorized by the Act of July 17, 1861 to help finance the Civil War.[10] These notes are payable to order, but the Treasury would issue them in blank form if requested. Secretary of the Treasury Chase suggested this rate of interest in hopes that the ease of interest calculation (a $50 note would accrue interest at one cent per day) would give the notes an opportunity to circulate as money, but apparently this did not prove to be the case.[11] Further issues of Seven-Thirties were made in 1864 and 1865. The issue of 1861, which preceded the First Legal Tender Act, paid interest in gold, but the government reserved the right to pay the interest of the 1864 and 1865 issues in either United States Notes or gold. (Source: Goldologist)

Comparison of a $5 Demand Note (upper image) and an 1862 issue $5 United States Note (lower image). Note the removal of the words “On Demand” and of the phrase “Receivable in Payment of All Public Dues”. Also note the Treasury Seal added to the United States Note.

This is undoubtedly the effect of the paper system; but its first effect is to cause an appearance of prosperity, which lasts a little while, until revulsion ensues. It is for this object that Mr. Chase projected it. He calculates that the stage of inflation will last until he can reach the Presidential chair. What future ruin may then overwhelm the people is to his cold and selfish heart a matter of supreme indifference. The poor may groan for centuries in debt; the country languish in decay, and our institutions change to any form of despotism, but what is all that to S. P. Chase? It is for this alone that the National Banking plan has been projected. We may briefly state some of its features:

1. The notes are issued to the amount of 90 per cent. of the market value of the bank's capital.

2. They are not redeemed in specie at all.

3. They are redeemed only in greenbacks.

4. They are a legal tender between the Government and its creditors, except wealthy stockholders, who get coin.

5. The issuers may be made depositors of the government money, at the will of Mr. Chase, and during his pleasure.

6. The capital ($300,000,000) authorized, is one-half to be apportioned by Mr. Chase, at his pleasure.

7. All the public expenditures are to be made in these notes.

8. The law requires 25 per cent. lawful money to be kept on hand by each bank, but its own notes, deposited in another national bank, may be called lawful money on hand.

The distinguishing features of the new bank scheme is, that no prudent capitalist will touch it, unless drawn into it from political obligations while, on the other hand, schemers and adventurers rush into it, because they have everything to gain and nothing to lose. This is a time of great paper inflation, when it is dangerous to lend, because values on which credits are based will collapse and ruin the lenders. The banking law, without doubt, will be set aside as unconstitutional, or repealed by the first Congress possessed of its senses. Either of these events will leave the stockholders in the position of individual partners, each liable for all the debts, notes, and all payable in specie, and hundreds may be ruined. These are some of the contingencies that business men will not encounter, even for the bribes of public deposits. When, therefore, Mr. Chase desired to get up a tax bank in New York, the attempt failed repeatedly. Finally, the order went forth that the Government defendants should be whipped in and compelled to start the bank. The subscription books were closed Dec. 17, and Mr. Opdyke, the dispenser of Astor-House patronage, the eminent shoddy commissioner, the gun contractor, and Treasury parasite-general, was compelled to take the Presidency, and the list was filled out with the names of Treasury brokers, stock agents, and speculators, who hope to use the Government money in stock gambling; each putting down his name with fear and trembling, only anxious to dispose of his stock as soon as possible, and get clear of the scrape. The other side of the question is that of irresponsible bankers. Thus, the law allows a capital of fifty thousand dollars, one-third, or sixteen thousand dollars must be paid up; one-third of that, or say six thousand dollars must be expended for United States 6 per cent. stock, to be deposited with the Treasury. The banker gets in return five thousand four hundred dollars in circulating notes; with these he buys as much more stock, and receives four thousand six hundred and sixty dollars more notes, with which he again buys stock. This process, repeated seven times, gives the banker thirty thousand dollars 6 per cent. stock, deposited with the Treasury, on which he draws 6 per cent for interest in gold, or one thousand eight hundred dollars, and the people hold $27,396 of his notes, which are redeemable only in greenbacks at the banker's counter. But the bank may be located in some inaccessible spot, and the notes can then be redeemed only at a broker's at a discount. This "broker is the issuer himself, and he will charge from 2 to 5 discount. He may redeem the whole six times in a year, giving him, perhaps, 20 per cent. on his circulation. His profits will then be, on an investment of one thousand six hundred dollars, as follows:

$30,000 Stock, interest in gold - - - - $1,800

27,896 Notes, redemptions - - - - 5,478

10,000 Capital, in 5 per cent legal

tenders, for reserve - - - - - - - 500

======

Profits on $16,000, 48 per cent. - - - - $7,778. This Secretary calls an "indispensable permanent currency." It is evident that this depends entirely upon continued suspension of specie payments. Hence, the whole herd of new banks form an interest to perpetual suspension.

These features, it will be seen at a glance, constitute the characteristics of a mere irredeemable bubble currency. Every bank is the creature of Mr. Chase, and lives on his pleasure, since he may give or withhold the public year are already $975,000,000. It is intended that the whole of this shall be paid out in the notes of these banks. Thus, soldiers, contractors, jobbers, officers, will all be distributors of these bubble bills through the whole mass of the people.

The paper flood starting from those banks will pour through countless channels over the land, in payment for every article of manufacture and production, and is to return to the Treasury through the hands of Mr. Chase's tax-gatherers, to be lodged with his pet banks appointed by him to receive it. Thus the thousand millions flow out through Mr. Chase's agents rob the people of the proceeds of their labor, by depreciation, and flow back into the hands of another set of Mr. Chase's agents, to be by them used in every county of all the States, as a political fund to further Mr. Chase's personal schemes.

This is the plot. Now, if we recur to the reasons for this foul and fraudulent issue of irredeemable paper, we shall hardly know which most to admire, the hardihood of the scheme itself, or the effrontery of the excuses made for it. The only reason given by Mr. Chase's fugleman, Mr. McCulloch, was that the heavy taxation made necessary by the war, "rendered it necessary that there should be provided for the people a circulation which the Government could receive with safety."

This is the whole story-the only plea given for the setting up of a permanent irredeemable paper system for the people, while the stock-jobbers, and these pet banks themselves, get their interest in coin. Now, the currency of this country, in times of high prosperity and peace, was composed of $300,000,000 of specie, and $200,000,000 of bank notes. This sufficed for the whole business of the whole country. There was no want of circulation; but, on the other hand, we exported $40,000,000 of gold per annum to make coin for other nations. When the war began, Congress authorized $50,000,000 of notes, payable in coin on demand. Mfr. Chase failed to meet the demand; he never paid a dollar. Congress then authorized $600,000,000 of greenbacks, as a legal tender currency. Mr. Chase has issued $450,000,000 of these, which, with the bank notes, make $600,000,000 of circulation. This is a pretty abundant currency, and the fact that it is so is manifest every day in its depreciation. For instance, in Canada flour is $4 25 per bbl., in coin; ten miles south of Canada, the same flour is $6 75 per bbl., in paper. The consumer is robbed of $250 by the depreciation of the paper, showing its superabundance. Those greenbacks are, however, the money of the Government. They are its own promise, and therefore can be "taken by it with safety." The Constitutionality of the legal tender is yet to be settled. Nevertheless, money is abundant, and safe for the Government to take, since it compels all people to take it, except those who are rich, and they get gold for their interest.

Now, if that paper is abundant, is safe and legal, what more does Mr. Chase want? What can he have to do with any bank scheme? The answer is plain. The manufacture of these notes involves no very considerable patronage, and, therefore, is of no political service. There are above deposits. The expenses of the Government are one thousand millions per annum. The appropriations this 1500 banks created by State laws, that comprise a large and powerful interest, if they can be combined under one head. Happily, they are not now so combined. Each State has, since the formation of the Government, had its own laws to regulate its own local business. Each has perfected a banking system, and in some of them, New York and New Jersey in particular, the people, in the exercise of their sovereign power, the powers declared reserved to them in the Federal Constitution, have delegated to their State legislators, by the State Constitution, declared that no bank shall do business within the State, without first " giving ample security for the payment of their notes in specie."

The issue of greenbacks by the Federal Government does not attack this right; but if the Treasury can go a step further, and force upon each State banks under Mr. Chase, and which do not pretend ever to pay a dollar in specie, then the State sovereignty and State banks fall together to the ground, and the whole banking system and money power of the country becomes consolidated in the hands of Mr. Chase, with "power to bind or to loose," to give or withhold Government patronage. The whole machinery will be in his hands, and $300,000,000 of irredeemable paper may be issued at his bidding. This political scheming has evidently been well advanced; but what has the Treasury gained? Instead of six hundred million dollars of greenbacks, legal tenders issued direct from the Treasury, we have some three hundred million dollars of greenback shadows, issued by three thousand banks, not a legal tender, but redeemable in greenbacks. There will be gold for the rich, greenbacks for the pet banks, and greenbacks diluted for the people.

The depreciation will be greater, because the notes, at a discount from the place of redemption, will be at a discount even for greenbacks. Thus, suppose Mr. Chase has given Mr. Opdyke a contract for army blankets: to make them, the wool must be bought; Mr. Chase gives him in payment Oregon national bank notes; Mr. Opdyke gives those to the farmer for the wool; the farmer wants the pay in negotiable money, at a moment when, as now, greenbacks are scarce; he must lose the discount, or expense of sending these notes to Oregon for redemption in greenbacks, probably 2 per cent. Thus Mr. Opdyke draws interest on his own stock, for his own use, in gold from the Treasury. He receives, in pay for his army contract, greenbacks that are at a discount of 36 per cent. today, for gold, and pays to the farmer national notes that are at a discount of 2 per cent. for greenbacks. The diluting scale runs down as we approach the producer of wealth. This is what the people get. Now let us see what the Treasury gets. In order to issue notes the banker must deposit United States stock, and he does so and receives 90 per cent. of the market value in circulation notes. If he deposits 6's of 1881, he gets for each one thousand dollar bond one thousand dollars in notes to circulate, and he also draws $60 per annum interest in gold, on his bond deposited. This is equal to 9 14 per cent. per annum in paper, and he lends his circulating notes at 7 per cent., making 16 1-4 per cent. per annum, which the producer must pay.

The Treasury, on an issue of three hundred million of dollars, now authorized, will have to pay eighteen million of dollars per annum interest, in gold, to Mr. Chase's pet banks, for the privilege of issuing the notes redeemable in greenbacks, instead of issuing the greenbacks themselves. Why should the country pay eighteen millions of dollars in gold per annum to issue paper, which may be done without any expense at all but the printing? The whole operation is a barefaced robbery of the public, to build up a political scaffolding for Mr. Chase's individual aggrandizement.

The pestilent issues should be scouted from every neighborhood; each State should make it a misdemeanor to attempt to pass one of the notes. Every farmer, working man, mechanic, should demand pay in gold, Constitutional coin, for what he has to sell, whether labor or produce. There are now twenty million dollars in gold lying idle in Wall street, while Mr. Chase is organizing banks to supply a currency. In Canada, on the occasion of every bargain, it is stipulated that part pay shall be taken in United States coin, and yet here the people are compelled to strike for more pay, because they get nothing but Mr. Chase's fraudulent promises, and he is putting out millions more of even less value. Let there be one universal strike among all people, and that simply the demand to be paid in gold and silver. It is the only way to save the Government, which is jeopardized by the infamous schemers who have brought on this war, and who seek through paper money to destroy, not only the Union, but what remains of popular rights, even the right to live by labor.

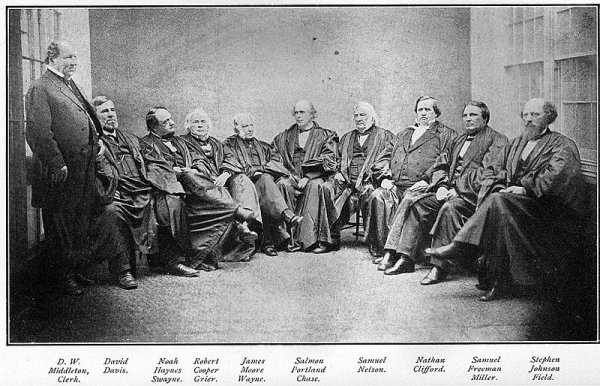

The Supreme Court under Chief Justice Samuel P. Chase. The Chase court presided over many important decisions during Radical Reconstruction following the Civil War. (Source)