ISIS militants are selling oil from their conquered territories, further

fueling tensions in the region. This has caused uncertainty on the

world market, but could also lead to a drop in global oil prices.Source: ISIS, oil and war

Submitted by Andrew McKillop, 12Aug2014

Outside the US and inside the Middle East warnings of this threat have multiplied for several months but Obama and his administration “didn't want to know”. We therefore have to ask if his administration wants a run-up of world oil prices as in 2008, which helped create or trigger the 2008 financial crisis which endures today?

Submitted by Andrew McKillop, 12Aug2014

Oil and Humanitarian War

Portraying American

intervention in Iraq as a purely humanitarian effort, president Obama is

following the same script he read in March 2011 for Libya, when he justified American

intervention as an effort to prevent a civilian massacre in Benghazi. In 2011

he addressed the American nation and said the US was acting militarily,

without “boots on the ground”, as a response to “brutal repression and a

looming humanitarian crisis.”

Obama was much too polite to

mention oil at the time, and again today when it concerns Iraq. Libya in 2011

was the world’s sixteenth-largest world producer and was supplying about 19.5%

of all European oil imports at the time, but since 2012 the oil production of

Libya is much lower and very erratic.

Toppling the regime of Muammar

Qaddafi was seen by Obama's advisors and Secretary of State Hillary Clinton as

easier than toppling Saddam Hussein of Iraq. But as in Iraq in 2003, US

strategists claimed that they would open a gateway to more and further oil

supplies from Libya.

Iraq today supplies almost

exactly twice as much oil to world importers as Libya did in 2011 - but no

longer does. Depending on he state of sectarian fighting in Libya, oil exports

by Libya can be practically zero. Now that Obama has moved “on and up” to Iraq

he has seriously raised the stakes. Taking Iraq out of the world oil export

“supply loop” would almost certainly cause enough supply shortage that oil

prices would “bounce” out of their current downward trend below the “magic

three-digit” price in US dollars per barrel, of $100.

Is this the real US strategy?

When Libya fell apart and

descended into chaos, and its oil production plunged from 2012, this did

nothing to bounce oil prices upwards. This was because of ultra-basic reasons

of supply and demand – world oil markets were more than amply supplied and the

loss of Libya had no impact. Doubling the stakes in Iraq, however, can achieve

the goal of a $150-per-barrel “sticker price”, if very high-priced oil, which

will be very bad for the global economy, is the real goal.

Libya Times Two or Times Five?

ISIS to date has captured

around $1.25 billion worth of American supplied military equipment according to

Turkish media including 'Daily Sabah', most spectacularly in June when the

IA-Iraqi Army threw off their uniforms and ran on the approach of ISIS to

Mosul. ISIS was far fewer in numbers (below 10,000) and far less equipped than

the IA around Mosul at that time but this is certainly not the case today.

Although ISIS has a probably

low number of captured Middle Eastern versions of US M1 Abrams tanks, built in

Egypt, it has larger numbers of Russian T-55s and T-72s captured in Syria, and

at least 350 – 1500 US Bradleys, Humvees

and other armored cars, a few military helicopters, some Manpads anti-aircraft

missiles, at least 50 - 100 field howitzers, multiple rocket launchers and

large numbers of anti-tank RPGs. It also has very large stocks of ammunition

and other military supplies including night fighting equipment. ISIS also

probably obtained a large part of the estimated $425 million of deposits held

in Mosul banks when it took the city in June, and may be able to use this to

buy weapons.

No reliable estimate exists of

actual field numbers of ISIS fighters today, but they are growing. Controlling

the Mosul and Haditha dams supplying Mosul and a string of cities to Baghdad in

the south, and numerous electric power plants and water-sewage infrastructures

it can paralyze Iraq when it wants. Under a worst case scenario, ISIS kamikaze

“scorched earth tactics” can also enable it to paralyze oil production,

refining and transport infrastructures across a swath of northern Iraq.

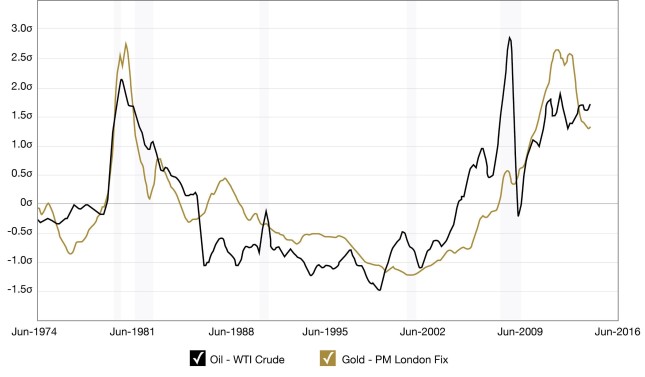

Outside the US and inside the Middle East warnings of this threat have multiplied for several months but Obama and his administration “didn't want to know”. We therefore have to ask if his administration wants a run-up of world oil prices as in 2008, which helped create or trigger the 2008 financial crisis which endures today?

Why High Oil Prices

We can list several

supposedly-perverse reasons. Both Goldman Sachs and the so-called energy market

maker banks including JP Morgan, Barclays and Societe Generale have tirelessly

worked to push oil market prices – upward – since the brief crash of oil prices

in 2009 when prices fell, for a short while, to about $40 per barrel. The

energy market maker banks and the major brokers like Goldman Sachs have

abandoned the coal, natural gas and most recently electric power markets,

following major regulatory investigations and large penalties on their

price-rigging. This has led Deutsche Bank to abandon all energy and commodities

market activity.

The oil market is however

still under their control.

World oil and gas spending on

exploration and production, and its financing benefits directly from high oil

prices. This spending was running at around $640 billion in 2013 according to

estimates from Citigroup, Barclays and Morgan Stanley. Major loans for this

activity are directly dependent on oil prices staying high.

Continuously high oil prices

are forecast by the International Energy Agency as certain for at least the

next 20 years, to 2035.

High oil prices are the

cornerstone of the so-called “low carbon strategies” to beat global warming and

develop alternate and renewable energy supplies, using state subsidies. High

oil prices are also a major support factor for maintaining, or increasing

inflation which is judged necessary or vital by central bank chiefs including

Janet Yellen and Mario Draghi. High oil prices therefore provide another

rationale for “print and forget” quantitative easing.

The near-automatic increase in

daily traded oil prices when equity markets rise is another proof of the vital

role for high oil prices in financial asset expansion, albeit totally

fictitious.

Sabotaging Iraq's oil supply

to the world after the “non-performance” of allowing or encouraging Libya to

descend into chaos, is therefore logical. Geopolitically however, regional

Middle Eastern states facing serious economic difficulties as “blowback” from

the G7 Group's enduring economic crisis will be active also in Iraq, not only

in humanitarian-designated military action.

The Obama administration may

or may not want high oil prices, but its actions to date only lead to that

conclusion.