Today the front month silver contract on the Shanghai Futures Exchange (SHFE) closed at an 8 % premium over London spot. Therewithal the futures curve of silver is in backwardation; silver is scarce in Shanghai.

Backwardation means the future price is lower than the present spot price. Normally the futures curve of precious metals is in contango, meaning the future price is higher than the spot price.

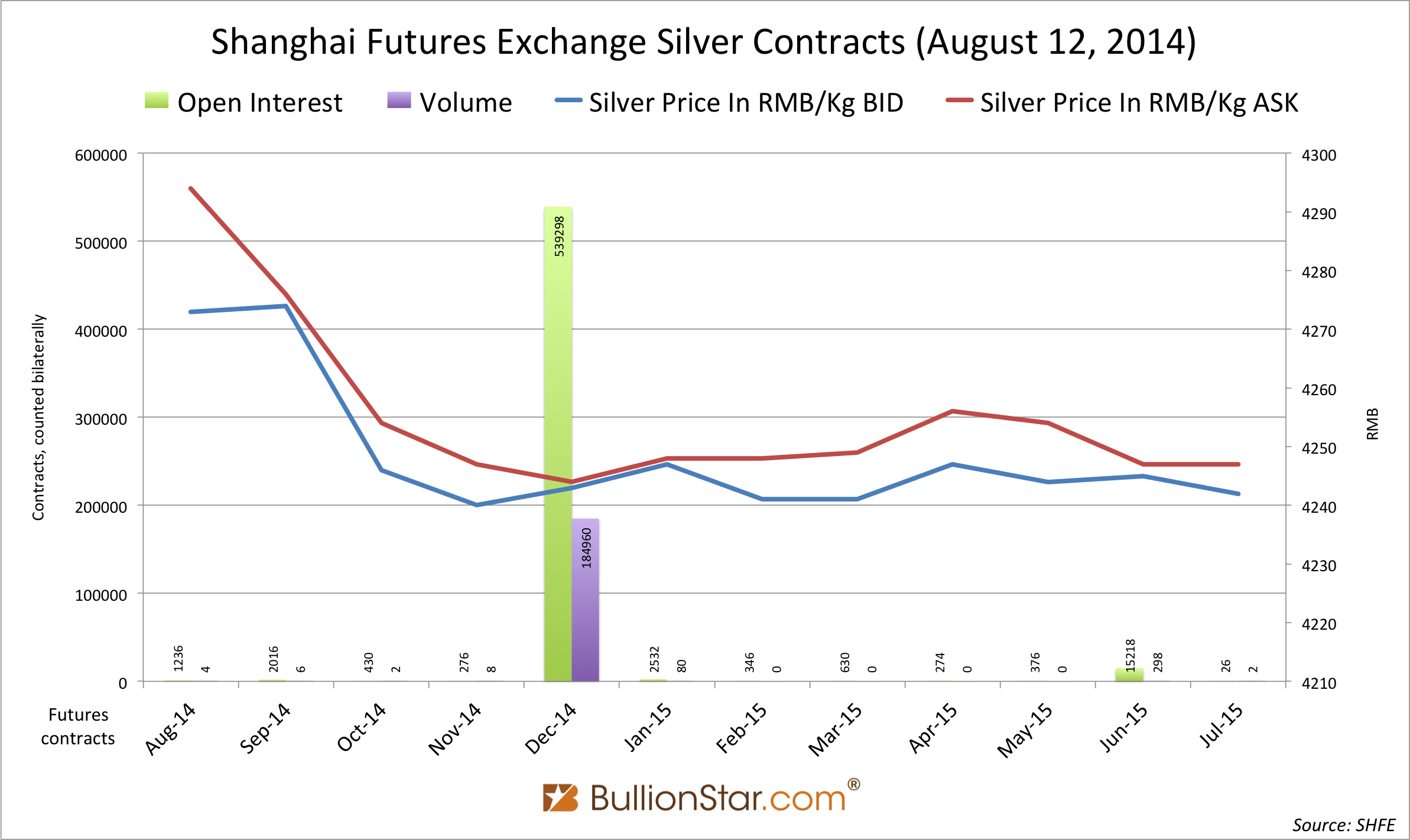

If we look at the Ag1412 contract (silver 2014 December), the ask price closed at 4244 RMB/Kg, while the bid price of Ag1408 (silver 2014 August) was 4273 RMB/Kg. Consequentially one could, for example, sell 900 Kg of silver in August for 3,845,700 RMB (900 Kg times 4273 RMB) and buy back the same amount of silver delivered in December for 3,819,600 RMB (900 Kg times 4244 RMB). This trade would make a profit of 26,100 RMB in 4 months on 900 Kg.

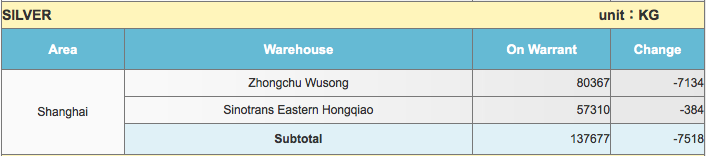

The open interest (OI) for Ag1408 is 1246 contracts. On the Shanghai Futures Exchange the OI is calculated bilaterally, so currently there are 623 long and 623 short contracts open. The contract size is 15 Kg/lot. The Last Trading Day of Ag1408 is friday August 15. If the 623 shorts/longs aren't closed before friday, these contracts will be settled and the longs take delivery of 9.345 metric tonnes (623 contracts times 15 Kg). When silver is delivered this doesn't necessarily mean the metal is taken out of the warehouse. What happens is that a warrant, a claim of ownership on silver in the warehouse, is transferred from short to long. If the long redeems the warrant and takes the silver out of the warehouse or chooses to hold the warrant and from that moment pay storage costs is up to him. Additionally, anyone can deposit silver in the warehouse and create a warrant.

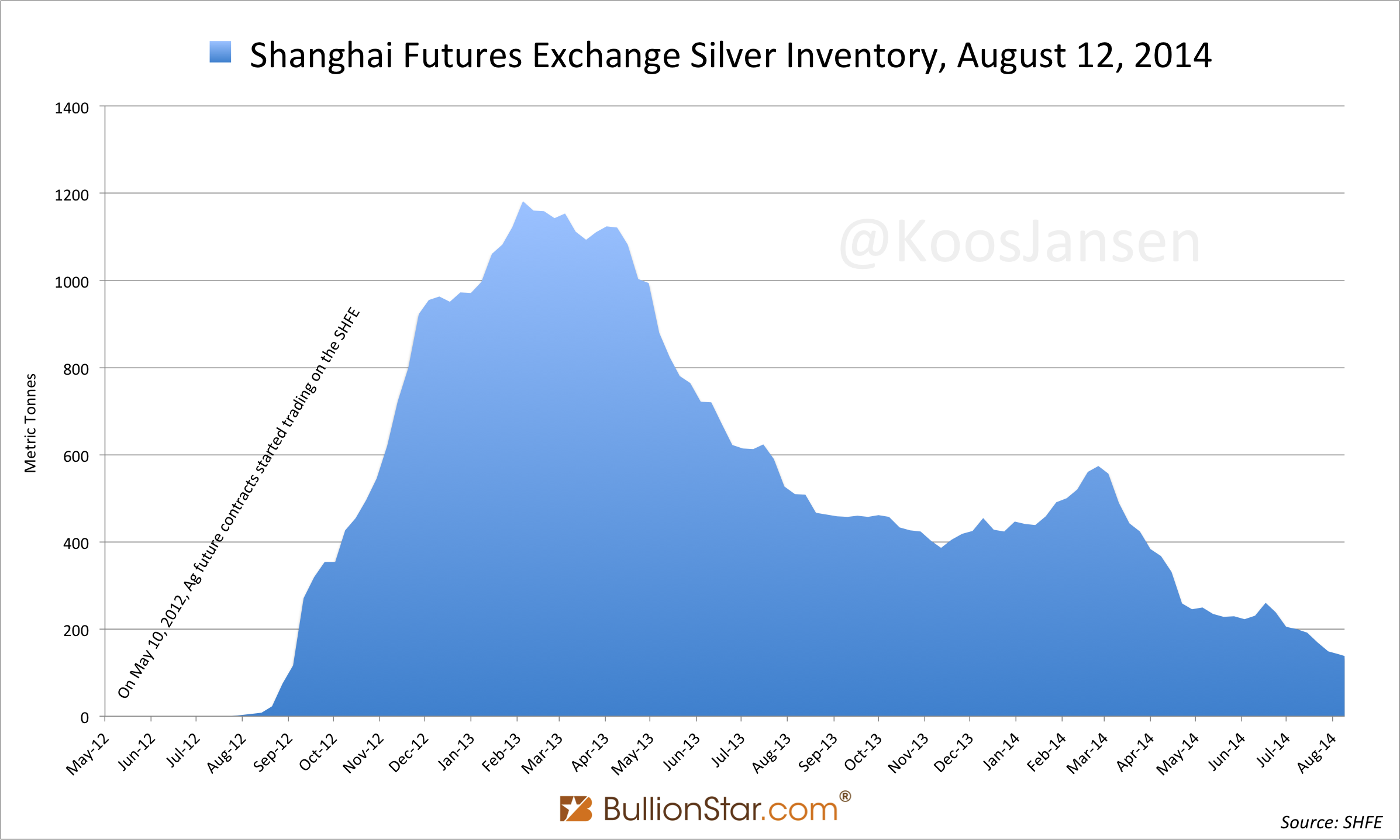

The owner of a warrant can redeem his silver any time he prefers. The SHFE today reported silver inventory (on warrant) was 137.677 tonnes,

down 7.518 tonnes from yesterday.

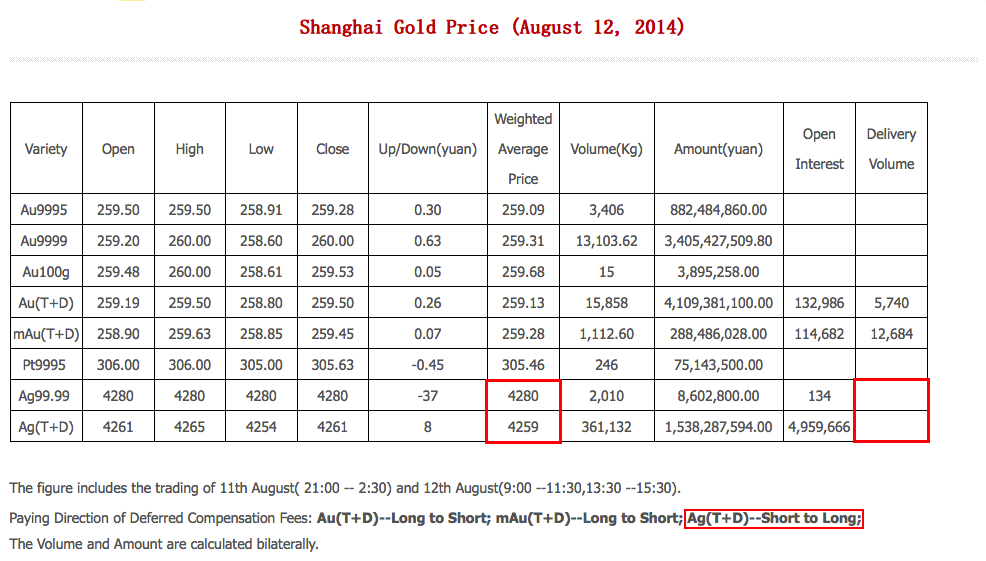

On the Shanghai Gold Exchange (SGE) we could see spot silver Ag99.99 trading at a premium over spot deferred silver Ag(T+D). The Ag(T+D) shorts chose not to deliver any metal, but instead pay the deferred compensation fee. Today Ag99.99 closed at a 7.8 % premium over London spot, Ag(T+D) at 7.3%. Note, the SGE does not close at the same time as the SHFE.

In May and June silver also traded in backwardation on the SHFE. The trading opportunity then attracted supply that pushed the futures curve in contango and the premiums lower. The next chart lags a couple of days.

Koos Jansen