Wednesday, August 27, 2014, 13:40 clock

After the dramatic rally three years ago, it's been pretty quiet around the silver. Even in the recent geopolitical turmoil, the precious metal could hardly score. When is the big silver comeback?

While the price of gold in the environment of rising political tensions in the crisis areas last grew again, the silver price fell short of the expectations of many precious metal investors.

In this case, both metals are bought by investors as insurance against inflation. That silver is stronger than gold, also used in industry, is one of the main differences between the metals. And this is certainly one of the factors that currently dampens the demand for silver. Since the beginning of silver has now again a drop of approximately 0.5 percent recorded, for a fat discount of more than 37 percent last year. Gold was down almost 7 percent, however so far after all. In euro terms, the impact is down even slightly larger.

The price of silver is much more volatile compared to other metals.

That is, the prices more volatile than about in gold. The value of relationship to each other is changing so continuously. To close on a negative or positive evaluation of one metal over the other, one examines the so-called gold-silver ratio. It is a simple ratio: gold price divided by silver price. The gold-silver ratio indicates with how many ounces of silver can buy one ounce of gold. Currently, we obtain for one unit of gold about 65 units of silver (gold-silver ratio = 65). Is silver to gold has to be classed as rather expensive or cheap?

For this one must seek the story and compare the geological conditions. According to scientific estimates, more silver is about 17 times stored as gold in the earth's crust. That alone already points to a mismatch between the current precious metal prices. It should however be borne in mind that silver is used industrially.

The quantities of ore once funded take so continuously. In contrast, all gold ever mined is still as good as being completely present.

More meaningful is the historical comparison. The gold-silver ratio was about 10 to 20 centuries peak periods experienced the quotient end of the 20s and beginning of the nineties, with values of about 100 The sharp rise in the 20th century is due to the fact that silver completely its cash function was robbed and it is now primarily viewed as an industrial metal. The central banks have large holdings of precious metals, but silver is not among them!

The silver market is also regarded as even more strongly influenced by speculative interests, than the gold market. In the spring of 2010 for the first time media attention manipulation allegations were against large U.S. banks (JP Morgan, HSBC) pronounced and later prosecuted, put the price of silver in the episode a dramatic rally on the dance floor.

Within just one year, the price of silver rose from $ 18 to $ 48. Since then, the silver chart is again in decline. So when is the big comeback? U.S. analysts such as Ted Butler and James Turk expect it for a long time. They assume that the current price represents the true scarcity of the precious metal is not nearly. Sooner or later become a new price jump coming - also in relation to gold. It seems as if only someone would take their foot off the gas. And perhaps, have to force a U.S. bank to again before the price of the white precious metal really picks up speed again.

source: Gold Reporter

While the price of gold in the environment of rising political tensions in the crisis areas last grew again, the silver price fell short of the expectations of many precious metal investors.

In this case, both metals are bought by investors as insurance against inflation. That silver is stronger than gold, also used in industry, is one of the main differences between the metals. And this is certainly one of the factors that currently dampens the demand for silver. Since the beginning of silver has now again a drop of approximately 0.5 percent recorded, for a fat discount of more than 37 percent last year. Gold was down almost 7 percent, however so far after all. In euro terms, the impact is down even slightly larger.

The price of silver is much more volatile compared to other metals.

That is, the prices more volatile than about in gold. The value of relationship to each other is changing so continuously. To close on a negative or positive evaluation of one metal over the other, one examines the so-called gold-silver ratio. It is a simple ratio: gold price divided by silver price. The gold-silver ratio indicates with how many ounces of silver can buy one ounce of gold. Currently, we obtain for one unit of gold about 65 units of silver (gold-silver ratio = 65). Is silver to gold has to be classed as rather expensive or cheap?

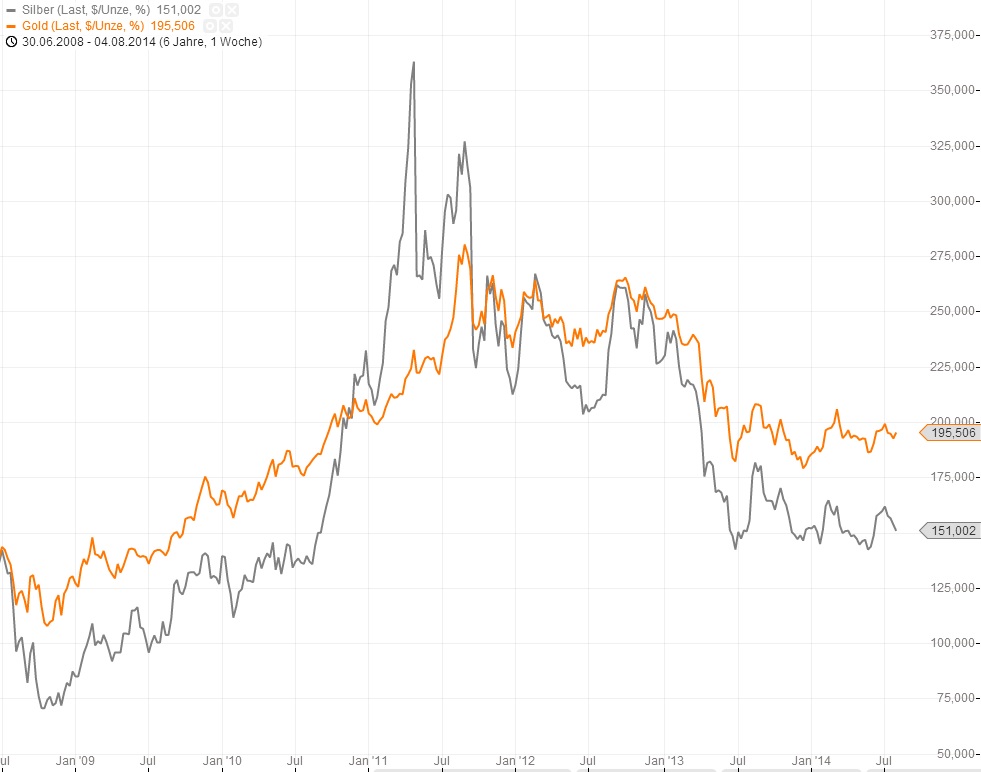

|

| Gold and silver price performance since 2009 in comparison (weekly closing prices, index) |

The quantities of ore once funded take so continuously. In contrast, all gold ever mined is still as good as being completely present.

More meaningful is the historical comparison. The gold-silver ratio was about 10 to 20 centuries peak periods experienced the quotient end of the 20s and beginning of the nineties, with values of about 100 The sharp rise in the 20th century is due to the fact that silver completely its cash function was robbed and it is now primarily viewed as an industrial metal. The central banks have large holdings of precious metals, but silver is not among them!

The silver market is also regarded as even more strongly influenced by speculative interests, than the gold market. In the spring of 2010 for the first time media attention manipulation allegations were against large U.S. banks (JP Morgan, HSBC) pronounced and later prosecuted, put the price of silver in the episode a dramatic rally on the dance floor.

Within just one year, the price of silver rose from $ 18 to $ 48. Since then, the silver chart is again in decline. So when is the big comeback? U.S. analysts such as Ted Butler and James Turk expect it for a long time. They assume that the current price represents the true scarcity of the precious metal is not nearly. Sooner or later become a new price jump coming - also in relation to gold. It seems as if only someone would take their foot off the gas. And perhaps, have to force a U.S. bank to again before the price of the white precious metal really picks up speed again.

source: Gold Reporter