Posted by mybudget360

People have a hard time understanding how inflation erodes their purchasing power. Little by little the cost of everything goes up and people simply assume this is normal in an economy. The $2 movie ticket becomes a $8 movie ticket. That can of tuna just got smaller but the price remains the same. The cost of going to college went from manageable to needing large student debt merely to complete a four year degree. Inflation is argued to be a purely monetary outcome. You have too much money, in the form of cash or credit in today’s case, chasing fewer goods. In our current economy, debt is the fuel accelerating inflation. You can see this in items like housing, cars, and college where debt is the primary fuel driving prices higher. The big problem today is that incomes are simply not rising fast enough to keep up with the rise in other expenses. Over time, inflation has a big destructive power. I thought it would be useful to look at the cost of typical items in 1938 and compare them to where things stand in 2015.

Comparing 1938 to 2015

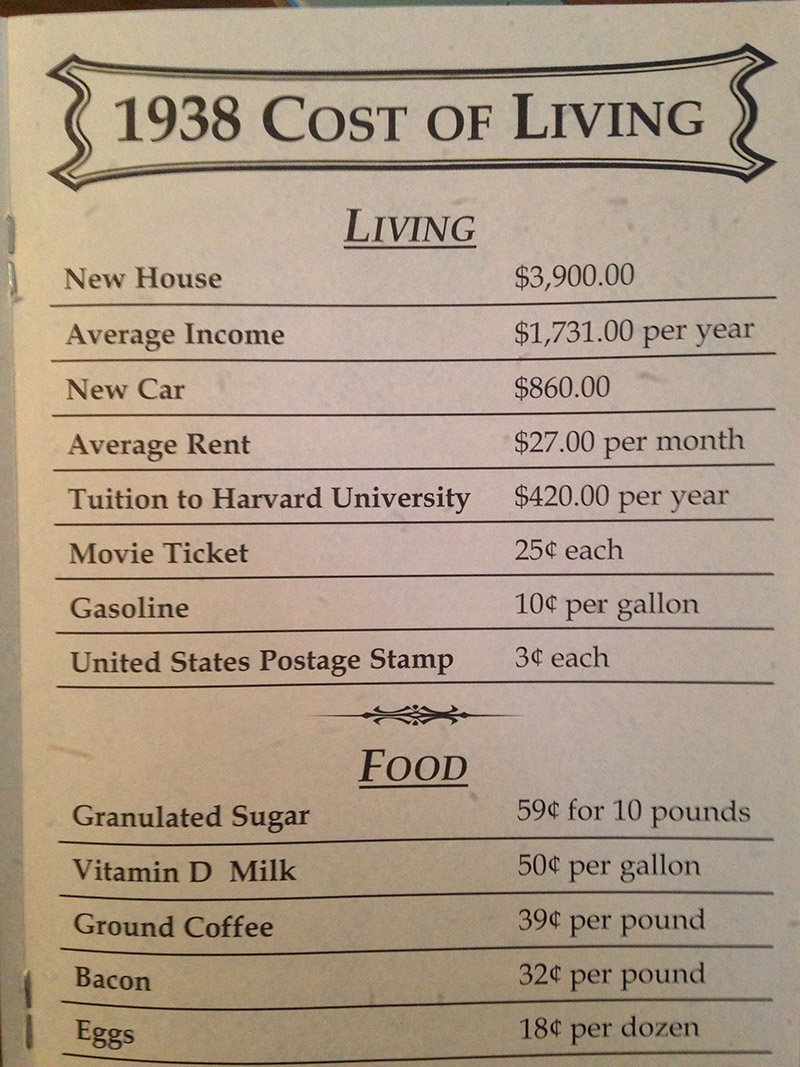

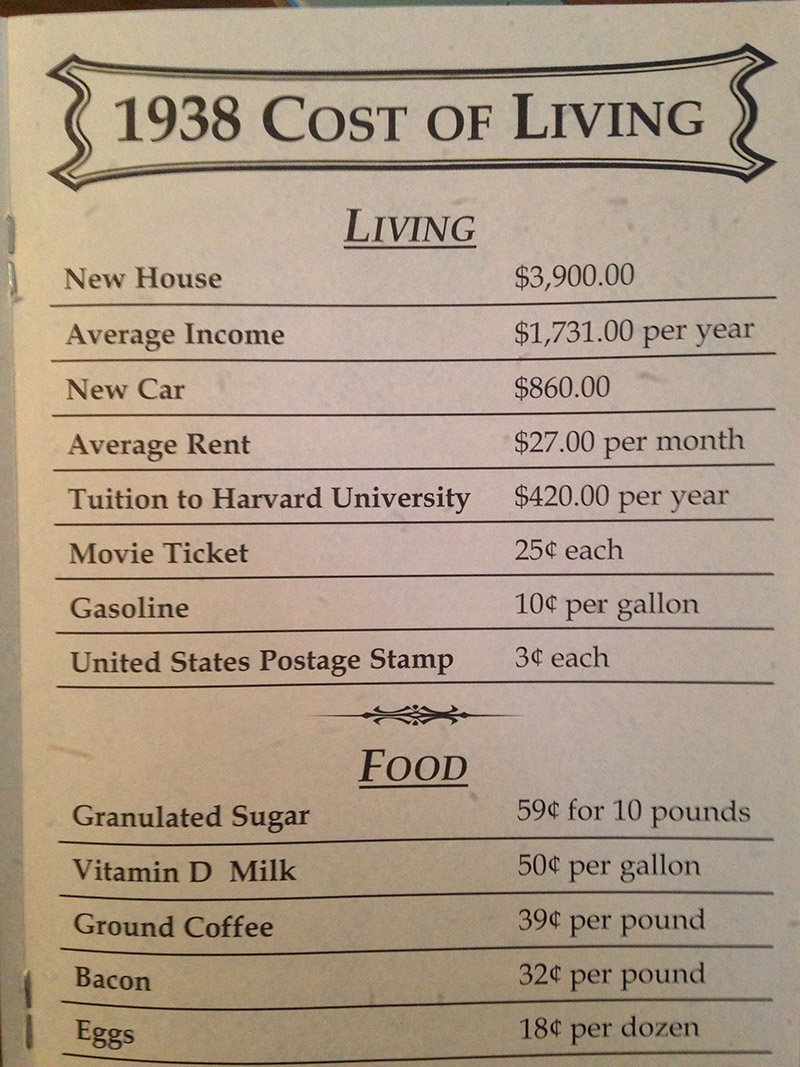

Over a year ago, we looked at some old data and found this to be useful to readers. I thought it would be helpful to update the data and see where things stand today in 2015. Someone sent this snapshot of the cost of living in 1938. It really is fascinating looking at inflation over a very long period of time. In this case, we are looking at spending pre-World War II. Most Americans probably have no sense as to what the cost of living was back then since they are mired in the fight of living paycheck to paycheck.

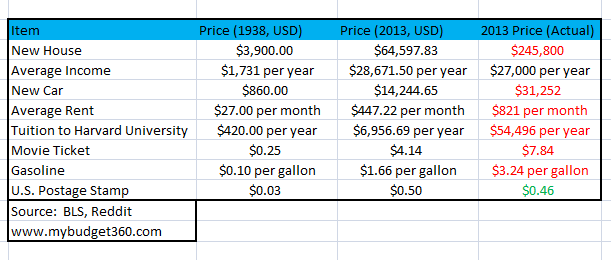

Take a look at the cost of living in 1938:

Source: Reddit

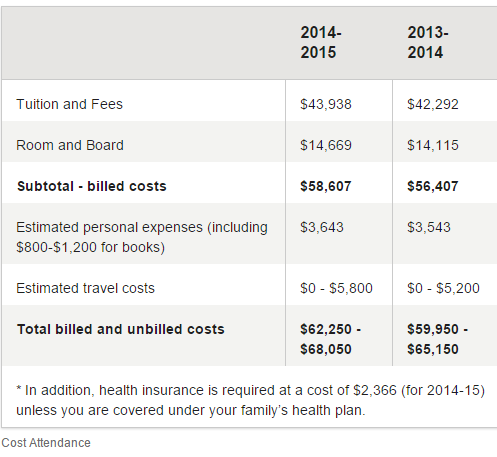

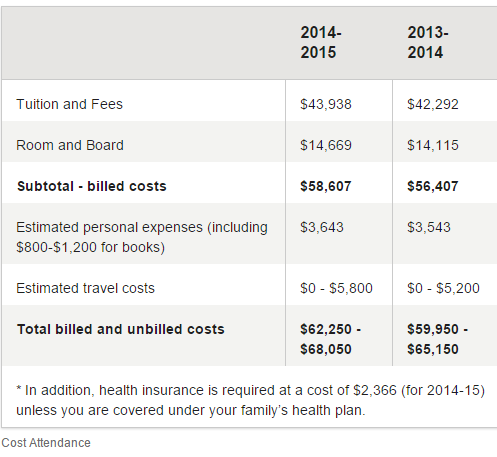

What is important is to look at income in relation to the cost of living. A new home was about twice the annual average income. Today, with the median household income being $50,000 and your typical new home costing $298,000 we are definitely on the more expensive side (6 times annual income versus 2 back in 1938). Look at the new car costs. A new car cost about $860 or half of annual income. Today, a regular car can cost $32,000 and most will need to finance it. Tuition to Harvard was $420 per year and today Harvard tuition is nearly $62,000 with room and board:

Source: Harvard website

In other words, the typical family of today would need to use all their annual income to send their kid to Harvard plus go in debt while in 1938, your average family had income to send 4 kids to Harvard per year. The most inflated of all categories is college tuition.

Looking at various costs adjusting for inflation

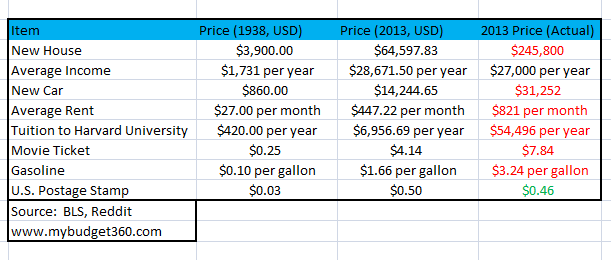

I put this table together and adjusted for inflation to give you a better perspective:

I wanted to update some of this data for 2015 as well:

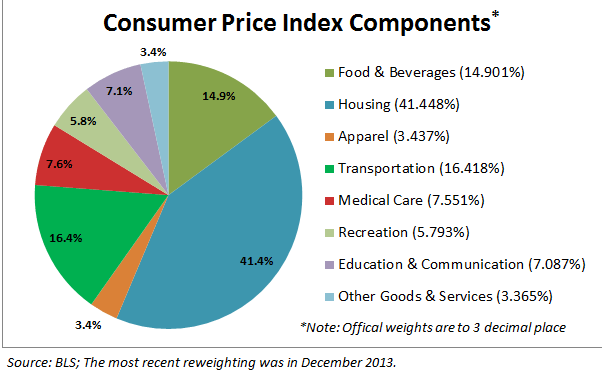

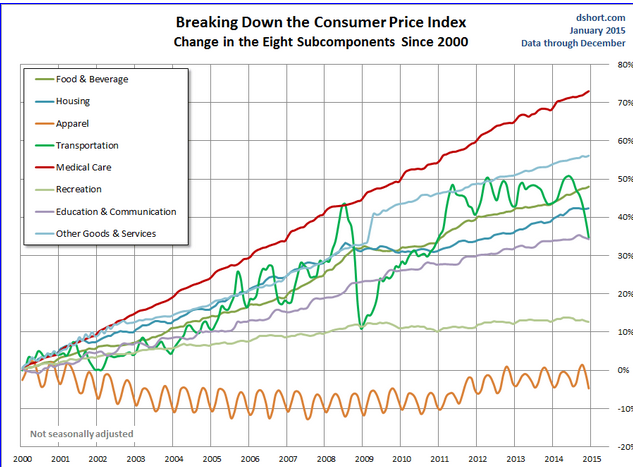

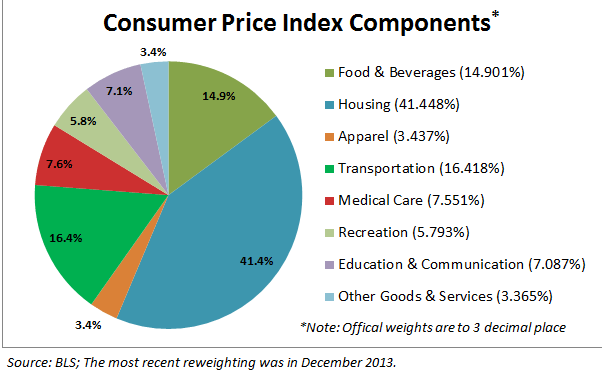

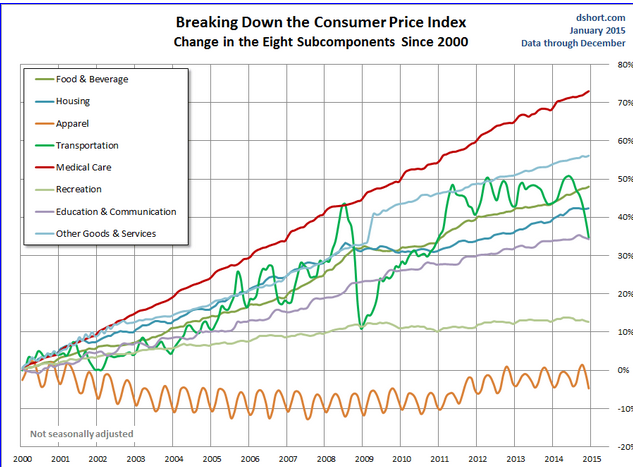

Housing, food, medical care, transportation, and education make up the biggest expenses. Housing by far consumes the biggest portion. And look at how fast prices have gone up since 2000:

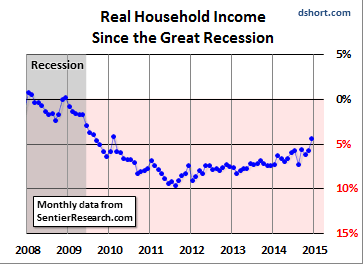

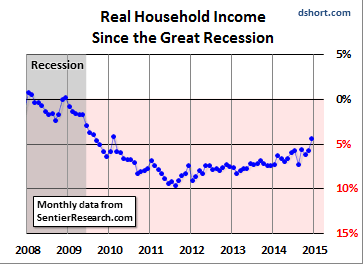

Medical care is up over 70 percent. Housing is up over 40 percent even with the crash in the housing market. Basically the only items that held steady were apparel and recreation. But look at how incomes are doing:

You wonder why you feel like you have less purchasing power? You feel poorer because you are thanks to the slow eroding power of inflation. The Fed would like to argue that there is no inflation but just look at housing costs, medical care, college tuition, and grocery bills and tell the regular working American family that there is no inflation.

Source

People have a hard time understanding how inflation erodes their purchasing power. Little by little the cost of everything goes up and people simply assume this is normal in an economy. The $2 movie ticket becomes a $8 movie ticket. That can of tuna just got smaller but the price remains the same. The cost of going to college went from manageable to needing large student debt merely to complete a four year degree. Inflation is argued to be a purely monetary outcome. You have too much money, in the form of cash or credit in today’s case, chasing fewer goods. In our current economy, debt is the fuel accelerating inflation. You can see this in items like housing, cars, and college where debt is the primary fuel driving prices higher. The big problem today is that incomes are simply not rising fast enough to keep up with the rise in other expenses. Over time, inflation has a big destructive power. I thought it would be useful to look at the cost of typical items in 1938 and compare them to where things stand in 2015.

Comparing 1938 to 2015

Over a year ago, we looked at some old data and found this to be useful to readers. I thought it would be helpful to update the data and see where things stand today in 2015. Someone sent this snapshot of the cost of living in 1938. It really is fascinating looking at inflation over a very long period of time. In this case, we are looking at spending pre-World War II. Most Americans probably have no sense as to what the cost of living was back then since they are mired in the fight of living paycheck to paycheck.

Take a look at the cost of living in 1938:

Source: Reddit

What is important is to look at income in relation to the cost of living. A new home was about twice the annual average income. Today, with the median household income being $50,000 and your typical new home costing $298,000 we are definitely on the more expensive side (6 times annual income versus 2 back in 1938). Look at the new car costs. A new car cost about $860 or half of annual income. Today, a regular car can cost $32,000 and most will need to finance it. Tuition to Harvard was $420 per year and today Harvard tuition is nearly $62,000 with room and board:

Source: Harvard website

In other words, the typical family of today would need to use all their annual income to send their kid to Harvard plus go in debt while in 1938, your average family had income to send 4 kids to Harvard per year. The most inflated of all categories is college tuition.

Looking at various costs adjusting for inflation

I put this table together and adjusted for inflation to give you a better perspective:

I wanted to update some of this data for 2015 as well:

New house: $298,000 (Source: Census)So basically every single category is up besides gasoline given the crash in oil prices in 2014. But this is a small drop in the bucket given what consumes the biggest portion of your budget:

Average income: $28,000 (Social Security)

New Car: $32,000 (Bankrate)

Average Rent: $950

Tuition to Harvard: See above

Movie ticket: $8

Gasoline: $1.99

US Postage Stamp: $0.49

Housing, food, medical care, transportation, and education make up the biggest expenses. Housing by far consumes the biggest portion. And look at how fast prices have gone up since 2000:

Medical care is up over 70 percent. Housing is up over 40 percent even with the crash in the housing market. Basically the only items that held steady were apparel and recreation. But look at how incomes are doing:

You wonder why you feel like you have less purchasing power? You feel poorer because you are thanks to the slow eroding power of inflation. The Fed would like to argue that there is no inflation but just look at housing costs, medical care, college tuition, and grocery bills and tell the regular working American family that there is no inflation.

Source