The lawful owner of the 8,134 tonnes of official gold holdings of the United States is the US Treasury. The Federal Reserve handed over the official gold reserves to the Treasury in 1934 and in return received gold certificates – which, by the way, are not redeemable for gold, only for dollars, but that’s not the point now. The point is these gold certificates are still valued on the Fed’s balance sheet at $42.22 an ounce.

The free market price of gold is currently about $1,200. The reason the US capped the value of gold on their books at $42.22 in the seventies is because they wanted to phase out gold from the international monetary system to increase the power of King Dollar; denying the true value of the yellow metal supported this ambition. And so the Fed pretends until this day gold is worth $42.22, all in an effort to make us believe in the strength of the dollar.

However, the US can’t pretend forever the price of gold is $42.22.

However, the US can’t pretend forever the price of gold is $42.22.

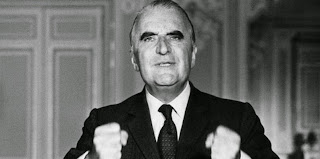

George Pompidou to Henry Kissinger, May 18, 1973:

I would therefore like to discuss the monetary question and also the question of gold—not the role of gold because we could debate that in vain and we know that we are not in agreement; but there is the question of the price of gold and we can no longer continue to go on pretending that an ounce of gold will always be worth thirty-eight dollars when it is now worth one hundred and six dollars.

On August 15, 1971, the President of the United States Richard Nixon announced the convertibility of US dollars for gold would be temporarily suspended. In particular France was not amused by the fact the US broke its promise; which was that the US dollar was as good as gold.

After the anchor in the international monetary system was removed in ‘71 a diplomatic battle ensued about the value of currencies (and gold). The US wanted to cap the value of gold, while Europe wanted to revalue gold. This period is very interesting because I suspect it gave birth to the euro.

…I would like for you to talk to Schultz first. Burns has this idea that we have to move quickly with Europe.

…The French are key, they won’t make a deal unless we raise the price of gold. It is my view that we can’t. I don’t want you to say that to him but just remember that Arthur [Burns] is pushing for cutting a deal with the French.

…Schultz and I feel that would be a mistake. We have to keep free.

…The first thing to do is talk to George [Schultz] a little. I would like to get it where you, George, Connolly and I — would make this decision. I want to put Burns, McCracken and Peterson off.

I will resume publishing diplomatic documents from this era to find out exactly how the rest of the world (the Arabs, China, Japan, Russia and Europe) reacted and what measures were taken when the US broke its promise. If we figure out what happened in the past we have a better perspective on the future – so we can know more accurate when the US is forced to accept the true value of gold.

Previously I’ve posted:

Below a conversation between the President of France George Pompidou and United States National Security Advisor Henry Kissinger. Paris, May 18, 1973, 11 a.m.

Read more