posted by ZeroHedge

When confronted with excessive debt, you can either “take the hit” or you can try to inflate the debt away.

In 2008, the Central Banks, lead by the US Federal Reserve, decided not to “take the hit.” They’ve since spent trillions of Dollars propping up the financial system. By doing this, they’ve essentially attempted to fight a debt problem by issuing more debt.

The end result is similar to what happens when you try to cure a heroine addict by giving him more heroine: each new “hit” has less and less effect.

Case in point, consider the Central Banks’ coordinated intervention to lower the cost of borrowing Dollars three weeks ago. Remember, this was a coordinated effort, not the Federal Reserve or European Central Bank acting alone.

And yet, here we are, less than one month later, and European banks have wiped out MOST if not ALL of the gains the intervention produced.

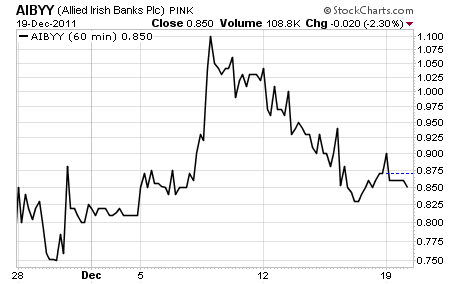

Here’s the Irish Bank Allied Irish Banks:

This is actually the best of the bunch I’m going to show you (by the way, this was a $4 stock at the beginning of the year).

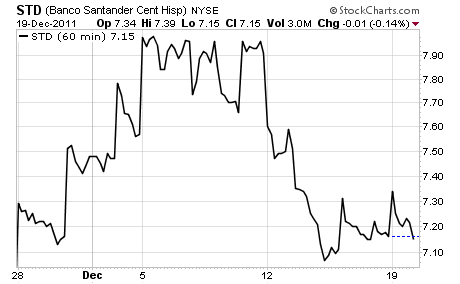

Here’s the Spanish Bank Santander:

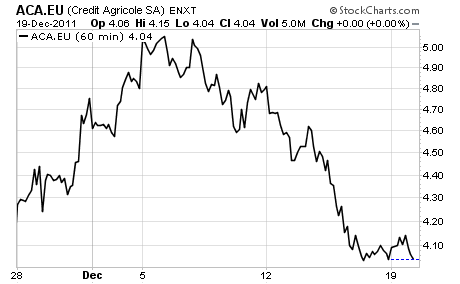

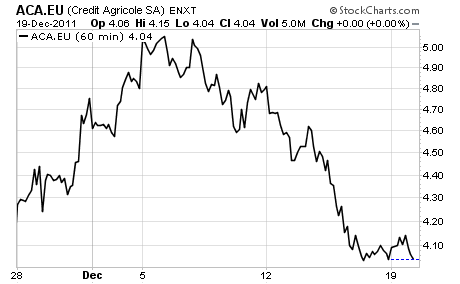

And lest you think it’s only the PIIGS banks that are in trouble, here’s French bank Credit Agricole:

#1e439a;">

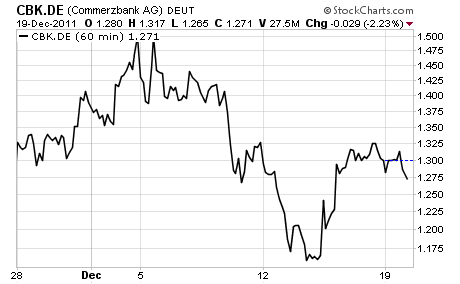

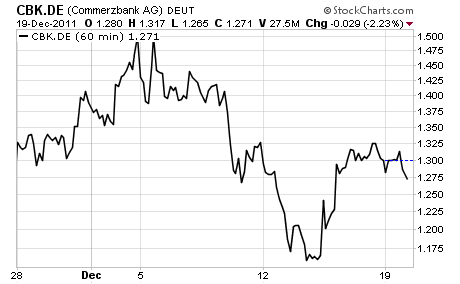

Here's German Bank Commerzbank:

#000000;">

So we're at a point where the impact of a coordinated Central Bank intervention lasted less than one month. It's only going to be getting shorter from now on. And eventually, we'll reach the point at which NO Central Bank moves will be able to rein in the carnage.

If you’re looking for specific ideas to profit from this mess, my Surviving a Crisis Four Times Worse Than 2008 report can show you how to turn the unfolding disaster into a time of gains and profits for any investor.

Within its nine pages I explain precisely how the Second Round of the Crisis will unfold, where it will hit hardest, and the best means of profiting from it (the very investments my clients used to make triple digit returns in 2008.

Good Investing!

Graham Summers