....Masking de-leveraging via debt markets

Posted by mybudget360

People tend to have a short-term memory when it comes to financial panics. Even when told that the US dollar has lost over 90+ percent of its purchasing power since 1914 when the Federal Reserve was first established, many just assume this is normal. Inflation is as common as air. Today’s purchasing power of one dollar is equivalent to 4 cents to put this in perspective. The Fed is trying to inflate its way out of the massive debt we are facing.

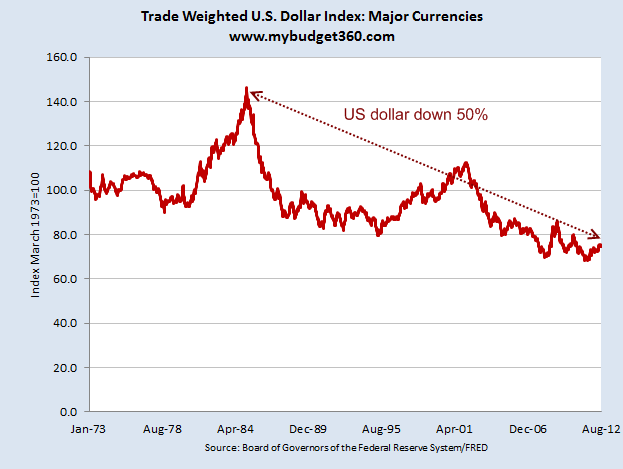

We all know a fiscal cliff is approaching. We’ve known this for well over a decade. Yet we continue to spend and witness a slow decline to the purchasing power of the US dollar. Much of the current economy is fueled by debt markets expanding but a saturation point will be reached. Breaking points do happen and you need only look at Europe to see what happens when the scales tip. What does a weaker dollar mean to American families?

The impact of a lower US dollar

There is little argument that the US dollar has fallen over the last 100 years:

Purchasing power has fallen dramatically. Even since the 1980s the US dollar has fluctuated dramatically:

If the dollar has fallen by so much, why did households not feel the deep impact? Well, to a certain level, many did (and ask the 46 million on food stamps how the economy is doing).

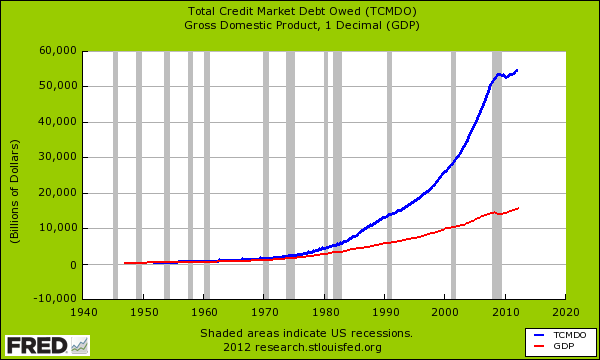

To a large degree much of this adjustment was papered over with access to debt. The debt bubble really hid much of the personal wallet pinching that would come about from a declining US dollar. The 2000s really culminated with a final scene where debt markets seemed to reach a global peak. Since that time, US households have been in a process of deleveraging that is continuing and will continue to unfold over the next few decades.

Perfect examples of this include the student debt bubble that is saddling over one trillion dollars in debt on the backs of younger Americans.

If you really want to see why the decline in the US dollar was not felt as dramatically as the charts above suggest, you need only look at the expansion in actual debt:

For the most part, this is where purchasing power was hidden with a debt binge. In order to keep the same standard of living Americans went into massive debt. The government, banks, and entire system essentially leveraged the future for short-term gains on unsustainable promises. At a certain point a peak debt situation is reached and people start realizing that the debt will never be paid back. This situation is unfolding in Europe.

The US faces a fiscal cliff next year and the Fed is trying to inflate our debt away.

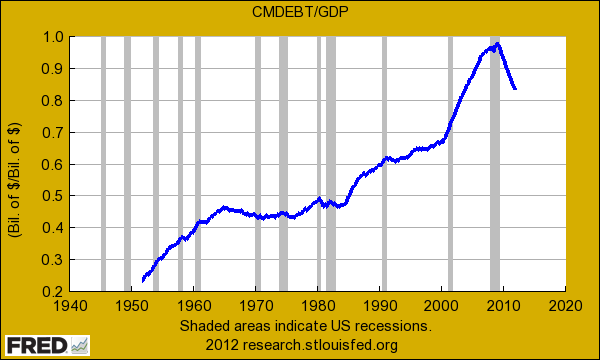

Yet as the total debt amount grows, US households (i.e., working and middle class Americans) have lived through a deep process of de-leveraging:

Total household debt to GDP continues to unwind signifying that US households did reach a peak debt situation in the current crisis. How is this being rectified?

-1. ForeclosuresYet overall access to debt to government and banks has remained open. Debt is part of our system but at a certain level it becomes unsustainable. We reached that point during the peak of the crisis. While households are going through this painful adjustment, some other segments of the economy seem to be delaying the inevitable. When we examine the crushing blow being felt by the middle class the above charts make more tangible sense.

-2. Bankruptcies

-3. Job losses

-4. Tighter credit markets

The cost of everything from education, housing, and automobiles seems high because purchasing power has fallen. A lower US dollar is only beneficial if the standard of living for many Americans increases. Look at the last few decades and try to see if that holds true.

Source: US Dollar already went off a fiscal cliff – what does a falling dollar mean to US families? Masking de-leveraging via debt markets.