- - US Household income continues to fall in midst of recovery

US households continue to face a declining standard of living. The first obvious item comes from falling incomes. Some of this is being masked by renewed access to debt as banks are once again lending money to over stretched consumers. Yet real wealth recovery this is not.

The next major depressing factor for households is the reality that inflation is eating away purchasing power. When incomes are falling, even a moderate amount of inflation is very dangerous to your bottom-line. A new report came out highlighting that the median household income has fallen by 7.3 percent since the inflation started. This is a big deal. Especially when the cost of other items is now going back up (housing), is sky high (college tuition), and is potentially a cause for bankruptcy (medical care). Let us look at the income figures.

US households see a drop in income since recession started

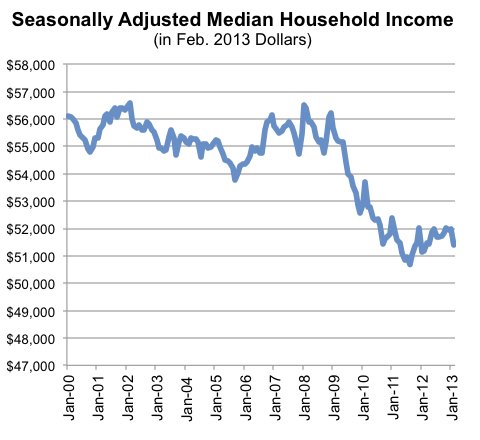

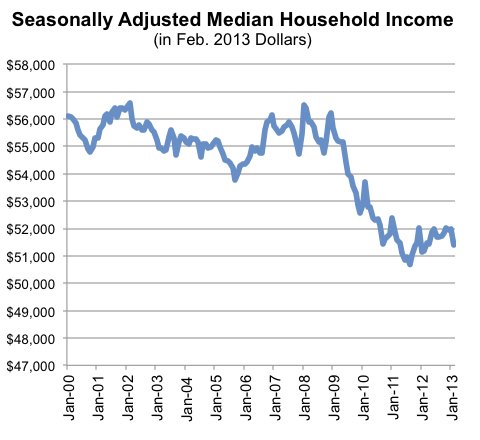

Keep in mind when you look at the below chart, the recession officially ended in the summer of 2009:

What is troubling is that most of the household income decline came during the recovery.

Part of this has to do with employers being able to slash wages and benefits. This has caused the stock market to soar which of course, only impacts a very small portion of our population. It is abundantly clear that your average worker is not seeing any real gains to their household income while inflation is slowly eating away at purchasing power.

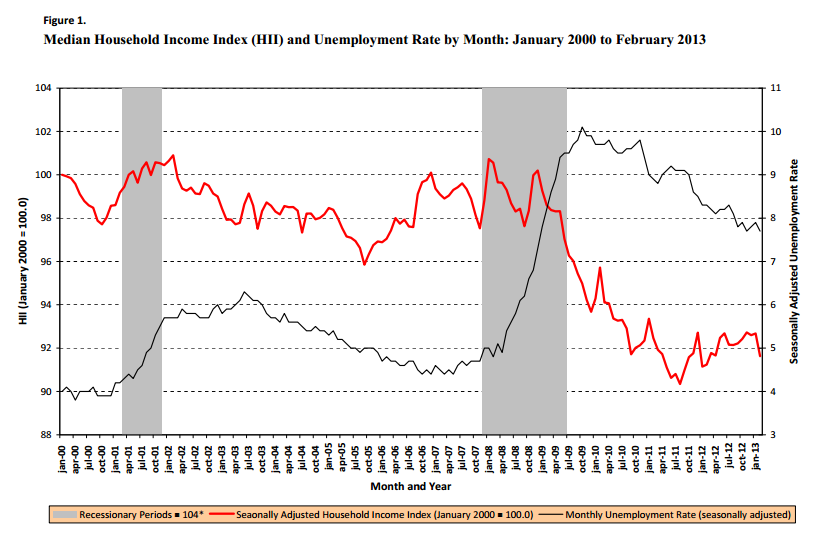

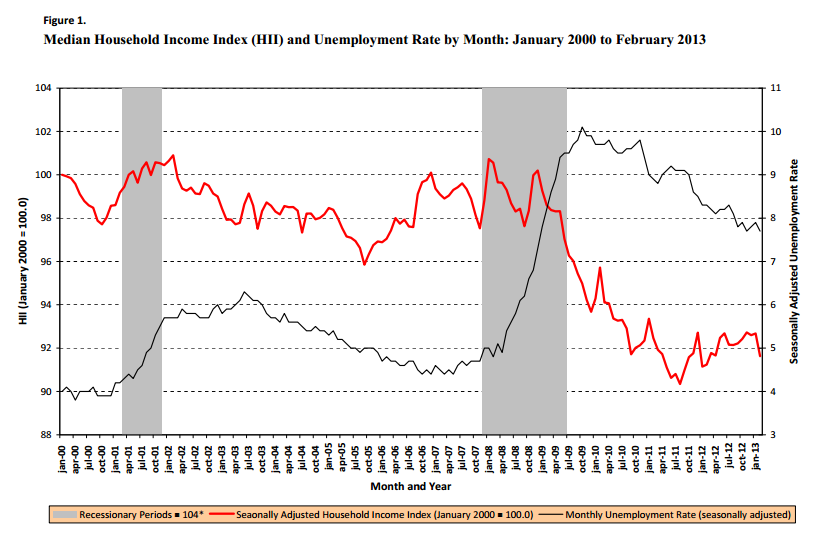

The lack of household income gains is not a new trend. This has been going on for some years now:

American households were about 10 percent better off in 2000 compared to where we are today. Of course you need to think about the individual circumstances that have changed since that time. We now have 47+ million Americans on food stamps. Our national debt is now at an incredibly high $16+ trillion. The unemployment rate although improving, is twice as high as it was in 2000 (4 percent versus 8 percent today). The challenge of course is that for the typical Americans worker they are having to live in a free market system with all the pressures that come with it while the connected few, can take banking handouts and use accounting magic to essentially socialize losses and privatize massive gains. Clearly by the look at household incomes your average family is not benefitting here.

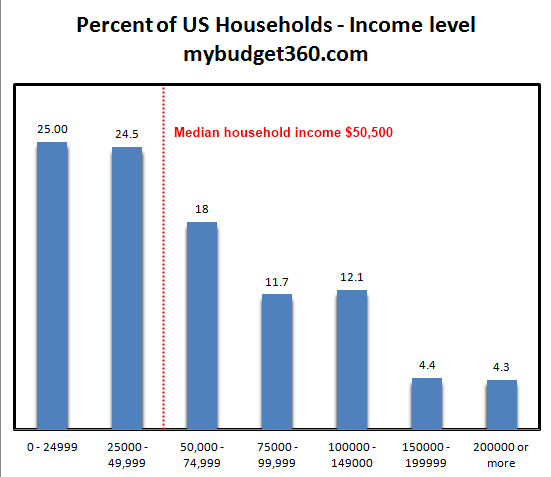

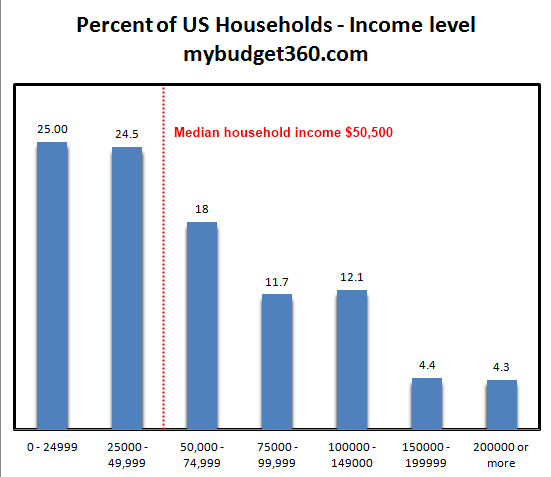

It is amazing how many times you hear people on the media saying “$200,000 is middle class” or something off the wall like that. No it is not. $200,000 is not even close to middle class if we actually use the English language dictionary. The middle is right down the center. This is why it is important to see where incomes break down:

Source: Census

The median household income in the US is around $50,500 according to the US Census. If you are in a household making $200,000 or more you are in the top 4 percent of households. Make $250,000 or more and you are in the top 2 percent. This is not the middle class but the upper class. That is absolutely fine yet the media tries to redefine these strata so Americans struggling to keep up will not bother looking deeper.

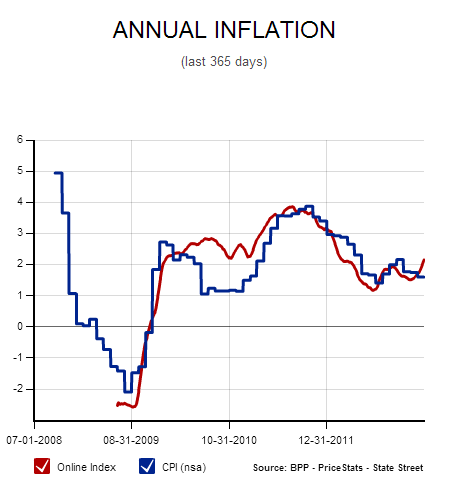

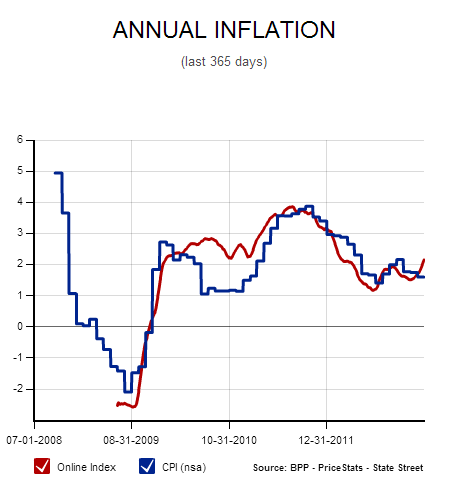

Inflation is absolutely happening:

We are getting inflation at a rate of 2 to 4 percent since the recession ended. This is incredibly high when actual incomes are falling. How is this a recovery when the typical household has seen their income fall by over 7 percent since the recession started?

The next major depressing factor for households is the reality that inflation is eating away purchasing power. When incomes are falling, even a moderate amount of inflation is very dangerous to your bottom-line. A new report came out highlighting that the median household income has fallen by 7.3 percent since the inflation started. This is a big deal. Especially when the cost of other items is now going back up (housing), is sky high (college tuition), and is potentially a cause for bankruptcy (medical care). Let us look at the income figures.

US households see a drop in income since recession started

Keep in mind when you look at the below chart, the recession officially ended in the summer of 2009:

What is troubling is that most of the household income decline came during the recovery.

Part of this has to do with employers being able to slash wages and benefits. This has caused the stock market to soar which of course, only impacts a very small portion of our population. It is abundantly clear that your average worker is not seeing any real gains to their household income while inflation is slowly eating away at purchasing power.

The lack of household income gains is not a new trend. This has been going on for some years now:

American households were about 10 percent better off in 2000 compared to where we are today. Of course you need to think about the individual circumstances that have changed since that time. We now have 47+ million Americans on food stamps. Our national debt is now at an incredibly high $16+ trillion. The unemployment rate although improving, is twice as high as it was in 2000 (4 percent versus 8 percent today). The challenge of course is that for the typical Americans worker they are having to live in a free market system with all the pressures that come with it while the connected few, can take banking handouts and use accounting magic to essentially socialize losses and privatize massive gains. Clearly by the look at household incomes your average family is not benefitting here.

It is amazing how many times you hear people on the media saying “$200,000 is middle class” or something off the wall like that. No it is not. $200,000 is not even close to middle class if we actually use the English language dictionary. The middle is right down the center. This is why it is important to see where incomes break down:

Source: Census

The median household income in the US is around $50,500 according to the US Census. If you are in a household making $200,000 or more you are in the top 4 percent of households. Make $250,000 or more and you are in the top 2 percent. This is not the middle class but the upper class. That is absolutely fine yet the media tries to redefine these strata so Americans struggling to keep up will not bother looking deeper.

Inflation is absolutely happening:

We are getting inflation at a rate of 2 to 4 percent since the recession ended. This is incredibly high when actual incomes are falling. How is this a recovery when the typical household has seen their income fall by over 7 percent since the recession started?