The $10 trillion question.

Posted by mybudget360

The Federal Reserve has waded deep into uncharted territory. The Fed has concocted new ways of monetizing debt and allowing banks to essentially expand their balance sheets with no real repercussions to the financial sector. Of course the shrinking middle class might have something to say about this or the 47.77 million Americans on food stamps might disagree that quantitative easing is the panacea for a better economy for all.

One thing is certain as the stock market makes new highs this year; the reality is the booming stock markets are not necessarily making life better for most in the economy. The stock market gains of the last few years have come from crushing wages, cutting costs, and expansion of low wage economics. Yet most of the gains have filtered to a very small group of people. The Fed continues to encourage this trajectory but so do other central banks around the world. If we look at the last seven years, we need to ask the central banks what $10 trillion has bought us?

The $10 trillion question

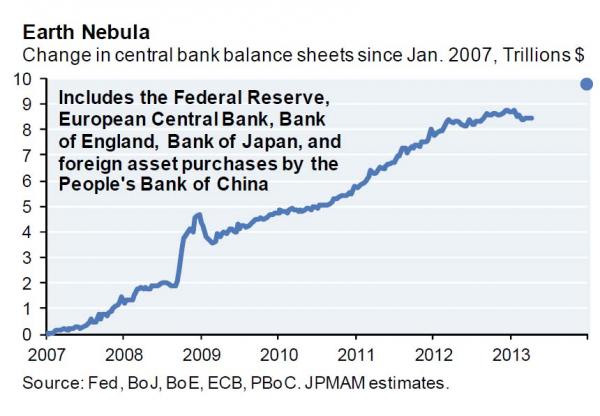

Here is an interesting chart examining the expansion in central bank balance sheets since January of 2007:

Earth Nebula

Global central banks have put on rocket boosters to their balance sheets and we have added $10 trillion over the last few years. Monetizing debt has been one of the best ways of doing this. Our Fed has become the primary buyer of mortgage backed securities at these absurdly low rates and has inflated their balance sheet to well over $3.3 trillion. They have also created an alphabet soup of programs like TALF, TAF, TSLFs, Maiden Lanes, and all these other goodies that have allowed member banks to run fast and easy with the bad loans of the last decade. It also has provided a platform to circumvent basic accounting rules and regulations.

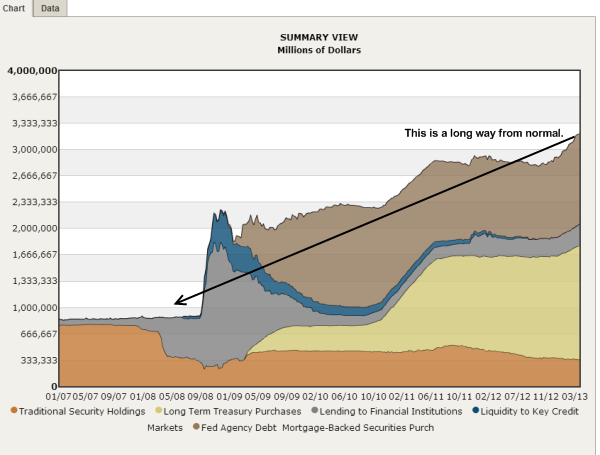

Take a look at the balance sheet at the Fed:

Fed balance sheet

You can see very clearly that the Fed has taken its balance sheet from $800 billion or so in 2007 to a whopping $3.3 trillion today. There is little indication that this trend will reverse especially with the Fed committed to buying up $85 billion in mortgage backed securities each and every month. From their perspective, things are working since the financial markets are making new highs. Too bad the stock market is largely a sideshow for 90 percent of the US population.

What does $10 trillion get us? Well so far we can see that we are facing a lost decade scenario in the US similar to Japan. Certainly the stock market would indicate otherwise but we have a rising number of part-time workers coupled with a large number of Americans that simply cannot find work. So we monetize the daylights out of everything. This is why we can have a peak in food stamp usage combined with a peak in the stock market.

Take a look at how much is being spent on food stamps and how the S&P 500 is doing:

food stamp amount

The price is high because we have over 47 million Americans on this program. What is more telling is that you have to be financially struggling and have virtually no assets to qualify for this program. It is an indicator of how the other half of Americans are doing.

So this massive expansion in central bank balance sheets has created bigger moral hazards in the financial industry. This is why giant hedge funds are now buying up rentals like they are going out of fashion. An artificially low rate is forcing people to chase yield as if they were searching for Sasquatch:

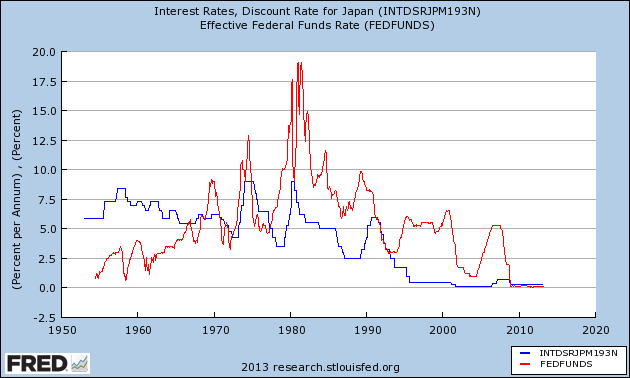

rates

The Fed and Bank of Japan are basically at the zero bound. The next step was quantitative easing. How has QE worked for Japan? Will the next step be to dive into the stock market similar to what the BoJ is doing? Hard to justify the Fed diving into our stock market when we are making new highs yet the “real” economy isn’t benefitting most Americans.

$10 trillion buys you a lot if you are part of the financial industry but doesn’t buy you much if you are part of the real working economy. Moral hazard is now policy number one for central banks.

via The $10 trillion question. The ever expanding central bank balance sheets: What does $10 trillion buy you in the market today?.

Posted by mybudget360

The Federal Reserve has waded deep into uncharted territory. The Fed has concocted new ways of monetizing debt and allowing banks to essentially expand their balance sheets with no real repercussions to the financial sector. Of course the shrinking middle class might have something to say about this or the 47.77 million Americans on food stamps might disagree that quantitative easing is the panacea for a better economy for all.

One thing is certain as the stock market makes new highs this year; the reality is the booming stock markets are not necessarily making life better for most in the economy. The stock market gains of the last few years have come from crushing wages, cutting costs, and expansion of low wage economics. Yet most of the gains have filtered to a very small group of people. The Fed continues to encourage this trajectory but so do other central banks around the world. If we look at the last seven years, we need to ask the central banks what $10 trillion has bought us?

The $10 trillion question

Here is an interesting chart examining the expansion in central bank balance sheets since January of 2007:

Earth Nebula

Global central banks have put on rocket boosters to their balance sheets and we have added $10 trillion over the last few years. Monetizing debt has been one of the best ways of doing this. Our Fed has become the primary buyer of mortgage backed securities at these absurdly low rates and has inflated their balance sheet to well over $3.3 trillion. They have also created an alphabet soup of programs like TALF, TAF, TSLFs, Maiden Lanes, and all these other goodies that have allowed member banks to run fast and easy with the bad loans of the last decade. It also has provided a platform to circumvent basic accounting rules and regulations.

Take a look at the balance sheet at the Fed:

Fed balance sheet

You can see very clearly that the Fed has taken its balance sheet from $800 billion or so in 2007 to a whopping $3.3 trillion today. There is little indication that this trend will reverse especially with the Fed committed to buying up $85 billion in mortgage backed securities each and every month. From their perspective, things are working since the financial markets are making new highs. Too bad the stock market is largely a sideshow for 90 percent of the US population.

What does $10 trillion get us? Well so far we can see that we are facing a lost decade scenario in the US similar to Japan. Certainly the stock market would indicate otherwise but we have a rising number of part-time workers coupled with a large number of Americans that simply cannot find work. So we monetize the daylights out of everything. This is why we can have a peak in food stamp usage combined with a peak in the stock market.

Take a look at how much is being spent on food stamps and how the S&P 500 is doing:

food stamp amount

The price is high because we have over 47 million Americans on this program. What is more telling is that you have to be financially struggling and have virtually no assets to qualify for this program. It is an indicator of how the other half of Americans are doing.

So this massive expansion in central bank balance sheets has created bigger moral hazards in the financial industry. This is why giant hedge funds are now buying up rentals like they are going out of fashion. An artificially low rate is forcing people to chase yield as if they were searching for Sasquatch:

rates

The Fed and Bank of Japan are basically at the zero bound. The next step was quantitative easing. How has QE worked for Japan? Will the next step be to dive into the stock market similar to what the BoJ is doing? Hard to justify the Fed diving into our stock market when we are making new highs yet the “real” economy isn’t benefitting most Americans.

$10 trillion buys you a lot if you are part of the financial industry but doesn’t buy you much if you are part of the real working economy. Moral hazard is now policy number one for central banks.

via The $10 trillion question. The ever expanding central bank balance sheets: What does $10 trillion buy you in the market today?.